The rise of Bitcoin has sparked a passionate community of enthusiasts known as Bitcoin maximalists, or "maxis." These individuals preach the virtues of Bitcoin as the ultimate financial system, advocating for self-custody as a fundamental principle. However, one crucial component that is often unmentioned by Bitcoin maxis is the practicality of living on the Bitcoin standard without self-custody.

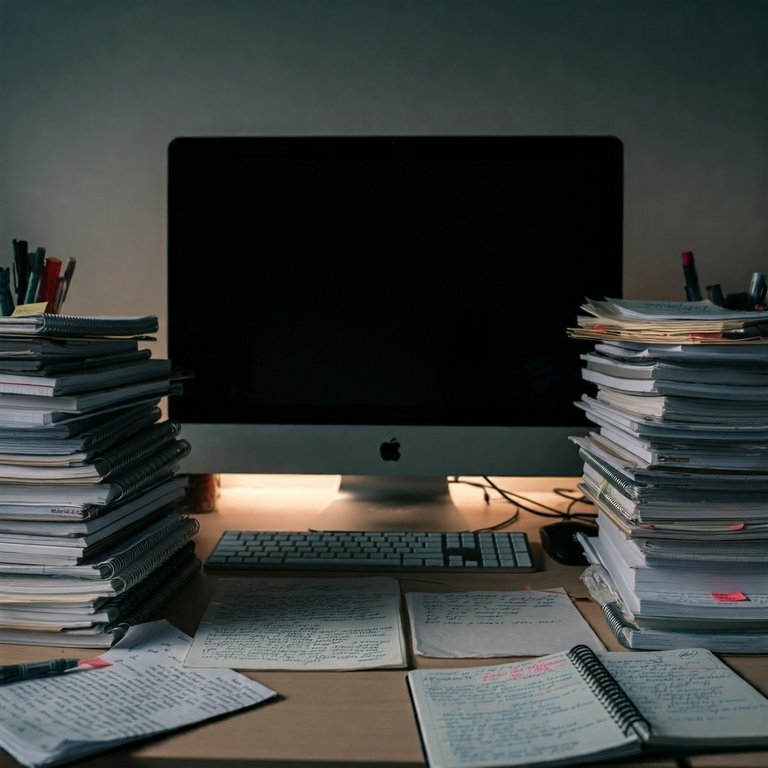

Image generated with Google Gemini

The main argument for self-custody is the mantra "not your keys, not your crypto," which emphasizes the importance of controlling your own private keys to ensure true ownership of your Bitcoin. While this is a valid perspective for those concerned about security and sovereignty, it overlooks the practicalities of everyday transactions and the infrastructure that has evolved to support them.

Living on the Bitcoin standard without self-custody is not only possible but also practical for most people, thanks to crypto exchanges and second-layer solutions. Exchanges such as Coinbase offer a seamless way to transact in Bitcoin without the need for on-chain transactions, which can be slow and costly. By keeping your Bitcoin on a reputable exchange, you can make instant, fee-free transactions with other users on the same platform. Or you can make debit card payments that draw from your Bitcoin balance. This is particularly useful for everyday purchases and small transactions, which would otherwise clog the Bitcoin network and cost you unnecessary sats.

Furthermore, the emergence of the Lightning Network has provided a scalable solution for fast and inexpensive Bitcoin transactions. This second-layer technology allows users to conduct micropayments and small transactions without burdening the main blockchain. While Lightning is a public option, exchanges offer a similar private solution, allowing users to transact efficiently within and outside of their ecosystem.

The notion that holding all of one's Bitcoin in a self-custody wallet is the only way to live on the Bitcoin standard is mistaken. In reality, dividing your Bitcoin into different categories—such as savings, investments, and daily spending—can optimize your financial strategy. For long-term savings, self-custody remains a wise choice. However, for everyday expenses, utilizing exchanges or services like Crypto.com, which allow for easy conversion of Bitcoin into fiat, can be more practical and cost-effective.

Moreover, living on the Bitcoin standard doesn't mean every transaction needs to be recorded on the blockchain. The blockchain is a valuable tool for securing and verifying major transactions, but smaller, routine transactions can be handled more efficiently through exchanges or payment platforms. This approach not only reduces congestion on the blockchain but also decreases transaction costs and speeds up processing times.

In conclusion, while Bitcoin maxis often emphasize the importance of self-custody, they sometimes fail to acknowledge the viable off-chain alternatives that exist for living on the Bitcoin standard. By leveraging exchanges, second-layer solutions, and other services, individuals can enjoy the benefits of Bitcoin while maintaining flexibility and efficiency in their financial transactions. This balanced approach allows for a practical and accessible adoption of Bitcoin in everyday life, without the necessity of self-custody for all holdings.

Posted Using InLeo Alpha

Bitcoin may be the store of value, but I think of SATS vis the Lightning Network and the V4Vapp as the functional option to take care of daily needs based on that value.

Plus with Fold and Fountain I am able to earn SATS doing things I'm already doing. It's a win-win.

I'm still trying to get Fold to work. During KYC, I moved while taking the verification photo and haven't been approved.

Their customer support is relatively responsive. Worth contacting them to get support.

I'll contact again. I got a support ticket and no action.

One factor that I believe that is holding back widespread adoption of cryptocurrencies is the difficulty of using it to pay for goods and services. So, I would be interested to know how you use a debit card to make payments.

Coinbase and Crypto.com both offer debit cards. But they operate differently.

With Coinbase, you can directly draw from a crypto balance. I can choose, in advance, to spend BTC or whatever other crypto balance I have. This card has selected 0.5% cash back in BTC rewards.

With Crypto.com, you can load your debit card from a crypto balance. You're actually spending fiat. I use this card for small payments as I keep a balance of about $20. The card level I have pays 2% cash back in CRO coin.

However, the way I do larger spending is that I use my credit card. The credit card has more consumer protections and protects my debit card information from being stolen. As needed, I cash out BTC to pay the credit card.

In these three cases, I'm not spending my crypto directly. I'm using a fiat payment option that either automatically converts manually converts crypto to fiat. This entirely avoids the problem of finding merchants that accept crypto payments.

None of this, my balance, spending, top-ups, or transfers happen on-chain. As far as Bitcoin is concerned, these payments never happened. I'm spending exchange Bitcoin, not actual Bitcoin.

Thanks. That clarifies it for me. I'll look into the options.

Congratulations @shainemata! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 5000 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: