We live in a reality where everyone seeks to get rich overnight. We are exposed to an immense stream of information, often unable to discern its truthfulness. Constantly, we are bombarded with portrayals of lifestyles and recommendations on social media, leaving us uncertain about what is truly happening.

The reality is that the majority of the information and lifestyles we see portrayed are often misleading. The primary objective is to convince the average individual that they can attain such lifestyles or achieve rapid wealth if they invest in the services being offered. These offerings frequently come with unrealistic promises. It's important to note that when discussing false promises, the culprits are not limited to 'internet gurus.' Large institutions and hedge funds are also part of this dynamic.

They profit through commissions, maintenance fees, and performance bonuses. Therefore, the more people they can persuade to believe in the illusion of making substantial money in a short period, the more beneficial it is for them.

This situation underscores the need for critical thinking and a cautious approach when encountering such claims, as the allure of quick wealth can often cloud judgment and lead to decisions that are not in one's best financial interest.

Critical thinking: Distinguishing the truth from the lie.

In Morgan Housel's book, 'The Psychology of Money,' a quote resonates deeply with me: 'Nothing is as good or as bad as it seems.' Since encountering this phrase, I've adopted a practice of seeking diverse perspectives and delving deeper into any new information that piques my interest or involves me directly. This approach stems from the understanding that things are often not as straightforward as they appear.

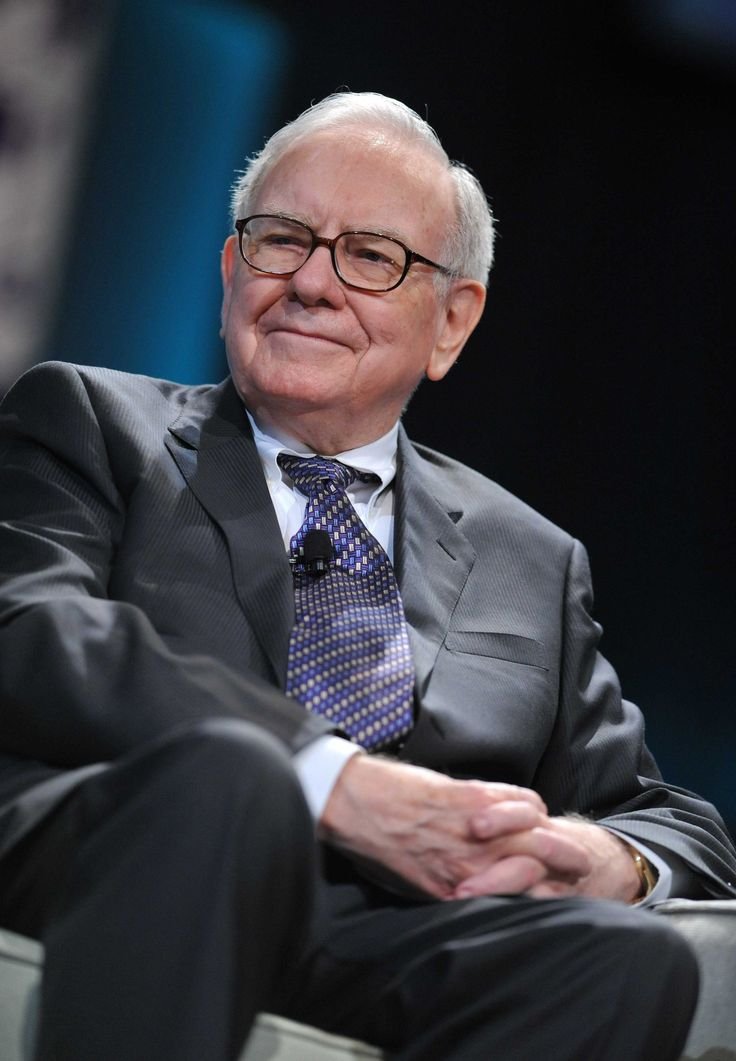

As Warren Buffett once said, ''It’s not what we don’t know that kills us, it’s what we know that ain’t so''

This wisdom underscores the importance of exercising caution in both our admiration and our disdain. It's crucial to recognize that success isn't always a result of hard work, just as poverty isn't solely due to laziness. Therefore, it's beneficial to focus less on individual cases and more on broader patterns, understanding the complex interplay of factors that contribute to different outcomes in life.

