Happy Sunday Hivers!

I started reading financial literacy books when the pandemic began. In fact, I have already written a review of The Richest Man in Babylon and posted it on Hive. It was one of the best books I have read. Since then, financial literacy books have fascinated me. They always spark my interest as I am eager to learn how others manage their finances. It intrigues me to see how people handle their money.

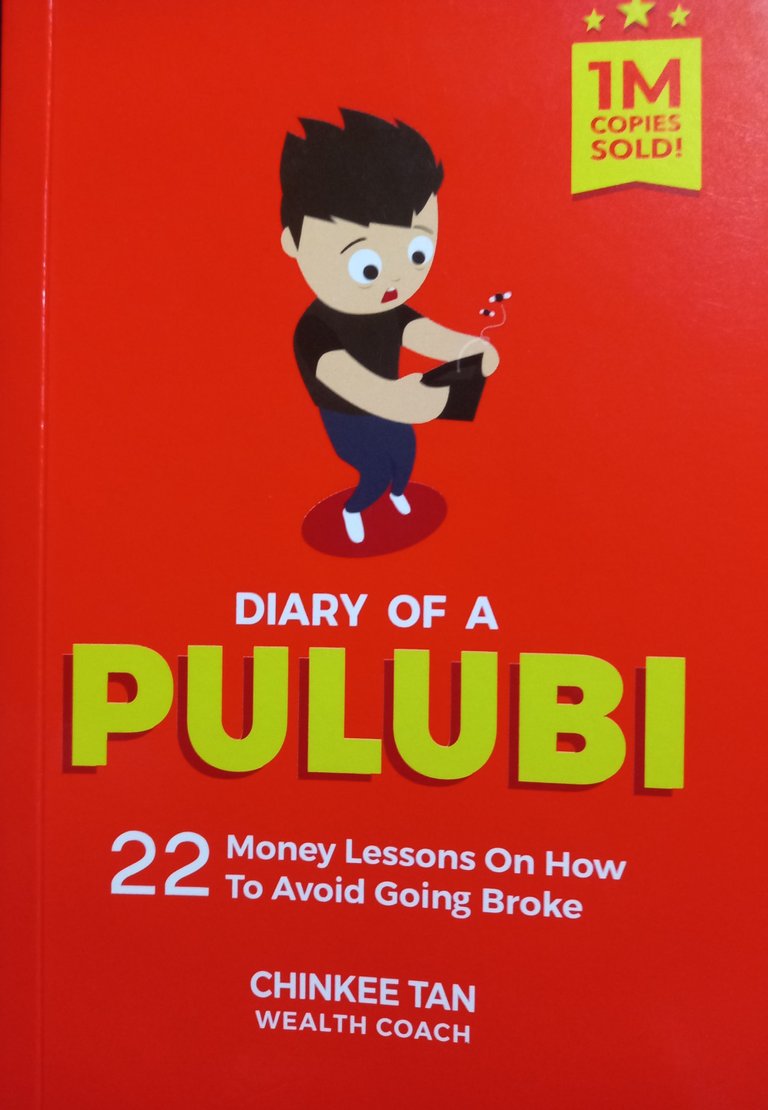

Today, I want to share with you a book that I just finished reading. It provides valuable money lessons to avoid going broke. I don't know if you can relate to the emotions I felt while flipping through the pages. Some of the content made me feel guilty, as I used to engage in similar habits, especially when I was financially illiterate.

But despite having knowledge about proper financial management, there are still habits that persist, potentially contributing to financial difficulties. This is why I love this book as it helps me become more conscious of my spending.

When the writer mentioned shopping with emotions, I smiled. Who wouldn't? I could relate it to my personal experience. I remember before the pandemic hit, I didn't have a daily expenditure monitoring habit or a budget plan. As a result, there were instances when my budget for the entire pay period would fall short because I hadn't been keeping track of it.

There were times when I would go to the mall, primarily for window shopping, but occasionally I would be tempted to buy items that were beyond my budget. I purchased these items not out of necessity, but simply because I was attracted to them. During moments of sadness, I allowed myself to indulge. The author refers to this behavior as 'Shopping with emotions,' and according to him, it is the quickest way to become broke since the purchases made are not aligned with the budget.

Being well-guided in financial management is an advantage because you are less easily tempted. You will always consider your financial priorities and goals. You have the habit of monitoring your daily expenses and making a budget plan, which is very useful for staying within our budget.

