Hey all, I'm working on a slow progression of how we handle fees on Hive-Engine.

Problem: We want more liquidity.

Current Solution: Use Bee to incentivie staking

Problem: It doesn't work very well

New Solution: Lower Gateway fees and add a fee to trade on Liquidity Pools. Hive-Engine will take no % on the fees for LPs.

We're going to lower the gateway fees from 1% to 0.75% (BSC and ETH fees will remain 1% on withdrawal since there are no fees on deposit).

While doing that we're going to introduce fees on the diesel pools. Pools will now have a 0.25% fee per transaction. Note, 100% of the fees will go to the liquidity provider. Maybe in the future we'll add a small fee to go to Bee token holders, but it's not the next priority.

Anyway, this isn't the final solution. We'll keep tweaking, but we're going to try this out for the next few months and see how it goes.

Changes are planned to go live at 8pm Eastern 1/25/22 (8 days from now). |

Measuring success: If this goes well we'll have deeper liquidity pools provided by more people, and they're generating the best fees in the entire industry for liquidity providers. We'll see.

so fees will accumulate in LP or paid in liquid both sides of the LP?

interesting Question, imminently the same, but very different as time progresses

in-case it isn't found, I think it was implied in a comment below that the fee is added directly into the pool (so liquidity providers have same share, but the shares value increases)

And the Gain would be potentially temporary because it's in the pool, or is my game theory off? :))

I actually thought they'd get paid in Hive, like BeeSwap but...maybe I'm wrong.

no, I don't think that makes sense unless every single swap fee were also paid in hive, which also doesn't make sense, so it's most likely that whatever token is being swapped is also the one that is used to pay the fee (or 0.125% on both sides of the pair after swap)

There won't be fees for adding or removing liquidity. Fees gather in the pool as trades happen.

ahhhh.... this makes your post make more sense- I really thought by 'transaction fees' you meant adding liquidity.

What you really meant was every swap would generate additional income for the LP not that adding or removing liquidity would be penalized.

If they gather in a pool with no distribution contract or rewards contract how will the distribution be determined?

liquidity providers each have a specific % of the pool, based on their shares, based on how much they've added to that pool... I don't understand where this question comes from because it seems obvious? well, I guess that's only if you're active there, maybe from outside perspective it seems more complicated than it actually is.

Basically if you have 100% of the pool liquidity and people are adding value to it from the fee, then you still have 100% of the pool afterwards, it's just larger now, does that make sense?

I understand liquidity pools well. I've actually set up pool and pool rewards up on Hive Engine. The problem I'm not understanding is that on Hive Engine pools and pool rewards are different functions. If you have a pool it doesn't automatically have rewards attached to it. You have to either create an LP Pool Rewards contract or a distribution contract to feed rewards into it. Both of those you then have to define the number of periods or intervals of how rewards are distributed. If a pool, let's say BEE:LEO, doesn't have rewards turned on then how will these new fees determine their distribution schedule back to the liquidity providers? I'm assuming it will be daily but what about pools that have 365 day intervals? Will they automatically move to daily disbursements of these new fees or follow the distribution schedule for that pool's rewards schedule?

After rereading your comment you seem to think the fees will just be added to your staked liquidity that's in the pool. If that's the case and it doesn't operate like other rewards options on Hive Engine how do they determine the timing for fees to be added to distribution?

I can't say for certain but I think the fees are going to be added to existing liquidity at the same exact time the swap is made, so there aren't any extra transactions being made that would create the need for daily distribution/payout times, and it would also be impossible for people to game it with those silly 5 minute in-out shenanigans. Of course, I'm just drawing this conclusion from a few implications, and the way it seems that every other idea has so many problems.

example:

I swap 100 BEE into said BEE:LEO pool

0.25 BEE is immediately added to existing liquidity, without affecting anyone's %

I get 99.75 BEE worth of LEO as a result, and the liquidity providers gained a little.