As I previously discussed in my article 'How to Create Wealth and Manage Your Portfolio,' I find it imperative to revisit the topic of effective risk management. It's crucial to understand that risk management does not imply seeking risk-free opportunities; rather, it involves 'studying the adversary to minimize losses in the event of being wrong.'

We live in the information age, which offers numerous advantages if we know how to leverage it to our benefit and understand our actions. This knowledge is key in minimizing risks. Even in cases where our investments do not perform as expected, it's important to view these situations as a cost of learning. Such experiences provide valuable opportunities to analyze what could have been done better and identify areas where greater caution could have been exercised. This approach not only helps in refining our strategies but also in enhancing our decision-making process for future endeavors.

Focus on what you love or your skills

“In the world of business, the people who are most successful are those who are doing what they love.”

― Warren Buffet

You may have heard the saying, 'Do what you love, and you'll never work a day in your life.' This adage is also applicable in the realm of investing. Finding your circle of competence or an area you are passionate about and investing in it will likely lead you to devote more time to analyzing potential risks and benefits. This approach almost guarantees that you'll stay updated with all the latest developments.

A crucial initial step for any investor is to determine where to invest. Before this is dismissed as a limiting mindset, consider this: as an investor, you are essentially purchasing companies or projects. Therefore, it makes sense to invest in areas that interest you or that you understand well.

In conclusion, it's evident that education plays a vital role in successful investing. The primary reason many investors lose money is that they act as speculators, entering the market with the aim of making quick money. What these speculators often fail to realize is that the easiest and most rewarding long-term strategy is to educate oneself and have a clear understanding of where you are investing.

Here is a good exercise to discover your circle of competence and your passions:

Don't be a speculator unless you have a gift

The title speaks for itself: in a volatile market like ours, the average person engaging in day trading or swing trading is essentially a speculator, unless they possess a unique talent or have access to privileged information (which is not readily available to the general public). My advice is to approach these trading methods with caution. If you do choose to explore these markets, perhaps to gain a better understanding or for some level of enjoyment, it is prudent to limit your exposure to just 5% or 10% of your total assets. With a combination of luck, minimized risks, and a well-developed strategy, there's a chance of making some profit, or perhaps even discovering the next groundbreaking project or cryptocurrency that skyrockets in value overnight. However, it's important to remember that such outcomes are exceedingly rare, with odds akin to one in a million.

Many of the well-known individuals you see on television making substantial profits in the market are often privy to insider information and have influential contacts. While leveraging such information is considered illegal, if it remains undiscovered, no legal consequences follow. Of course, there are notable exceptions: some are exceptional speculators, seemingly possessing a crystal ball that predicts market movements. These individuals are akin to the Cristiano Ronaldo of the markets, possessing a rare gift. However, do not be misled; the majority do not have such talents and rely heavily on insider information. Therefore, if you do not have access to such privileged information, it is advisable not to engage in speculation.

Therefore, my recommendation is to focus on Dollar-Cost Averaging (DCA) and the power of compounding, which I will discuss in the following chapter.

The power of Dollar-Cost Averaging and Compounding in Investing

In the world of investing, two strategies stand out for their ability to build wealth over time and reduce investment risks: Dollar-Cost Averaging (DCA) and Compounding. Understanding and applying these methods can significantly enhance your portfolio.

Dollar-Cost Averaging: A Strategy for Risk Mitigation and Discipline

Dollar-Cost Averaging is an investment technique where you invest a fixed amount of money at regular intervals, regardless of market conditions. This approach offers several advantages:

Reduces Market Timing Risk: DCA mitigates the risk of investing a substantial amount at an unfavorable time. By spreading out the investment, it avoids the pitfalls of trying to time the market.

Encourages Financial Discipline: Regular investments cultivate a disciplined approach to saving, turning investing into a consistent habit rather than an emotional reaction to market fluctuations.

Less Emotional Stress: The systematic nature of DCA reduces the stress associated with market volatility, helping investors avoid impulsive decisions.

Benefits from Market Dips: Over time, this strategy allows investors to purchase more shares when prices are low and fewer when prices are high, potentially lowering the average cost per share.

Compounding: The Key to Exponential Growth

Compounding is the process where investment earnings, both capital gains and interest, earn additional interest over time. This strategy is crucial for long-term investment growth:

Exponential Growth of Investments: Compounding leads to the exponential increase in the value of an investment, as the earnings accumulate over time.

Maximizes Long-Term Benefits: The true potential of compounding is realized over an extended period. The longer the investment, the greater the benefits.

Significantly Enhances Returns: Over time, compounding can dramatically increase investment returns, especially when these returns are reinvested.

Rewards Early and Consistent Investing: Starting early maximizes the benefits of compounding. Even modest investments can grow significantly over time, highlighting the importance of consistent investing.

Conclusion

Dollar-Cost Averaging and Compounding are powerful strategies in the investor's toolkit. DCA offers a prudent way to invest in volatile markets, reducing risks and promoting disciplined investing. Compounding, on the other hand, works as a force multiplier, significantly enhancing the value of investments over time. Together, these strategies can help investors build a robust portfolio, ensuring long-term financial stability and growth.

We have compelling examples, which I will discuss later, that demonstrate the efficacy of compounding. Additionally, by examining the S&P 500 index over the past decade, we can observe the significant impact that even modest annual investment returns can have over a span of 20 or 30 years. This approach could be a viable solution for retirement planning, especially considering that relying solely on state social support currently poses a substantial risk. In the following sections, I will delve into these examples to further illustrate the power of compounding and its potential role in securing financial stability for the future.

Follow the best

To conclude this article, I want to emphasize a crucial point for those aiming to outperform the market and achieve success: follow the best.

In today's digital age, there is an abundance of information on the internet about achieving success and amassing fortunes in the market. Much of this information comes from individuals who have suddenly emerged with what they claim to be a simple, magical formula. However, beating the market is indeed simple, but not in the way some people on social media might oversimplify it. These individuals are easily identifiable as they often employ a similar strategy: join my course for a thousand euros, and I'll make you a millionaire in a week.

The most effective strategy is to observe and learn from the world's wealthiest individuals. Understanding how they amassed their fortunes can provide valuable insights. By using them as examples, we are more likely to adopt their strategies. Even if we don't reach the same level of wealth, we can still achieve more stable financial health.

Reading top-tier financial books is also immensely beneficial for financial success in the market. These books often contain information and experiences from authors who have proven successful over many years. Investing in our education before entering any market or business venture is always the best investment – an investment in ourselves.

Additionally, following leading financial websites can be extremely helpful. They keep us updated on market happenings and provide access to valuable information and education, free of charge and in a well-structured, easy-to-understand format.

Need an audit for your blockchain project?

Our expertise lies in developing sustainable, efficient blockchain solutions across various sectors. Specializing in smart contract auditing, we've secured over $275M in on-chain assets, meticulously reviewing over 225,000 lines of code. Trust us to safeguard your digital innovations.

https://sub7.xyz/

https://ecosystem.polygon.technology/8871610587/

Join our community!

OffChain Global is building a trusted global community where members can build their professional social network through virtual and in-person events and find the resources, both locally and globally, required to be a productive member of the Web3 professional world.

Chapters in 70+ cities around the world.

Crypto, DeFi, Blockchain or Web 3.0 enthusiasts

Discussion groups, trading groups, and employment groups

Offchain Luxembourg WhatsApp: https://chat.whatsapp.com/DpyqRtWdjFA0YMedDncXck

OffchainGlobal Telegram group: https://t.me/+DQ03UXkugYM5NGVl

Congratulations @wgomes26! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 100 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts: