I particularly like to have organized the money that comes in and goes out of my personal finances, managing money is not an easy task, however it is important to know what are the expenses, how much is spent and what are the outflows for investment and savings, according to the income received, this allows me to have a clearer picture of the current economic situation and to plan for the future.

In recent years I have had to take greater control of my finances because I do not have a fixed income, when working on a piece rate it is important to be aware of how much money I have available and how much I leave in reserve. This generates a risk that must be taken into account, to safeguard a fund for a possible unexpected situation that requires an expense.

When we are entrepreneurs, it is important to separate personal expenses and costs from those of the business. In this case the personal expenses will come out of the professional fees or salary assigned and not out of the total profit.

Having the habit of following up and having a budget of the expenses contributes to have a better use of the resources, to establish limits and even helps to make decisions in the case of requesting a credit, loan or acquiring some debt, to evaluate a payment plan or a negotiation of terms or interest rates, because it also allows us to see our financial behavior.

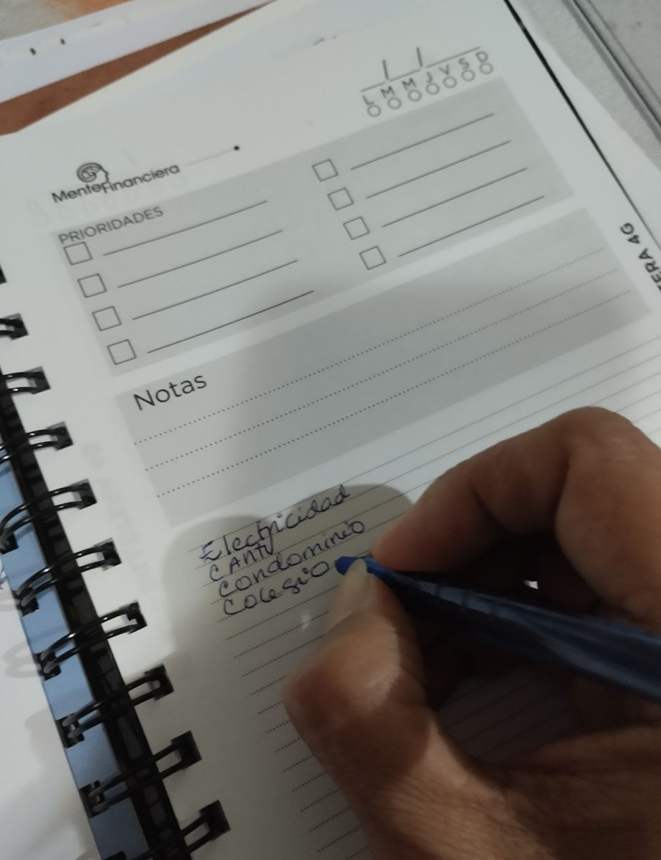

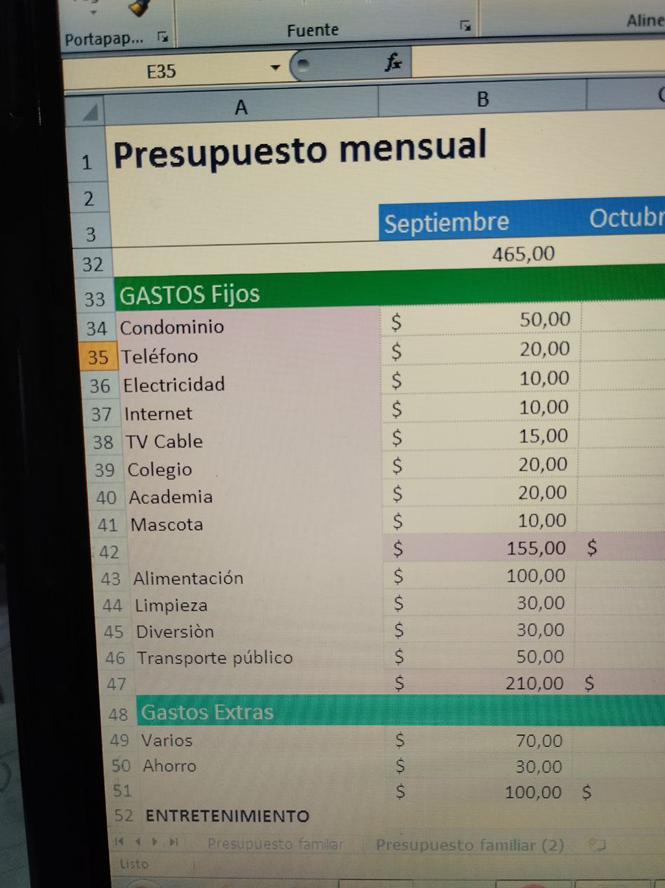

If I identify my fixed expenses on a monthly basis I know how much money I must have or how much money must come out of the account to meet those obligations; in my case I do it manually in an agenda with my personal finances and I also keep a domestic accounting in an Excel document; with the finances of the venture it is best done in a spreadsheet and in ledgers if necessary.