Do you know why the writer created this book? It's because he discovered that the main root of financial stress is not a lack of income, but rather a lack of knowledge, discipline, and proper guidance from experts on how to manage finances.

One of the habits that the writer emphasized as a reason why we easily go broke is giving too much. Have you experienced it? When we give too much, it impacts our finances and may result in experiencing financial stress. What I have learned from this is that being selfish sometimes is beneficial, as it helps us slowly build our wealth. Once we have enough money, then we can be more generous to others.

The best way to help others is not by giving too much, but by helping them learn skills that can provide them with a lifelong source of income. As the writer says, "Remember the old proverb that says, "Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime."

I want to reread this book to remind myself of the things that I sometimes struggle to control. Financial management is crucial because without it, it can inevitably lead to going broke. I am grateful that my friend @psychkrhoz let me read his book, as it can greatly help me avoid financial difficulties if I follow the advice given by the writer. It is truly helpful.

Thank you for reading and see you on my next blog. Cheers!

Watch with glittering eyes the whole world around you because the greatest secrets are always hidden in the most unlikely places.

Discord: kellyane#0924

Note: I use Grammarly to help me check and fix grammar.

Namaste! I am fond of reading books, watching korean, american and filipino series/movies and I am also fond of gardening. I love listening to different life stories and I am always captivated with the beauty of nature so travel is my escape when life turns into blue. But hey, how could I forget my photography hobby? It is one of the best, so follow me as I will be featuring my experiences of the stuff that I am passionate with.

Kinahanglan jud ko makabasa ani kay nagsugod napud kog kasaag ba 😂.

Bitaw tigpaminawan pud baya ko nanag Chinkee Tan every Sunday morning sa radyo Jack, nice jud kaayo iyang mga financial advices ba.

Gipalitan nako kausa si kuya sa one of his books, Iponaryo, murag na-apply man pud nya gamay (gamay ra 😅). Dapat pahinumduman utro, ako pud diay utro pud haha!

Bahala nalang ug gamay day basta kay gi-apply 😁

Naa gyuy times day nga masaag ta, need jud natu ug reminder para mabalik tas saktong dalan 😂

Your financial status is the result of the things you know and the things you don't know about money that's why financial literacy is very important. Sad to say, it was not taught at school.

"Money may not be the most important thing in this world, but it affects everything that is important in our lives"

Thank you for guiding me @psychkrhoz.

Unsaon man kung broke na daan? 😆

manginhas nalang sa hunasan mem 😄

Ana akong boss sala na gyud daw sa taw karung panahona if walay kwarta kay daghan na daw pama-agi maka-kwarta, ug usa na ana ang hive hehe

Heheh map jud no. Daghan na jid pamaagi. Kakugi na pang ug diskarte..

I always hear about this book but haven't had the chance to have it yet. Since I am still single, I am trying to have budget plan as my salary is so small enough for our needs. But I think reading this will add another knowledge for me. Thanks for the review.

You're welcome. It's a good thing that you've practiced it early. Thanks @jenthoughts for dropping by!

Yes, dear @kellyane, this kind of financial literature has an aura that, at least it is my case too, drives you to read and educate yourself more deeply of this topic so crucial to life. I remember that I read the richest man in Babylon quite some time ago. Of all the factors that the authors of these works advise, the most important is in our hands, it is our total responsibility to create the habit, to put into practice the knowledge acquired and the many tips they give there. Because beware, we can also make the mistake of falling into this kind of suggestion. Read how much financial education book appears and only stay with the good results of its author or other people quoted by them in their books.

The book that opened me to financial knowledge and curiosity was Think and Grow Rich, a classic by Napoleon Hill.

Thank you so much for sharing such an interesting publication. I hope you have great success in balancing your finances and in the long run write, why not! Your own financial book.

I have also read the book "Think and Grow Rich" way back in 2018. I liked that book too. Thank you @bravofenix for dropping by.

Sometimes you can't help but to give too much because you care about the person, but the lesson here is to use the care we feel into a bigger purpose: share the financial knowledge we know.

I also want to read financial literacy books and this is now on my reading list! 😊

I agree with you @ishwoundedhealer . Since there was no financial literacy subject at school, and our parents were also financially illiterate, no one guided us on how to manage our finances properly. That's why we easily become broke and live in a cycle of the rat race. Sharing financial knowledge with someone is a way of showing care because we want them to also become successful in their financial aspect.