Hi everybody!

We have recently traveled around Eastern Europe, crossed a few country borders and on our way, we did some grocery shopping. We noticed though, that the VAT rates were printed only on some of the receipts in Greece.

Also, only within a few tens of miles, there were quite big price differences, even when it was about similar things, mostly food.

That got us thinking, why is that? Some of the countries, like Greece, Bulgaria and Romania and all members of the European Union, so probably they should have the same VAT rates?

VAT stands for Value Added Tax

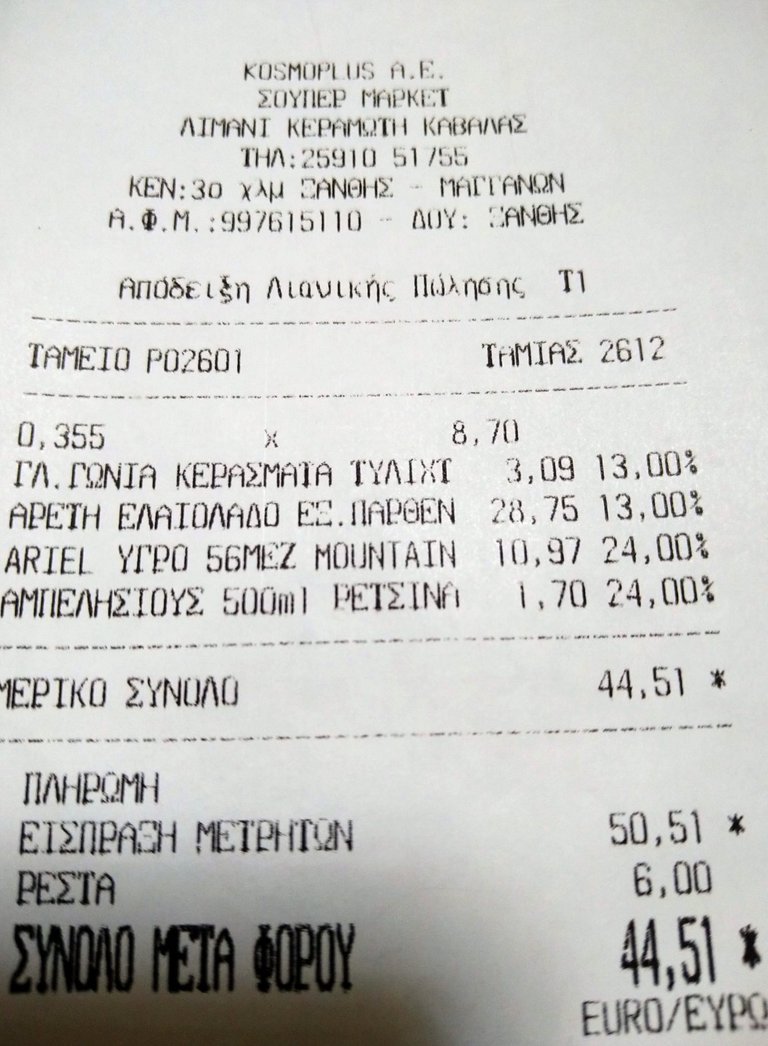

Here is the receipt we got from a Greek supermarket. The VAT rate is imprinted at the end of each line. The first two lines are food related with 13% VAT. The third line is of a washing detergent and the last, fourth line is a bottle of a specific local wine, called "Retsina", that we highly recommend :)

Again, 24% VAT.

So after some research and asking around, below is a table, in Alphabetical order, that's just compiled out of our research, first-person experience and some online sources, found later.

Let's also note, that there are particular items with 0% VAT rate in those five countries we've checked. Like "Intra-community and international air and sea transport", or bread and flour in Bulgaria, but that last one is rather an exception, as it has been implemented only a few months ago.