Does this help clarify how the extra transactions can be avoided?

I think this is the only way that really makes sense, right?

hmm, Maybe .5% and .75% on withdrawals seems a bit better, Must buy more workerbees than.

Now that's an airdrop!!

how about @aggroed lowers fees down to 0.1% ONLY for users who buy like a LOT of BEE or worker bee or whatever lol

Awesome. I have been thinking for a while something like this was needed, not because I want to pay fees, but because without this some of the pools have nearly zero incentives, so with this change people can justify adding liquidity to pairs that have some volume even if nobody has added a reward distribution contract for it. I think it's a little double-edged since some people might have knee-jerk reactions (hive spoils us, you know), but I can attest that I am now even more stoked to add more liquidity to everything whenever possible, more reason to keep bringing in outside funds, and I think 0.25% is fair.

tl;dr - Great news as far as I'm concerned.

I like this, totally free transactions are awesome but more liquidity is even better. Can't wait to see how this evolves. Oh, and it should help with the impermanent losses.

So interested to see how it goes with the trade fees... have you thought about letting the LP pool creator decide which system to use (this new one or the previous one)? Or are you forcing all pools to the new system?

As a large Liquidity provider myself I'm very intrigued of course but I also do use the system to do trades so both options are interesting. Seems like there was however an interesting marketing potential to not be the same fee as all the other LP exchanges. Aka .20% seems like an option.

As for the deposit fees:

I would have said something lower than .75% maybe .5% coming in... you need more liqudity IN the ecosystem and there are 3 competitors all doing .25% anyway but they run out of liquidity pretty often (or at least when i look) but it's hard to get used to .25% then be willing to jump to .75% ... Go for the big play... push for huge amounts of money and tons of users via the lower fees. Unless of course you're looking for measured growth and not the problems that come along with bigger viral growth.

I think if it were 'optional' or a setting that pool creator could modify, then we run into a problem with "owner is MIA" or potential hijacking scenario where someone makes a pool between 2 popular tokens and messes with the settings into something not ideal for anyone. It would also create a contrast that made any pool with fees look like some type of negative thing you're supposed to avoid through circumventing around between the pools that turned it off.. and whatever charity it offers to the people swapping is coming from the opportunity cost of the liquidity providers, in a way. For those reason I think the universal fee is better, even though I personally love to have more options available.

Makes sense... However I keep hoping that if there is a will to make it work there will be a way.

i think if peakd used these pools for swap.BTC and put 1 satoshi swap.BTC tips as some sort of meta layer over hive posts, with your existing built in tip system, we could have all sorts of cool ways to show off hive mechanics and have tip reward pools, all in swap.BTC or hive engine tokens, show the pool liquidity in optional peakd widgets, and yeah i think peakd could have all sort of really cool hive engine and swap.BTC dynamics and fun.. tips and one button access to the pools to swap the hive for swap.hive and swap.btc ... make that a one button experience or something ... next to the tip button i dunno, it could be col to see comments on every pool and posts woith time stamps on the liquidity charts etc .. all on the hive posts ... in the comments maybe bots can have live feeds or screenshots or FLASH players lol

maybe peakd can allow some sort of flash based games or something like that inside peakd front end, and use hive engine tokens lol, like mini games in the comments, with swap.BTC and hive engine pools, really given justice in the front end ... and peakd could make a cool hive engine swap front end page i think ... yeah peakd could do all sorts of really cool friggin stuff with this pool and hive engine trades and swaps in general... thank you for all your work on Peakd!

i want a way to use scotbot style settings for staking to stake my pool deposits so i cannot even withdraw from the pool for X amount of time or even never . forcing people to have to have the token to take out the swap.hive etc .

There options already available that do 0.25% and most people moving a serious amount likely use them. There will however always be people who use the default option unknowingly.

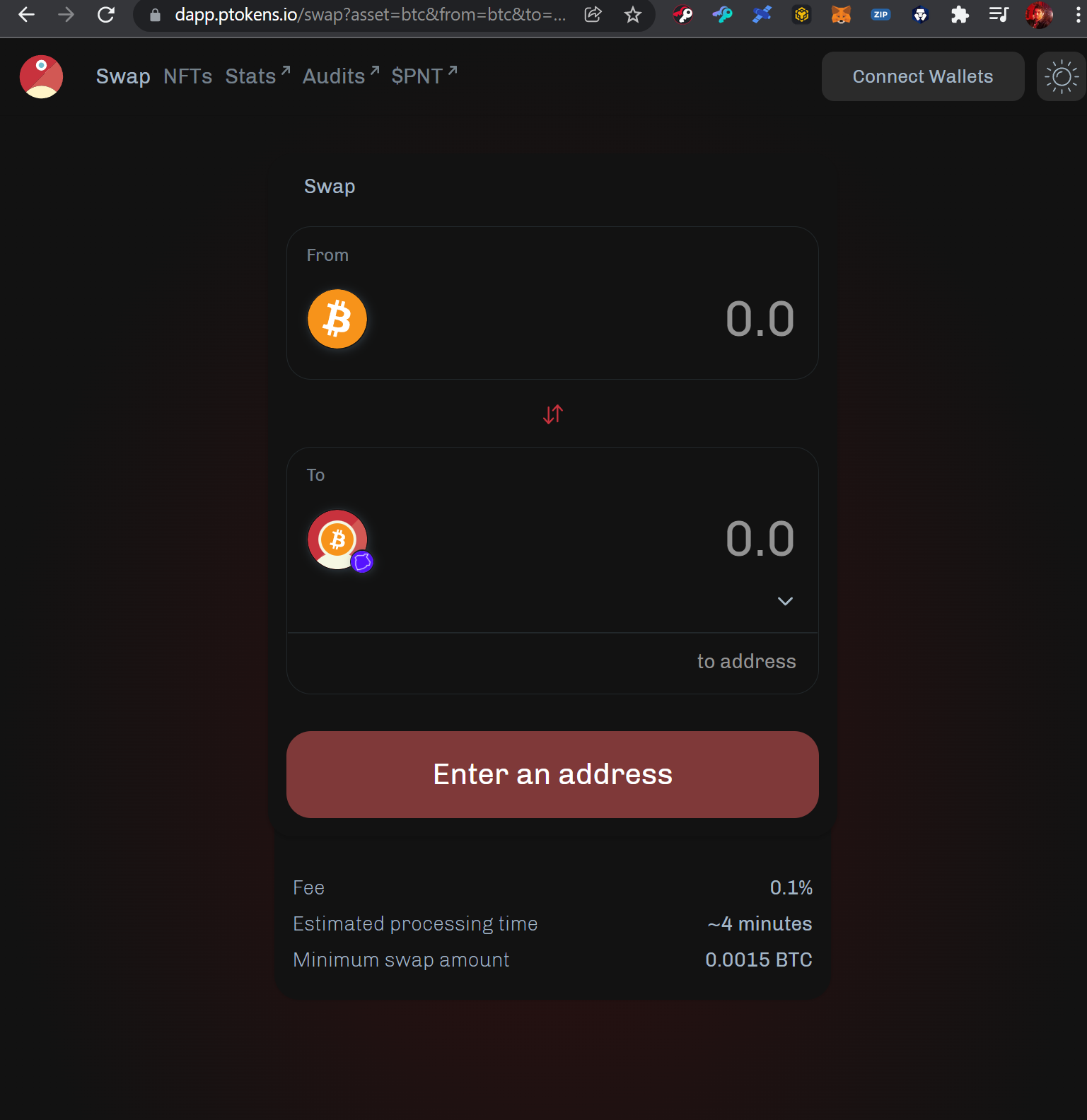

an example of 0.25% fees for Ethereum/BSC pegs of tokens across many other chains, even eosio / dpos ones have pegs .. their PBTC for example has many millions of dollars more in volume and supply (of real btc backing) than swap.BTC .. and PBTC has their eosfinex partners from bitfinex working with the ptokens.io github: PROVABLETHINGS guys (Who DID say I CONVINCED THEM to add HIVE to their system )

