In case you've been living under a rock throughout the pandemic, or potentially if you're a #bitcoin maximalist: NFT's (non-fungible tokens)

are blockchain-secured digital assets including art, gaming, music, and much more. During the last legs of 2020, the NFT industry began receiving a significant increase in buyers, speculators, etc. With the DeFi hype still fresh in everyones' minds, a number of chads who'd gotten substantial returns began buying NFT's in droves. As the DeFi community and the NFT community began to blend into one another, more use cases for NFT's began to come forward, and while DeFi remained the hot topic among the majority of the crypto space, NFTs began to cause ripples which, a few months later have become massive waves.

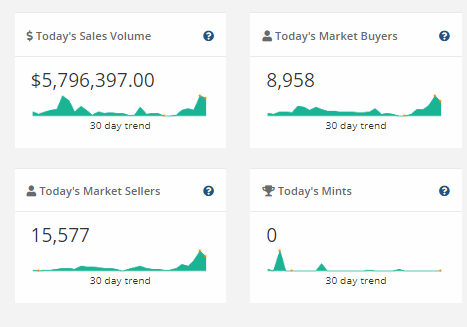

With the near-limitless potential of nonfungible tokens being realize, and new use-cases being explored, the crypto community began paying a bit more attention to what was happening in the NFT ecosystem; if mostly for speculative reasons or to hopefully acquire assets at a low cost to sell for a profit at a later date. As the 2021 brought relief from the year-which-should-not-be-named, everyone who's passionate about NFT's were keeping a close eye on NBA Topshot, a platform on FLOW blockchain through which users can buy packs of tokenized video highlights featuring thrilling moments from NBA games. The true significance of these collectibles is that they contain stats and info, much in the same way traditional sports cards would; and are officially licensed/endorsed by the NBA. By allowing users to directly add to their account balance via credit card, and by offering a nostalgic experience of collecting sports cards; Topshot has quickly become one of the most active NFT dapps on the market, with single moments of very rare qualities have consistently been sold for prices in the six-figure range, and with every packs release selling out within minutes. At the time of this writing; NBA Topshot sales over the past 24h have been a total of close to 6 MILLION US dollars; all of which has been secondary market sales. This is a perfect example of whats to come as household names continue investing large sums of money in bitcoin, which inevitably causes the realization of the vast network of Dapps, artists, musicians, and brilliant innovators that primarily use Ethereum.

Another project to take note of is Hashmasks. Originally released less than a month ago with a primary sale held exclusively on their website, the collection of just over 16000 unique generative-art portraits has a reported total volume of 16,938 ETH, or approximately 32.2 million dollars at current ETH prices. While there's certainly some credit due to FOMO, the sales history will live forever on the blockchain and will always be available as proof of the collection's immediate success. To further increase the overall value and appeal of the assets, hodl'ers are able to periodically claim $NMC (Namecoin) which can be burned to change the name displayed on the NFT's front-facing metadata; implying that over time $NMC will be steadily deflationary, making it a source of additional value to Hashmasks owners who have held onto the NFTs with titanium hands despite profitable offers by other collectors.

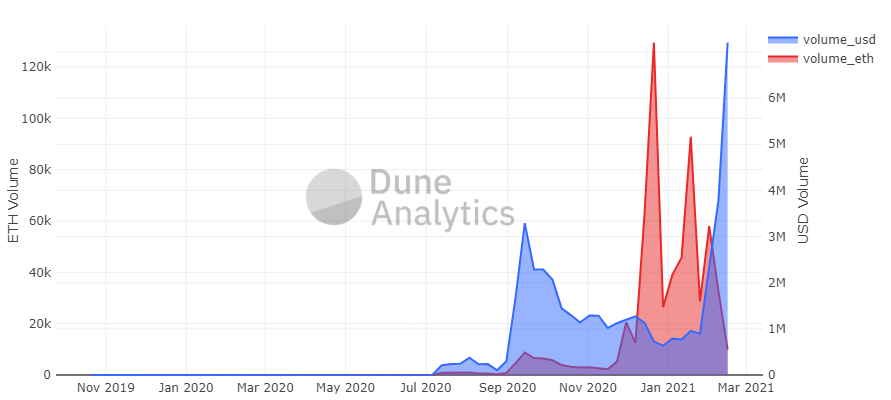

It's truly incredible to see the NFT space growing the way it is. As someone who never had any interest in crypto prior to a year ago when I learned about NFT's, and have done all I can to turn cryptoart and NFT trading into a sustainable career, the overall success of NFTs as an asset class instills a sense of confidence that I've never experienced from anything else I've done with my life. To emphasize the significance of the continued growth of the NFT market, let's compare some data [some may be slightly off, as I'm relying on memory]

Active users creating on Rarible:

Feb 2020 - ~100 | Feb 2021 - 50k+

A-List Celebrities Creating or Talking About NFT's

Feb 2020 - 0 | Feb 2021 More every day

Within the course of the past 4-6 weeks, we've seen Mark Cuban, Soulja Boy, Paul Logan, Mad Dog, T-Raww, and very likely several other celebrities I've not taken notice of creating and selling NFTs on the Ethereum mainnet, and a influx of new artists/collectors/investors that is likely equal to or more than the total of all new users over the past 6 months. The instant app sensation clubhouse appears to have near-constant rooms discussing the topic with thousands of active participants, and major crypto publishers as well as mainstream media outlets are talking about this sudden craze (though some of us have been predicting it for a year or more, but of course we aren't looked to for information).

Possibly the most impressive fact among this immense and rapid wave of adoption is that the world's oldest art auction house, Christie's will be auctioning an extensive collection of NFT artworks by the renowned digital artist known as Beeple. [ Which will in fact be the second time Christie's has included NFTs on it's auction roster, after auctioning a physical work based on the bitcoin network in Oct. of last year, which included a corresponding NFT published on Async Art].

Just in case all of those massive milestones don't convince you that you've been sleeping on NFT's this whole time ( unless you'd read my articles and were perceptive enough to pick up on the intense passion i have for this industry; in which case you've been collecting and you're likely sitting on a gold mine.) the man who is arguably the world's most brilliant and among the most famous entrepreneurs, Gary Vee, has taken a different approach. While numerous celebrities are seizing the oppurtunity to further increase their wealth by selling what is very likely to be art they commissioned for next-to-nothing, at least when compared with the resulting income; Gary has been collecting, researching, and telling his several million followers that NFTs are comparable to the inception of social media in the early 2000s, and the early days of the internet in the 1990s.

As a final piece of data to ponder; sales volume during the first week of Feb on Rarible, once widely considered the "street dealer" of NFT's; a single marketplace among dozens of currently available NFT platforms on Ethereum mainnet:

Second Week of February 2020 - 7 day sales volume: $360 USD

Second Week of February 2021 - 7 day sales volume: $7.13 Million USD

data by Dune Analytics

I'll close with a sincere and heartfelt request, as this space becomes saturated with financial giants, please keep in mind that a very large number of artists have spent months or years dedicating themselves to their art and to the NFT community, with tens of thousands of incredibly talented artists and creators are joining the space as well; hoping only to be able to support themselves by following their dreams.

- BruceTheGoose, CryptoArtist

https://beacons.page/brucethegoose

Resources

https://explore.duneanalytics.com/queries/20157

https://app.rarible.com/brucethegoose

https://discord.haus/nfthub

Posted Using LeoFinance Beta