The most interesting and question-raising parts however, are, what goods fall under the reduced rates and thus the particular states tax less.

| Country | Standard VAT rate | Reduced VAT rate |

|---|---|---|

| Bulgaria | 20% | 9% |

| Greece | 24% | 13% or 6% |

| Romania | 19% | 9% or 5% |

| Serbia | 20% | 10% |

| Turkey | 18% | 8% or 1% |

A first glance would read, hey, the differences are not that big, right?

Moreover, let's note that Serbia and Turkey are not members of EU.

However, to our deep and sincere surprise, there is one HUGE difference.

We all know the food is the basic need of any human being.

The food VAT rates for all those countries, except for Bulgaria, fall under the "Reduced rate". Thus, all other citizens, apart from Bulgarians, pay food VAT in the range of 8-13% while Bulgarians pay 20%.

Is it a cultural aspect?

Is it because Bulgarians are rich?

Contrary, Bulgaria is known to be the poorest country in the European Union.

Don't you find that very strange?

Or this angle just explains, or is one of the reasons for that fact?

Here are sources we've used in particular:

Bulgaria: https://www.avalara.com/vatlive/en/country-guides/europe/bulgaria/bulgarian-vat-rates.html

Greece: https://www.avalara.com/vatlive/en/country-guides/europe/greece/greek-vat-rates.html

Romania: https://www.avalara.com/vatlive/en/country-guides/europe/romania/romanian-vat-rates.html

Serbia: https://www.vatupdate.com/2021/04/18/vat-rates-in-serbia/

Turkey: https://www.orbitax.com/news/archive.php/Turkey-Adjusts-VAT-Rates-on-Va-49483

!ALIVE

PS. You will earn more ALIVE tokens if you add #aliveandthriving too as we have a curation project looking for that tag with the largest ALIVE stake in the tribe behind it.

Made in Canva

Thank you for the token and for the info! 👍

@culturelanguage! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @wearealive. (2/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

That's indeed interesting and those questions... spot on!

Keep it up!

!PIZZA

Thanks! 👍

I gifted $PIZZA slices here:

@lightcaptured(1/15) tipped @culturelanguage (x1)

Learn more at https://hive.pizza!

Hey guys, it's been a really long time! Good to see you here again. How are you? Still stuck in my "favorite" country? 😂

Very interesting research you have done. I think it is very useful for everyone who is going to settle in Europe. 24% standart Vat rate for Greece - that's too much, isn't it? Well, these people really buy quality products in their stores and eat quality food (unlike people in Bulgaria). But I have been in one of the richest countries in Europe, where VAT was 16% until a few years ago.

Which means that the wealth of a country is not created by the taxes that are collected from its inhabitants. There has to be something else here, right? This is food for thought 🤔

Btw, once you're here again, I'll expect you to be more engaged with the platform by replying to comments as well as communicating with other accounts under their posts.

Cheers and see you soon!

Hi, Soulsdetour, thank you very much for the time and your tips.

True, the VAT in Greece may seem very high but actually the majority of the food items fall under the reduced, 13% VAT. Probably the situation in Bulgaria is not that bad at the end, with regards to the food quality, just that the state wants to collect more taxes. That is what it seems trying to comprehend the bigger picture! 😃

If you go to any large supermarket chain in Bulgaria, even those that are foreign, you can easily notice the low quality of the products sold at a high price. Maybe the price is really high because of VAT (it drives prices like those in Belgium, for example), but the quality is really low. In addition, if you once happen to shop for products in another country and then return to Bulgaria, the difference becomes more than obvious.

Oh, I mistakenly thought you were in Bulgaria just because you wrote that you were "stuck". Haha, "stuck" can only be someone in a really hopeless country like this 😃😎. But anyway, luckily you're clearly not here. Or, don't tell me! 😊 Just share here more of your experiences and discoveries.

That's very interesting. If what you are saying here is exactly like this, that means that people in Bulgaria need more information to see what they are actually in. Or perhaps they do not care that much, if at all?

From clear market perspective, Bulgaria and Greece are probably in the same range, with their totals of 6-7 million of population ergo customers.

"Stuck" rather shows the desire to travel worldwide. 😃

Thank you! 👍