Summary

- Are we in a coronavirus stock market crash? Not yet.

- Real crashes can be far deeper and longer.

- Perhaps it’s not over. The virus could spread much more. Markets seemed to be overpriced before the outbreak already.

- The good news is, central banks and governments are willing to take extraordinary measures.

Is This a Crash Or Not?

Stock markets had hard days in February. At the time of writing, investors were guessing if we are in the middle of a coronavirus stock market crash, or not. Or, only at the beginning. And if it’s time to buy stocks now or is this too early.

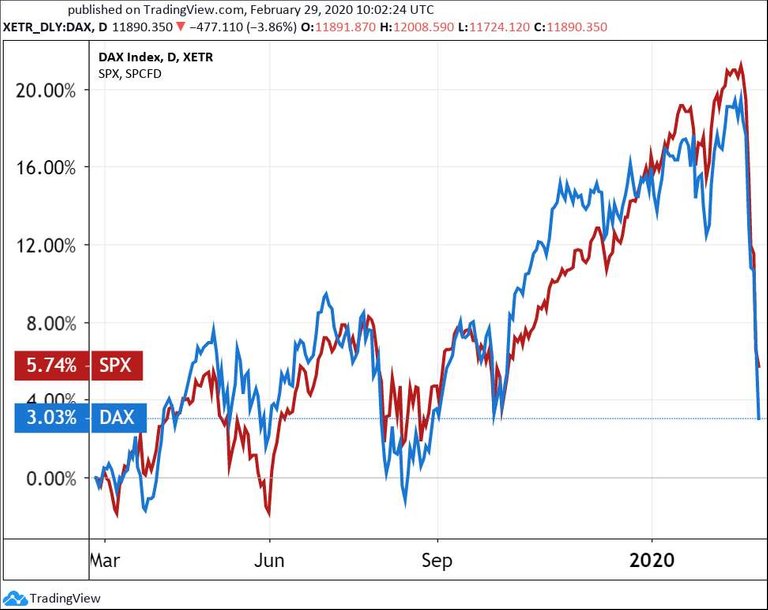

Last week, some stock exchange indices had their worst week since the “Lehman-crash” in 2008-2009. In Europe and North America, they fell 10-15 percent, in Asia, only 4-10 percent, approximately. (Week February 24-28, 2020.) This week, so far, we saw a roller-coaster, indices went up, down, up. Still, one-year and three-year index returns are, in a part, positive. Or, at least, near zero.

Chart 1: 1 year of the S&P 500 index (US) and the DAX index (Germany). (Tradingview.com)

But what means crash? In the stock market, “a correction” is considered if the main index falls more than ten percent. It’s a “short-term trend that has a duration of fewer than two months.” (Investopedia) A bear market is a greater, longer downtrend with an overall pessimism. Professionals are talking about it if prices fall 20 percent or more from recent highs. And a stock market crash is:

A rapid and often unanticipated drop in stock prices. A stock market crash can be a side effect of major catastrophic events, economic crisis or the collapse of a long-term speculative bubble. (…) abrupt double-digit percentage drop in a stock index over the course of a few days. (Investopedia)

Not Even the Fed Can Stop the Coronavirus?

Are we in a coronavirus stock market crash, then? Not yet. Neither the speed nor the extent of the fall indicates a crash. As well as no bear market has developed yet. The state and future of the stock market depend now to a large extent on the news about the spreading or containing the coronavirus. But also on the economic and political effects.

The Fed (Federal Reserve, the Central Bank of the USA) cut rates on Tuesday, by 0.5 percentage points. But the market reaction wasn’t entirely positive. Many people have serious concerns if an interest rate cut can solve the coronavirus-crisis. Stop the impacts of the plague on the production and the stock market.

That’s How a Real Crash Looks Like

If the virus unfolds across the globe and causes much more damage, it can cause a far greater stock market panic and collapse. A real crash. A decline, for example, when prices fall by 12 percent, not in a week or two, but a single day. Perhaps, in hours. However, with the arrival of really good news, such as the rapid rollback of the virus, capital markets may forget this crisis in a few days. Indexes are still not very far away from their historical peak so far and can set new records soon.

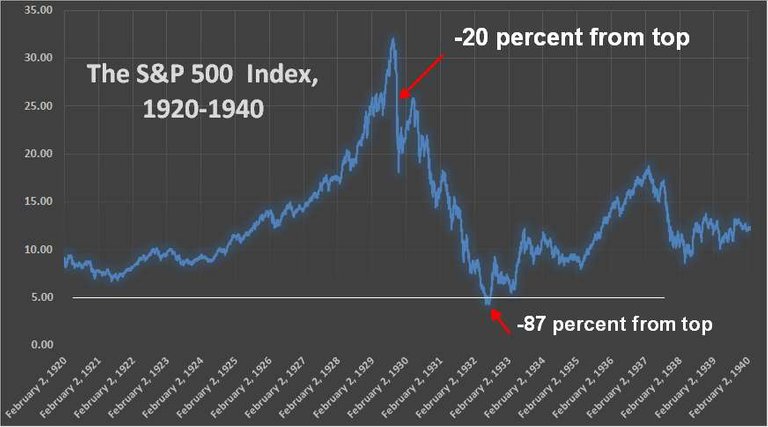

Chart 2: The greatest stock market crash in history. The rise and decline of the S&P 500 index (estimated values), in the 1920s and 1930s. (The Great Depression.)

On the chart, I marked the –20 percent decline from the top with the first arrow. And the more than –87 percent on the bottom of the crash in 1932. We are very far away from that. This “Great Depression” was the worst crash in history, very deep and very long. Many others “only” caused 25-50 percent slumps in average stock prices. Or, the impact resulted to be temporal and the recovery fast.

Looking Beyond the Virus

The problem is, stock markets seemed to be already overpriced in the long term. Long before the coronavirus outbreak. (Continues here)

Continue Reading on Agelessfinance.com

More Important Readings for You About Your Money

- Can You, Indeed, Build a Decent Passive Income with Stocks?

- Looking for a Good Investment Return? Use the Magic Triangle!

- 6 Effective and Proven Ways to Lose Your Money

- How Works Compound Interest? Learn the Secrets of the Dark Side

- Eight Ways How Inflation Threatens Your Income and 13 Ways to Fight It

- Is It A Myth? – The Genuine Truth About Passive Income

(Cover photo: by ArtTower from Pixabay. The bear is the symbol of a declining stock market.)

Disclaimer

I’m not a certified financial advisor nor a certified financial analyst, accountant nor lawyer. The contents on my site and in my posts are for informational and entertainment purposes and reflecting my collection of data, ideas, opinions. Please, make your proper research or consult your advisors before making any investment or financial or legal decisions.

You post has been manually curated by BDvoter Team! To know more about us please visit our website or join our Discord.

Are you a Splinterlands player? If Yes, then checkout MonsterMarket.io. Get instant 3% cashback on every card purchase, and 2% cashback on every booster pack purchase on MonsterMarket.io. MonsterMarket has the highest revenue sharing in the space - 60% for cards and 40% for packs, no minimum spending is required. Join MonsterMarket Discord.

BDvoter Team

Thank you.

Great research ! Congrats.

I think that we can start buying for some time, I think that market crash will be in the next years. 2025 @deathcross

I think it depends on the virus. Imagine 1-5 million Americans infected.

Hi appreciated @deathcross.

This is a great interpretative analysis.

Based on the premise that the evolution of the virus affects the stock market, we would have to consider the spread in South America. The first cases have already appeared.

In the American territory the government State residence will invest all the technological and financial resources that are within its reach to attack the virus. But in South America it is something else.

How much can an outbreak of great magnitude in the South affect the American economy? Would your interests be affected? Would military and commercial cooperation treaties be suspended?

Your friend, Juan.

I have some ideas how health care in South America looks like. Where many people has almost nothing to eat, states are weak or corrupt, state hospitals are horrible... (And also In Africa.) The virus vill spread with an accelerated speed and after that, it can return from there to the "developed" countries. I'm afraid much greater problems are approaching than what we have seen until now.

Me contaron cosas de los hospitales estatales de América del Sur y no me gustaría poner mi un pie en ninguno de ellos.

You're right. I hadn't thought about the boomerang effect. OMG, what will happen?

Sincerely, this is a coronavirus crash in the stock market.Buffet lost billions of dollars. A lot of countries that wagered the stock market are investing in drugs and facilities currently and the pandemic keeps spreading. China has spent a lot of money trying to keep the market safe and i am sure other countries will be doing the same.

I'm afraid this is only the beginning.

This is a good analysis. Full of important informational data. It is good to have these points clear, talking about crisis is not the same as talking about collapse. And so every single thing you clarify.

It is impressive how much an epidemic, or an international health alarm, that has not yet been catalogued as a pandemic, affects.

I believe that the spread of the virus will continue, for a while, and it will still affect not only the economic but also the psychological and social aspects. This will go down in history just like that great depression of the 1920s.

Very good input.

I suppose states are more prepared than in 1929 and more willing to help the economy. But this epidemy can took a year or more and the world will change completely.

Hi @deathcross

This virus is wreaking havoc in all areas of our lives. It was expected to affect the stock market. in the same way as it is affecting the population of the world.

I think we should still be captive in this regard. of what may happen depending on the scope of this virus ..

Nothing good for world trade. Nothing good for the world economy.

Saludos-

In America it is only begining to spread. In Africa, some Asian countires, too. Millions more can be infected and tens of thousands can die. 9/11 and ISIS changed the world, all are prepared now for terrorism. This virus will change evevything, again.

There is a part of me that is seriously surprised that an epidemic with a lethality of approximately 3% has generated so many problems at all levels.

Nobody wants to be in these 3 percent. Mostly elderly people die, but not exclusively. I'm glad I have my parents and the parends of my wife alive and we don't want to loose them.

Many people in their middle-ages are also in danger. With lung problems like Asthma, COPD... Smoking often causes COPD.

Yes, I read that the most vulnerable people were the oldest, young children and people with an already depressed immune system due to previous conditions or diseases.

Hey, I am sure you will love @datadash channel in youtube. Nicholus Mertin. According to him stocks are overpriced, fundamentals are not there...please check out his videos.

I get insights from him on many things. For example he said emerging technologies like solar energy for future will pick, and I picked Power Ledger to invest long term.

His channel, infact I am going there now...iching to see his videos that showcase economy so beautifully. You would love him.

Unfortunately, he talks about US market, not directly useful to me, but still he is super facinating.

Your article was nice, I liked it that you see it as over valued and your present reasoning that you can confirm it's a bear market only when market falls 20%...

Reason why stocks are high - stock buybacks, definitely not fundamentals because GDP growth is low I think...not fundamentals surely.

The 20 percent limit of bear market is a general definition, as I linked it on Investopedia.com. But maybe this type of limits have not so much sense. Statistical category only.

The problem with valuation is: It should depend on interests, and interests are on an unprecedented low level. In reality, we are in an unknown territory.

Thank you.