https://dapp.ptokens.io

ok so today its 0.1% .. (Its exciting to imagine what a Hive, EOS or Telos chain would do with the fees made from just this swapping, while using PBTC or swap.BTC has no fees to transact on our main net eosio/dpos chains ... but the money does FLOW when people want to withdraw to the main net (WHich they hopefully wont need to do as theyll directly sell swap.BTC or PBTC for eps/telos or swap.HIVE and just keep the token in the ecosystem....

so just an example of the only OTHER big peg of Bitcoin that 8is actually used on a DPOS / EOSIO network by tens of thousands of active users, without any fees, except when they want to withdraw to actual BTC and then they pay the BTC fee + the 1% fee, which i see now can be lower ... (and we know theres always the idea of binance style tokens you hold/stake to get a cheaper withdraw fee etc )

whats cool is to imagine we take up all that Bitcoin transaction fees traffic, and sorta freeze a lot of BTC into our ecosystem, and only charge money for the GATEWAY like this like pnetworkdefi ptokens.io or @privex ... and use that model to literally fund the hivedao .. using what were going to bitcoin and ethereum transaction fees... and use communities to plug into erc20s like telos evm... man im going too fast 1000 mph again gotta slow down

When I learned about beeswap, I was ecstatic to go from paying the 1% deposit fee to 0.25%. That was huge for me. Been telling anyone I know who's moving funds into the HE to use them. 0.75%is still high imo

Interesting! Im just learning about spinterlands related liquidity pools and liquidity pools in general today, wonderful to see this and finally follow your profile after playing since August!

I have been wondering after reviewing the SPS whitepaper recently, a significant amount of SPS is allocated monthly to LP incentives. I remember in SEPT there was a SPS liquidity incentive with Pancakeswap syrup pools which has since ended. Adding SPS bonus incentive payouts to all tribal dex/diesel pools- splinterlands related LP pool payouts would be awesome, what do you think?

currently the SPS airdrop is still going, which includes a lot of the DEC pools, so I'd imagine more SPS LP rewards would come near the end of that or some time after, to keep things a bit more coherent and not flood the market.

makes sense!

I am unfortunately totally lost. I'm guessing contextually that gateway fees are the deposit/withdrawal fees? But I haven't the foggiest idea what a liquidity pool is.

you can see/use them here: https://beeswap.dcity.io/swap?pools

this is a way for people to swap one token for another, using the liquidity provided by people.

for example you can take $10 of DEC and $10 of SPS and add it to the pool, then you would have some shares of that pool, get some rewards, and make it more stable when people go to swap between those, because higher amount of liquidity means a single trade will have lower price impact. Different pools have different token pairs, volume, liquidity, and rewards. It's somewhat new around here, but it's awesome.

Ahhhhh okay, that makes sense. Thanks for the explanation!

its like the uniswap of hive engine

"contextually" btw

"contextually" is what I said?

i just like to point out OOPBW Out Of Place Big Words

lolol ok ok heres 100 LVL tokens congrats!

im pretty sure @psyberx has their hive engine pool set up right?

😂 Ok I thought you were spellchecking me and I was like ...but that's how I spelled it??

Thanks for the tokens!

I confess to know very little about staking liquidity.

I staked liquidity for a while... but I was not sure it was doing anything.

Can someone point me in the right direction with that?

sure, here is the right direction: https://beeswap.dcity.io/swap?pools

tribaldex is great for superuser/devs/etc,

beeswap is great for liquidity providers.

both interact with the same pools.

Nice. Thank you very much.

I will check it out but also follow up once I regain liquidity after buying all the #Splinterlands packs I could buy!

If you are overwhelmed by the Tribaldex UI, https://beeswap.dcity.io/swap?your_positions is a bit simpler and does a good job overall.

Thank you. That's new to me, I'll give it a shot.

I tried the Tribaldex one and yes it was a bit difficult to understand.

Tribaldex is doing a lot of things, beeswap is doing one thing and @gerber is not bad with UIs (if he wants).

just think of staking liquidity like you are a bee in a hive collecting sunlight by the square meter through photosynthesis

see its simple, you collect pollen like interest and hah

hahaha ok im not serious about that analogy but i was about to do that

POLLEN

see, this one gets it

validated

finally

heres 1 dogecoin for hive-engine.com so you can say you earned liquid crypto today

If you want to take the bee theme to a higher level, check out the SWAP.HIVE:PLN pool. It has some rewards in the usual tokens, and then a whole bunch of bee-themed gaming tokens. From an analogy standpoint, it's mind-blowing!

But you get points for creativity!

You stake Liquidity and if the pool has rewards, you get them periodically. That's basically it.

Alright. What token is used for the rewards?

And when you say "if" that means that there is no guarantee that there will be rewards?

Rewards details are given with all of the pools which has rewards associated with them. If there is no rewards description then it means that pool has no reward/s.

Right... Thanks, I will keep a lookout on that.

Somehow I think that the one pool I was in gave me BEE. I was expecting a different token, saw nothing happen and then unstaked but then saw BEE in my hive-engine wallet and I was not sure where it had come from.

When you click on "has LP Rewards", it will show the details.

Yap, basically all pools started without and rewards had to added in a separate motion afterwards.

Well.. now.. they all do, 0.25% of all the transactions, right? Can be a lot, can be very little.

This change, as I understand from this post, will cut 0.25% of anyone who uses a pool for swapping and those tokens will be distributed to the liquidity providers. This should increase the earning of the providers overall by exactly those 0.25% of the overall transaction volume.

check out the open source pools on https://alcor.exchange we need to learn from the math and work of @avral from Golos , the OTHER steem fork!

Another STEEM fork? äääääääääöhm what?

golos is the fork of steem from waaay back in like 2017 or something https://golos.io that i think the cia made @dan and @ned go set up in Russia as part of some alien technology sharing deal where the extra terrestrial DPOS software had to be shared like nuclear weapons or something (think late 90s mac g5 commercial)

and then the golos.id witnesses got so stupid and centralized one of them had to beg for millions of goplos afterBOTH back up hard drives were lost in an "electric fire" mafia style hahaha

so golos.io people made ANOTHER fork of the already forked steem fork golos.id and made golos classic or golos ID https://golos.id which is a lot like hive ... they actually pioneered the path of a steem adversarial steem fork where they had to zero out / max out certain big accounts etc for the new golos, like hive did when it forked from steem etc

see how the DPOS tree of life works from @dan ?

GET THE MESSAGE?

We are essentially filtering out all the best most free thinking people for the us government / military / intelligence agencies to see who the AI should listen to in the future to write the next gen governance blockchains that will end up ruling over us...

then we are handed over the keys to the treasury of the NEWdollar or EOS programmable US dollar or a Local Hive Dollar backed by social media content, one of these concepts will become the new treasury system, probably backed by Proposals, like if the dollar was just Telos or Hive, and our Proposal systems replaced the Congress and Senate, that would allow a decentralized direct democracy with @edenos one person one vote local randomized hierarchial governance possible

Warnings echo from futures past:

"the current battle is never the last"

and then they said - [

never attack the phoenix]and they were right.

trash poem lol

This is a lot to digest, let me read and research this at first.

I must say I really liked fee free transfers in the pools, I'm going to miss that. But having said that with fees you might be able to attract more liquidity which could bring the price down of a swap.

That's the logic they're going with, and I think it will work out.

A small fee is vastly preferable to 1%+ price swings because of low liquidity.

