There was a time when most of the financial investments done by people require working with brokers. Things have changed and it has become a different story now — the creation of modern internet has not only made it easy for common people to learn about financial management, but it has also provided a direct means of investment in almost every variety of asset class. A new kind of asset class has surfaced in the form of digital currencies and it has garnered quite great deal of interest as people are beginning to adopt it — millions of people are buying, trading or investing different kinds of cryptocurrencies. Since the creation of bitcoin as the first cryptocurrency, it has quickly established itself and many other big altcoins as a prominent means to investment for people.

The first set of bitcoin exchanges only focused on making the process of buying bitcoin easy and safe for the people. However, once the developments of spot markets became more advanced enough, exchanges gained more trust from their users and the interest to regularly trade cryptocurrency increased. The trading of bitcoin started to resemble traditional markets with the introduction of margin trading. At the early stages, the systems were still slow but it allowed traders to borrow USD through leverage or buy and sell digital assets

The majority of early bitcoin adopters only implemented buy and hold strategy hoping for the value to increase. It worked out well enough as bitcoin saw a rapid value appreciation in its early years. However, as more players begin to onboard the ship, they discovered the market instability and began to look for ways to trade bitcoin's volatility in both directions.

Derivatives allow traders to hedge the crypto market volatility

The early kinds of derivatives for bitcoin were in the form of futures contracts. The contracts enabled traders to lock certain price for their bitcoins in the contract and allow the use of sophisticated strategies for trading.

As early as 2011 when bitcoin was still very new, a handful of entrepreneurs were interested in building basic marketplaces where bitcoin derivatives such as ICBIT can be trade. Traders could use arbitrage to buy cryptocurrency at spot markets and sell futures contracts to receive their profits in BTC if premium existed. Futures contract was used by traders to lock-in their BTC price in order to hedge the price volatility.

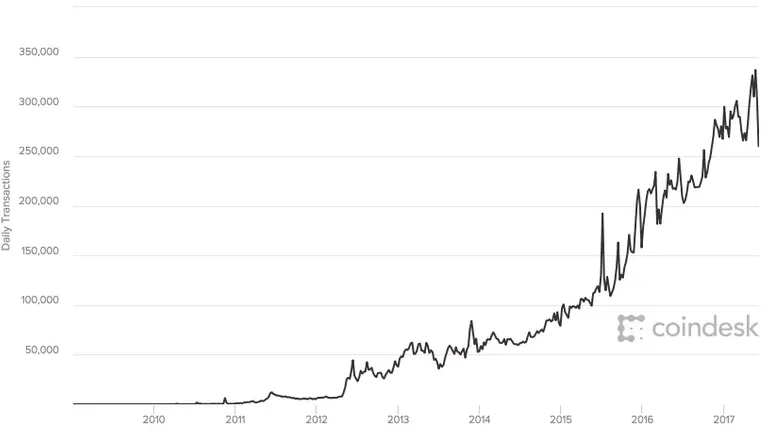

The total daily transactions in BTC market did a 900% increase from 33,800 to over 335,000 in only the last five years as reported by CoinDesk. Cryptocurrency generally has become popular, same way the different instruments to trade it. More crypto exchanges are created in surprisingly numbers, and bitcoin ETFs may soon be on their way — but one tool that is already in use is bitcoin options (a form of derivatives). The trading of bitcoin options was not regulated in the US for many years, but this is set to change with the recent actions of SEC and Commodity Futures Trading Commission (CFTC)

What are crypto derivatives?

The conventional definition of derivatives refer to them as financial products which have their values hinged on another existing assets. As financial contracts, derivatives exists between two or more people. For cryptocurrency derivatives, they derive their value from the value of underlying cryptocurrencies. More comprehensively, derivatives can be regarded as an agreement to buy or sell a particular crypto coin or token at a specified time in the future and at a fixed price.

Cryptocurrency derivatives are very important for advanced traders and institutions because they serve as a major risk management tool. Essentially, derivatives offer huge form of protection against the infamous volatility of the crypto market. In addition, derivatives allow traders to offset potential losses through hedging and ''put option''.

Real-life instance of how derivatives and options trading works

Assuming a trader wants to buy 5 BTC at a price of $10,000/BTC. But considering the crypto market's tendency for wild swings, the trader is concerned about a sudden price dip. The trader can use the call option to get the opportunity to buy 5 bitcoin for a total sum of $50,000 for a specified period of time. When the time of the contract expires, regardless whether the price of bitcoin goes up or plummets within the specified time, the contract has been locked and the trader maintain the position to buy 5 BTC for the fixed cost of $50,000.

Imagine that by the expiry time of the contract, BTC has done double the price and moved to $20,000. The trader still get to buy the BTC for the predetermined price and sell for the current market price. This means that the trader makes a profit of $50,000. The same goes for when the price slumps within the contract time.