What else lets me know how I spend my income?

For example in my country, detecting the progressive increases month by month of the fixed and varied expenses and making the decision where I can reduce those expenses, changing the service plan, substituting the supplier company, looking for more economic options without the quality being highly affected, reducing the frequency of recreational activities or development and integral wellbeing have been decisions that I have had to make to maintain the budget of the obligations.

I make a monthly budget, however the follow-up is practically daily, due to the fluctuation of the currency value; I have to make many decisions during the month to be able to maintain my budget at the end of the month.

As I monitor my expenses I adjust next month's budget, if I need to cut costs I need to know my expenses, because determining what cost to cut depends on what I am spending on.

How do I keep track of my personal expenses?

Categorizing expenses:

1.- As there is a monthly increase in fixed expenses, the amount spent the previous month is the minimum to budget for the next month.

I write down first the fixed expenses of first necessity such as utilities, condominium, school, academy, transportation, food, entertainment and pet.

2.- Then, depending on the extra expenses, I have a line item for:

Eventual expenses, such as medical appointments, extracurricular educational or personal development activities, clothing and footwear, school supplies, fun outings outside the monthly budgeted.

It all depends on the income the eventual expense will be allocated, its priority or if an unexpected and urgent expense arises.

These expenses are the ones that I generally reduce if I do not have enough money in my budget.

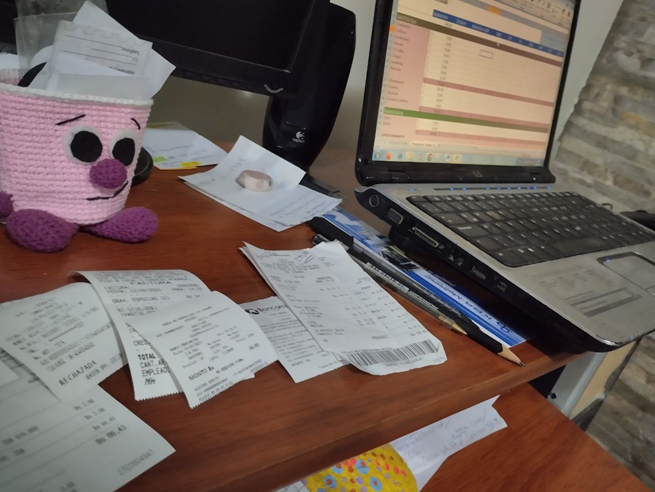

3.- Minor expenses, which are small purchases that are made on a daily basis and that I add up with the purchase tickets, such as a drink or a candy or a pill for a headache, which if not taken into account will add up to an amount spent that unbalances the account and I do not know where it comes from.

Another way of control is to reconcile with my bank account and the purchase tickets or captures, this allows me to see how much I have spent on the food item for example, and how much I have available until the end of the month. I do this with the entertainment line and with my pet's expenses.

What else lets me know how I spend my income?

Keeping track of expenses helps me to know how much I can save and to set realistic goals for planning a trip, buying a new car or taking a course. Since I don't have a fixed income, another option is to have a new income or a contract with a higher income that allows me to incorporate this savings if I didn't have it set.

It is important for me to spend less than I earn and to have money available because I don't know when I will have my next employment contract.

I remember that before, many years ago, my income allowed me to allocate a percentage to savings, today in the volatile economy in which I live, saving is not an option if you do not have a real and medium-term purpose.

Having financial habits allows us to manage our money efficiently and effectively, acquiring healthy habits such as defining goals, making a budget, keeping track of bills and purchase tickets, looking for savings and investments as much as possible, avoiding unnecessary debts and superfluous expenses, identifying priorities and having realistic objectives.

Finally, acquiring financial habits requires discipline and commitment to achieve better financial health.

Thank you for making it this far and taking the time to read my post, until the next installment.

• Banners and layouts in Canva with the elements available in its free version

• Translated with www.DeepL.com (free versión)

• Photos taken with my Redmi cell phone

Ya ni llevo cuentas de lo que gasto...pa qué..todos los meses me preguntó ¿como es que logro honrar mis compromisos sin tener ingreso fijo?...

Es un misterio ☺️🤞

El reto del administrador venezolano, gracias por comentar.