Don't blow smoke up our ass blow splinterlands cards up there silly :P sounds good, .25 fee is manageable. funny comment just to see if you read these.

oh it will be read

the fees on dapp.ptokens.io are now 0.25%

it is a nice low fee at least!

hah i was gonna send u a free splinterlands card instead i choseto be lazy/more efficient and just send you 10 LVL tokens for the new hive engine game coming out called "PsyberSEX"

next generation sex games on the bawk bawk bAWK chain

sex sex sex

sexes nexus ... get a lexus.. fuel'er up apostrophe Xz

we got the staircase to success on hive engine ... i could sell hive engine at 11pm in over lit hotel conferenz rooms like sherry sharman and buck reed

i want to sell hive engine tokens as part of an MLM where i get all of my own people to jump ship to all the more succesful hive engine tokens but to always promote OUR hive engine tokens, and ill get them all to buy EACH OTHERS tokens

i REALLy wanna promote hive in big hotels and comiccon san diego convention center etc, i could just work a crowd and explain so much and get investors fired up!

BWAHAHAHAHAHA!!!!!

Thanks I think... lol PsyberSex huh I love that and sharing it. I have millions of LVL token already got in early!

I have worked Comicon a few times yet not in several years, having people at these conventions promoting HIVE would be cool.

AHHH WTF DAMNIT U ALREADY HAD SOME LVL??

YOU GOTTA GIVE EM to NEW USERS THEN MAAAAN

PROMISE ME

PROMISE ME YOU WILL DO THIS SHIT THAT I AM PRESSURING YOUI TO NOW DO OUT (OF NOWHEER

PROOOMIIISE MEEEEEE

Is that 0.25% fee per transaction for adding/removing liquidity, just swaps, or both?

It's for doing swaps, and goes to the liquidity providers.

Thanks for clarifying, Kenny!

!PIZZA

!BEER

wow these colors work well with your profile and the upvote image , and the red circle outline... its a secret cia hive/voice/eosio symbol

OH - "[

IT GOES DEEPER (\V/)]"Fair solution in my opinion :)

So are the pools on H-E the same as the ones on BeeSwap? Or are they totally different?

If they're the same, then do these fees being discussed only apply when you're using H-E/TribalDex? And BeeSwap has it's own fees?

I guess I'm not 100% how these all fit together...

you have the right idea just needed confirmation:

yes, beeswap/tribaldex/HE all show the same pools, and will have the same fee

Looking forward to the changes and start adding to these pools. Thanks Team

Will there be a fee for adding / removing liquidity or only for swapping?

no

thanks!

good question

I have the same question.

well, this should stop the in and out dec buyers and dumpers that hop in and out of the LP pools right near snapshot time. bravo.

Looks solid, cheers !BEER

View or trade

BEER.Hey @aggroed, here is a little bit of

BEERfrom @manniman for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Thanks for update.

0.5% would be even better ;)

If the fees are too high would anybody swap?

I meant the deposit fee

PIZZA Holders sent $PIZZA tips in this post's comments:

torran tipped kennysgaminglife (x1)

@wanderingmoon(1/5) tipped @aggroed (x1)

You can now send $PIZZA tips in Discord via tip.cc!

I think a fix % fee speech against super high volume deposit/withdrawals.

There must be a cap somewhere. Maybe 100$ or 500$, but someone that deposits a million for some trades never wants to pay such a high % fee. Special because it's the only fee and shows up quickly.

Lower fees on hive would be cool :)

Makes Sense.

I have another thing in mind. We are using multiple pools on HE for same token. For example, we have 4-6 pools for just DEC and is try for BEE and every other token which distributes the liquidity. It would be better to have pairs with standard token like hive or BEE whatever team choses and get a deep liquidity. So if someone wants from DEC to BEE, they will auto use DEC to HIVE and then HIVE to BEE pools, instead of using an illiquid pool of DEC to BEE.

