Operating the @defi.campus account and manually looking out for and curating DeFi related posts allowed me to observe the rising interest in DeFi here on Hive. Overall, I think it is a good thing. The DeFi Campus community is aimed to educate Hivers about DeFi. It is not here to shill DeFi projects or to spread FOMO. Hence, amidst the current DeFi hype, I will like to share a few risks that you should be aware of before you jump onto the bandwagon.

Technical Risks

In DeFi, the technical risk goes beyond losing the private keys to your wallets. Just today, a couple of Balancer liquidity pools were drained. For those who are not aware, Balancer is a decentralized exchange based on the AMM (automatic market maker) concept.

According to official statements from the Balancer team, the attacker drained funds from 2 pools that contained tokens with transfer fees (sometimes referred to as deflationary tokens). Though the team was not aware that such an attack is possible, they have warned about the unintended effects ERC20s with transfer fees could have in the protocol.

As of now, folks on Crypto Twitter are still debating as to whose fault is it. According to a reply from "Hex Capital" on Balancer's tweet, "Hex Capital" claims that they have informed Balancer about this possible attack vector through the bug bounty program. So, I think this debate will still go on for days.

While I do not want to comment on whose fault is it, I think this incident shows that technical risk in DeFi is something which users are subconsciously aware of but often neglect.

Financial/Market Risk

DeFi at this point is mostly about borrowing and lending money; it is about managing credit. In this amazing decentralized space, everyone can be a creditor or a debtor but most of the time, you are both.

In this recent hype of yield farming or liquidity mining, I have heard of people going to the extreme by taking up loans so that they can farm more yields. While that may seem profitable now, you are putting yourself to risk of liquidation in the event of a sudden crypto market crash.

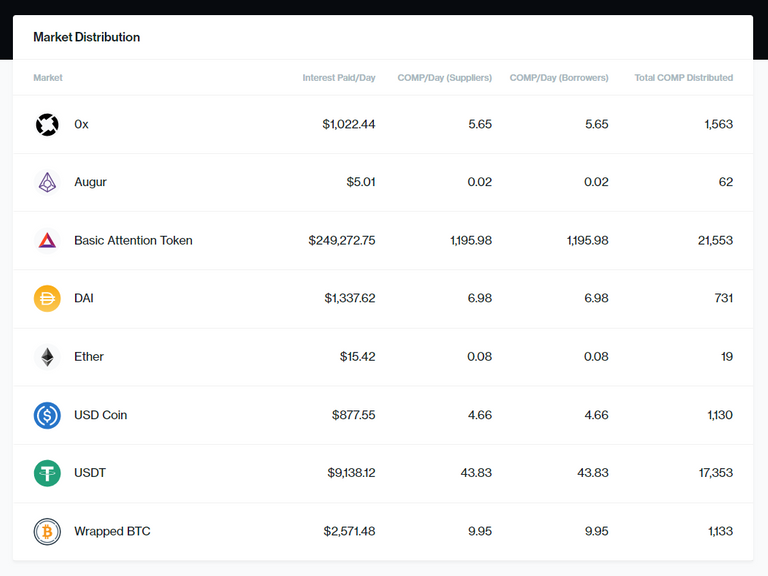

For example, BAT is among the most popular "crops" right now for yield farming on Compound. As you can see from the screenshot below, not only does it has the highest interest paid, most COMP tokens are also being distributed to the BAT market.

You may be tempted to buy some BAT and put it into Compound. Using BAT as collateral, you can loan some DAI/USDC and then use that to purchase more BAT to farm more COMP. While that might sound like a great idea when the market is stable, in the event of a sudden BAT price crash, you might be liquidated if you are not careful. At that point, the amount of COMP you farmed, may not be sufficient to cover your losses.

Scams and Hoaxes

We do not see a lot of DeFi related scams or hoaxes yet but I anticipate to see many of them as the DeFi hype continues to get fueled. Like always, scammers will take every opportunity to capitalize on people's FOMO and devise scams to cheat you of your money. Hence, always do proper due diligence and background checks before you part with your money.

When in doubt, feel free to drop a message to any of my posts so that DeFi Campus can help assess if it is a legitimate opportunity or a scam.

Conclusion

The allure of making profits is making DeFi really tempting but if you jump in recklessly, you might get burnt. That is why DeFi Campus is formed to educate Hivers on this opportunity which can so easily become a trap.

25% of post rewards goes to @ph-fund and 5% goes to @peakd to support these amazing projects.

!BEER

for you

Thanks

This aspect of DeFi is still in development, I wouldn't jump in so deep, there's still a lot of building left before it will stabilize, but in all, some nice progress has been made.

Yup, it is always good to be cautious

The innovation need to go through that phase to improve and become better.

Yes, I also believe that it will continue to innovate and improve over time

Great warning and nice that Defi Campus can provide advice. With Defi being so hot now, I was also tempted to jump into it but we must investigate and find out more first!

!tip

Yes, that is correct and thanks for the tip! 🙏

@culgin first of all very nice article. Yes I have also seen this currently everyone is the having risk with this incident. We just need to be safe this is cryptocurrency world anything can happen here.

Thanks for your comment! Yes, there is risk with any kind of investments and it is important to understand them before jumping in.

🎁 Hi @culgin! You have received 0.1 HIVE tip from @dolphin-assemble!

Sending tips with @tipU - how to guide.

View or trade

BEER.Hey @culgin, here is a little bit of

BEERfrom @eii for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.