The size of the derivative market

The derivative market is a very huge. The market is often estimated on the high side to be over $1 quadrillion. Unbelievable, maybe! But this is largely because there exist too many derivatives which are available for virtually every kind of investment or asset class — from commodities to bonds, equities and currencies. In fact some analyst think that the size of the derivative market is 10x the size of the GDP of the world. However true this is, there is no denying that the derivative market is a gigantic market.

The journey of derivatives on crypto exchanges

The financial side of bitcoin economy was still very primitive by 2014, and derivative exchanges such as BitVC and BitMEX were about to launch in Hong Kong. In the early years, futures were the major form of bitcoin derivative, with OKEx establishing itself as one of the major venue for futures trading. Although futures trading was popular, bitcoin perpetual swap became traders' favorite and ignited the trend in the volume of derivatives in 2016

Bitcoin futures are majorly used for arbitrage and hedging, but the expiry date in the contract makes them undesirable for investors who wants to profit from predicting the market fluctuation. The price of futures can also deviate from the price if underlying coin.

The position of Injective protocol in the derivatives market

Injective Protocol is a layer-2 decentralised exchange created to provide liquidity and offer the DeFi features such as derivatives. The project aims to usher fresh interest into decentralised finance which could inspire the next bull run. Injective protocol is developed to disrupt the DEX market segment and competes with existing decentralised exchanges in the kind of services that offer — the security of user assets and platform features that align with the DeFi trends.

Injective Protocol exchange will offer markets in perpetual futures with up to 100x leverage for the traders. A recent virtual AMA with Injective protocol CEO Eric Chen revealed that Injective protocol derivatives is looking to adopt options trading by Q4 of 2020.

Deeivatives offered by Injective Protocol

Over the next few years, Injective Protocol has prepared to embrace the interest to develop a platform that integrate a wide variety of derivative products. Some of those derivative products are explained below

- Futures

Futures is the most popular bitcoin derivative. In the futures contracts, two parties are obliged to buy or sell a coin at an agreed price on a specified date. Futures provide traders with a tool for valuable hedging. Traders who initially holds a spot position can chose to take an opposing position in a futures in order to slash down the effect of price changes.

Trading crypto derivatives like futures also allow traders to use leverage position that can not be used in spot trading. Leverage is a tool that allow crypto traders to borrow funds to enter positions and invest in derivative contracts. Leverage makes it possible for traders to hold a high position without doling out their own capital. Injective protocol will develop futures trading into its exchange in order to provide traders with more DeFi options that would increase their profits.

- Perpetual contracts

One of the derivative type that Injective Protocol will incorporate on its exchange is perpetual contracts. Perpetual contracts are like a clone of futures. The notable difference is the time duration — they do not expire. Perpetual contracts enable traders to hold positions for a long time, as long as they have enough assets. Perpetual contract suits traders more than futures which require than they invest after every few hours to keep their positions. Perpetual contracts are more desirable for traders since it combine the risk hedging features of futures market together with the intuitiveness of spot market.

- Options

By adding options trading to the offered derivatives, Injective protocol enable traders to buy and sell an underlying coin within a specified timeline and at a predetermined price. Unlike the usual futures that require that parties involve buy and sell at the expiry, options trading allow traders to take a call or put option — traders are not under any time obligation as in the case of futures

Here's an example of how options trading works for better understanding

Assuming that a trader wants to buy 10 ETH at $300/ETH, but because of the nature of the market and possible swings in both directions. The call option will enable him to buy the 10ETH at the specified price of $300 regardless of whether the market goes up or down

- Swaps

This is another kind of derivative that is quite popular on exchanges. Most exchanges that offer derivatives often incorporate swaps. Injective protocol aims to have a swap market on its exchange. Swap is used by traders to exchange crypto assets among themselves without setting orders on the spot market. It is a derivative contract made between two traders to exchange cash flows in the future. The swap of interest rates and currencies are the most common type of swaps. Swaps are usually traded over the counter between the parties involved. Swaps are done by institutional investors, and not traded on the regular exchange markets.

- Forwards

Forwards are similar to futures contracts, but with a little difference. Forwards derivatives can be customized to suit the trader, unlike futures. However, traders need to take into account associated risks because unlike futures, forwards are traded over the counter (OTC)

Wrap Up

Derivatives are essential for decentralised finance (DeFi). They allow individuals and corporations to manage the risk of the crypto market. Derivatives offer the tools to counter the volatility of the market. They are particular interesting because the are contracts based on the predictions about the instability of the market. Trading derivatives has huge rewards and profits but with equally huge risk of loss.

Derivative contracts, options and futures together are considered by traders and investors to be the best hedging tools and can be used to speculate the price movement and make maximum profit out of it.

Understanding the importance of the derivatives to the crypto market and the desire of the traders for decentralised finance, Injective protocol has developed an exchange that offer different derivative options for traders — with tools to minimise the risk and increase their chances of profits.

Congratulations @kryptarion! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: