Foreword

Countless legendary investment figures have proven the extraordinary potential that can only be found in the world Asset papers---Starting from @georgosoros, @carlicahn, @lika-shing, Until @warrenbuffet..

Asset papers may exist Paper assets is probably the single most democratic place on the planet. He never mind his investors Is a man or woman, young or old, who has an academic degree "along the train" or has not graduated from elementary school, an Ethiopian or an American , even "whole" or disabled people. All are the same in the eyes of the market...However, has it ever crossed your mind, if so, why are there so many stories about failed people around us? Try to pay attention......., Generally they are which fails when asked questions such as ..;

- What is your time horizon in investing?

- What parameters do you use

- When is the right time to buy or sell?

- Which stock is the right one to buy or sell?

- What are the reasons behind this decision?

- What is the risk:reward ratio used?

- What are your expectations

- Etc.................

No matter how many questions there are, they are generally answered clearly and concisely: "I don't know" ! .. in fact, often the answer seems a little bitchy. Maybe it's emotion because it's a loss to be asked all kinds of things... but either way, it's an honest answer. Unfortunately the situation That's what will distinguish successful people from those who fail

Introduction to technical analysis

An investment in knowledge always pays the best interest.

(Benjamin Franklin)

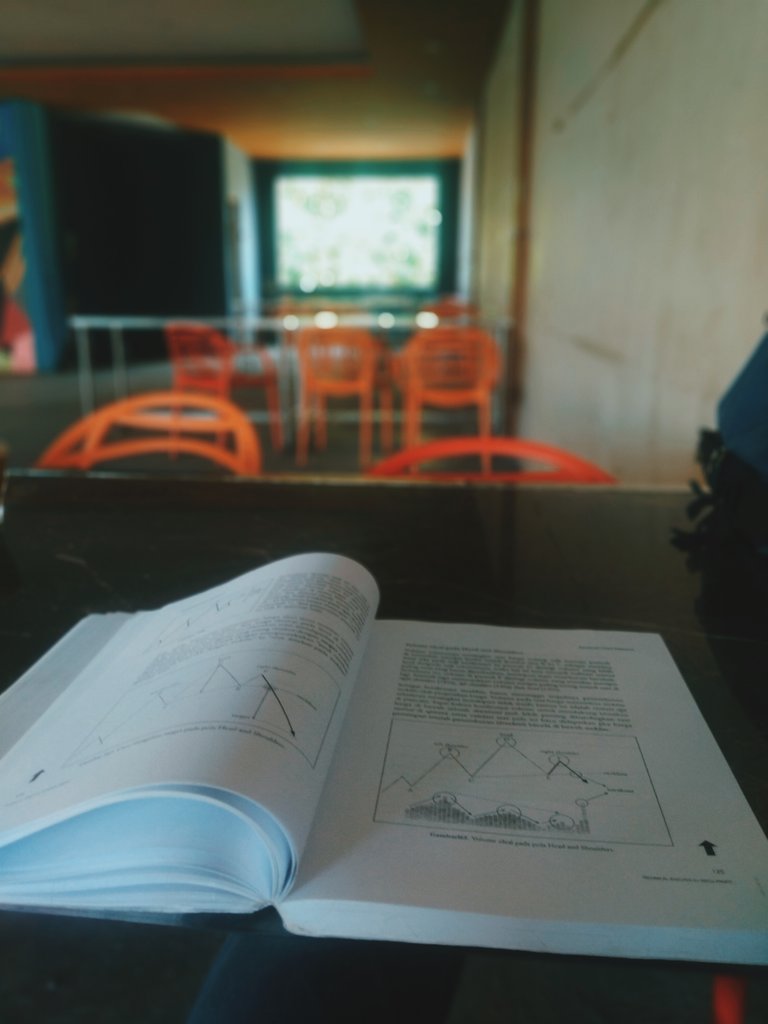

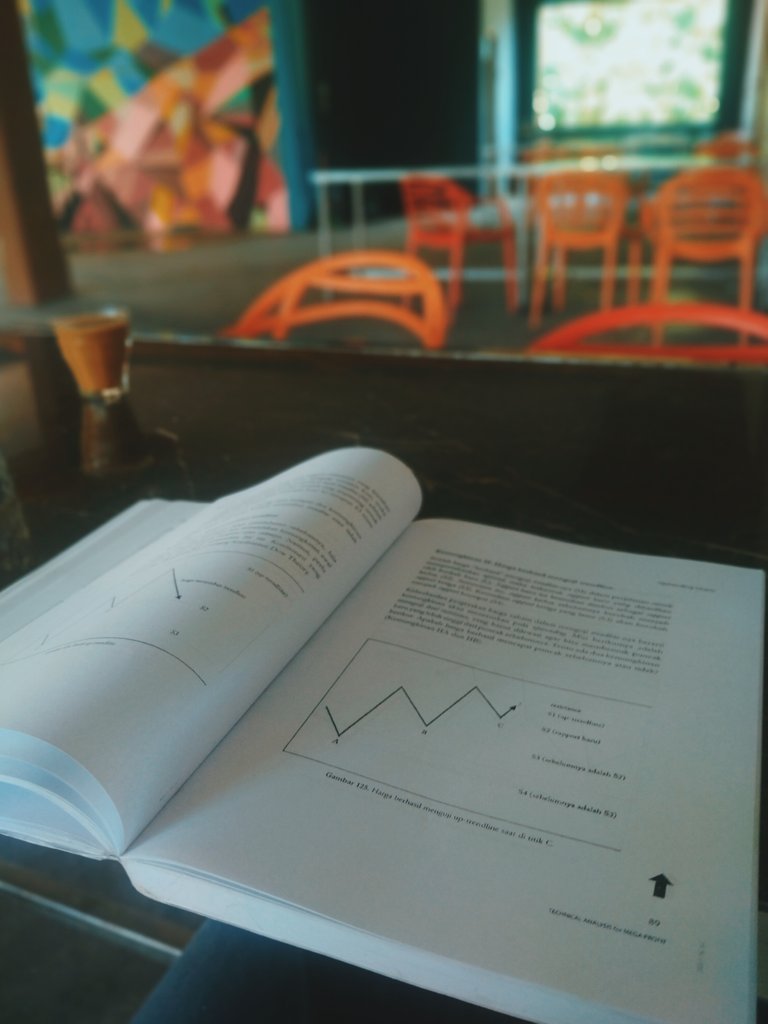

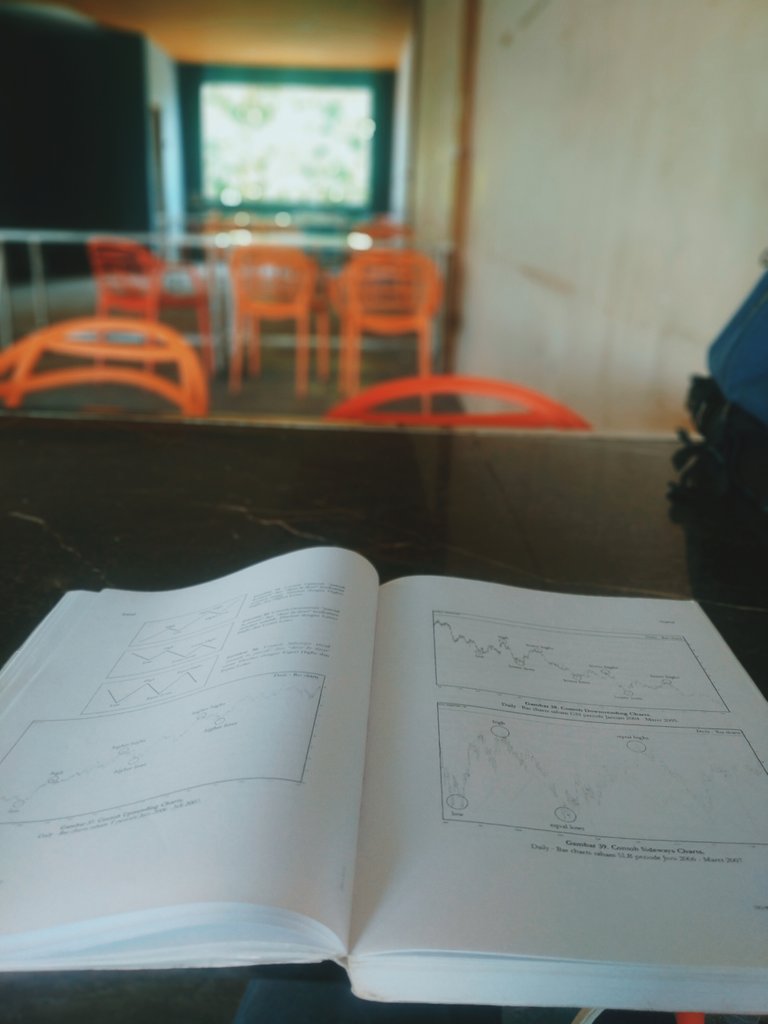

Technical analysis is a method of evacuating stocks, commodities or other securities by analyzing statistics generated by past market activity in order to predict Future price movements.

Analysts who conduct research using technical data are referred to as "technical analysis" or also known as technicalists. Technician, or chartists .. these technicalists do not use economic data to measure the true value (intrinsic value) of a stock as they do by fundamentalists, but using charts that record price movements and the number of transactions to identify a pattern of price movements that occur in the market..

so that it is easier to understand, the difference between fundamentalists and technicalists can be likened to people who are shopping at the mall. fundamentalists go to every store in the mall, learn the value of the goods, then make a decision to buy. while a technicalist sits and watches people who go in and out and shop at these stores, only then make decisions based on it without measuring its own intrinsic value.

There are three thoughts that form the basis of technical analysis, namely:

- The price movements taking place in the market have represented all other factors.

- There is a trend pattern in the price movement

- Sejarah akan terulang.

History of technical analysis

Technical analysis was probably first used for agricultural trade in Europe in the early 16th century. Then around the 1700s in Asia (to be precise in Japan), a new technique was created in technical analysis, namely by using a candle chart to analyze the rice trade in that era. Whereas in America, it was only at the end of the 18th century or to be precise in 1882@charlesdow and his partner @edwardjones and charlesbergstresser founded dow jones & co. Dow then put forward his recognized and respected ideas as the foundation for today's modern technical analysis by writing an editorial series in The largest daily newspaper in the world at that time, which was also owned by Dow Jones & Co. Namely The Wall Street Journal. The world finally knows the theory by the name of dow theory. Charles Dow himself never officially launched the book he wrote other than in his newspaper editorials.Dow Jones & Co. Then it was listed as a public company on the new York stock exchange with the stock symbol: DJ. In 2007 dow jones & co was acquired by news corporation owned by conglomerate @rupertmurdoch, who was listed as the 33rd richest person in America in 2007 (Forbes)..

Technique and cover

The techniques in this book will guide you, among other things, in:

- Identify golden opportunities intelligently

- Define entry-exit points clearly

- Minimize loss

- Maximize potential to earn mega profit are

That's all for the explanation of the technical analysis book for mega profit, hopefully you like it and can add to your knowledge in the world of paper assets

This is my entry for the daily #books challenge hosted by @hivebookclub

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more