I really liked the idea of Thora chain where everything is pooled against RUNE. So Rune value is derived from what is locked in liquidity and you can do swap on any listed tokens without creating redundant pools. We can try to work this for HE pools as well and may be use BEE token for every pool. This would increase demand for bee and also give deep liquidity for larger swaps. We don't need redundant pools. Let me know if you need help on idea/concept.

Here is thorchain for example only: https://app.thorswap.finance/

I made a German translation of this post for a better information of the German-speaking users.

$WINE

Hi @theguruasia, You Or @aggroed Belongs To Hivewatchers/Spaminator or In Our Blacklist.

Therefore, We Will Not Support This Reward Call.

(We Will Not Send This Error Message In Next 24 Hrs).

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.290

Hive is so ready for series A big money angel investors and for splinterlands to be on CNBC

capital ackzas to peopel who cant normally get it

1000 plots for $800,000 virtual land, but also have stuff that sells for $0.22 very important that theres a variety, that you can start from $0.22 and MAYBE trade or POST your way up to $50k nft i mean dude, if you become a hero an dget investors or big twitter users into hive, you can really become powerful and rich inside the hive community and become a legend if you can get big names to talk about hive or post on here

its like the secret exploit to actually socially engineer twitter, get hive clout and fame and use that to get whales to upvote you forever ... just get one big name or company or organization to buy Hive

Can someone tell me what staking bee is for?

Great, mid-game rule changes and penalizing trades in order to get more liquidity? How does that even start to make sense? Starting to feel more and more like the old Steemit Inc is now running hive-engine.

"giving incentive for liquidity providers to get more liquidity? How does that make sense?"

yes, that's the question you're asking.

What happens with liquidity when a stock exchange with say a competitive 0.1% stock trading commission gets hit with a 0.15% sales tax by the country it resides in?

Penalizing transactions doesn't normally create incentive for liquidity to grow. It normally does the exact opposite.

So, how does proposing it helps liquidity in this case even start to make sense in the slightest?

AFAICS, these are exactly the type of weird back of a napkin theory mid-game rule changes that Steemit Inc used to pull on us, and the type of weird back of a napkin theory mid-game rule changes that nuked two of my projects back in STEEM days.

Please explain to me how I'm wrong?

I think "Penalizing transactions" is a silly way to interpret this, because in a low liquidity pool a large trade is going to have much more than 0.25% price impact to begin with, and outside of the pools the trading margins are high from lack of liquidity as well.

So if low liquidity is the problem, you might wonder 'why' and I'll tell you exactly how that works - many of the pools currently have zero incentives for adding liquidity, so while a few people or hive engine itself might provide liquidity out of the kindness of their heart, nobody else is going too far out of their way to bring in funds from outside the ecosystem. However, as soon as I read this post, I already began to assess how much more I can bring in, and what pools I will put that value into. That is already going to amount to many thousands of dollars added to pools liquidity before the fees are even paid, from me alone, and even without upfront additions like this, the fees accumulate over time into higher liquidity which reduces price impact on future swaps, which saves more than the 0.25% for the people swapping (even if they never actually appreciate it)

does it make sense?

I can't wait to see how this works out and thanks for the update.

!PIZZA

!HBIT

Would be nice if Diesel pool owners had the ability to specify a percentage of these fees to go to the LP reward pool. Although I believe there is a fee to create a reward pool for a Diesel pool so that would be prohibative.

At that point, since the fees go to pool owner, should they be able to set the fees?

having some settings like that available would be nice as a pool owner but would also need some really clear UI work done on the frontends ahead of time so people are making informed decisions. personally I'd love more pool contract options but also I'm a crazy person so there's no telling what I'd do with it.

btw you might already have got this, but I think the fees are going directly to liquidity providers by expanding the value of their shares in that pool, and not to the person that created the pool, since the point is to give more incentive for adding liquidity across every pool, and I think it stands a good chance of working, at least to some degree.