The Goods and Services Tax (GST) is applicable to all online gaming in India. Currently, the GST rate for online gaming in India is 18%, considering it under the category of 'game of skill'. GST is charged by online gaming platforms for the services they provide to users. Similarly, the users who make payments for online gaming services are also liable to pay GST on those transactions. It’s imperative for online gaming platforms and online gaming users to comply with the GST regulations in India.

Current Scenario

Currently, the below mentioned GST rates are applicable to online gaming (including card games and other e-games) and casino earnings in India:

- For a game of skills, for example, e-puzzles, e-sports, and card games, an 18% GST is chargeable on the platform’s service fee or on gross gaming revenue after deducting distributed winnings.

- For a game of chance, such as gambling at casinos, a 28% GST is chargeable on the total bet value.

Proposed change

After the 50th GST Council meeting in July 2023, it was decided that 28% GST on full face value will be charged on online gaming, casinos, and horse racing without keeping any distinction between 'game of skill and 'game of chance'.

The major challenge among the group of ministers was whether to impose a 28 percent GST on the face value of bets, or on gross gaming revenue, or just on platform fees. But it is decided that the tax will be levied on the entire value.

Below are some of the initial reactions from gaming industry:

"The implementation of a 28% tax rate will bring significant challenges to the gaming industry. This higher tax burden will impact companies' cash flows," Aaditya Shah, chief operating officer at the gaming app IndiaPlays, said.

Roland Landers, CEO of The All India Gaming Federation, said the decision was "unconstitutional (and) irrational".

According to Statista, the market size for online gaming industry in 2022 is up to 120 billion rupees. In 2024, it is expected to be 153 billion rupees (approximately $1,92 billion). This is because internet facilities are easily and widely reaching people of India at economic tariffs. Further, people are ready to spend more on entertainment nowadays.

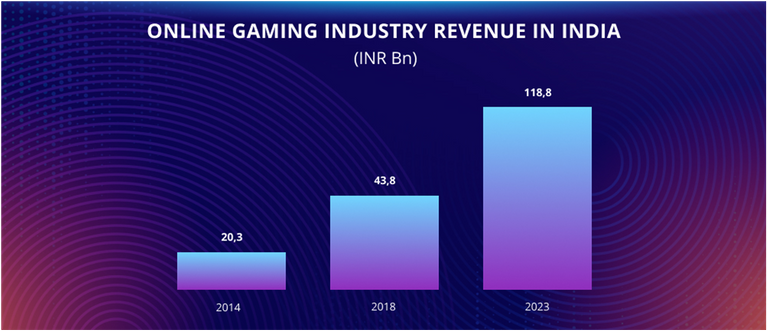

According to KPMG research, online gaming industry revenue doubled over 4 years from 20.3 billion rupees in 2014 to 43.8 billion rupees in 2018. And is expected to further increase more than double by end of 2023.

Next steps

Online gaming firms have written to the finance ministry to reconsider the increase GST, expressing their concerns that higher taxes would impact the gaming industry and could lead to job losses.

Higher GST rates will also lower the playable value received by the platform users. Additionally, online gaming platforms will be left with lower profit margins which would further result in a massive drop in foreign investment.

A group of top online gaming firms represented by the FICCI Gaming Committee had earlier urged the Central Board of Indirect Taxes & Customs (CBIC) not to hike the GST rate for the sector to 28 percent as they cited it would be “extremely detrimental to the survival of the online gaming industry as no business operations can survive with such high taxation.

Although, a review or a rollback of the decision to impose 28% goods and services tax (GST) on the full value of online gaming seems doubtful from the ministry. However, the gaming industry is hoping to get some relief that could come in the form of revision in proposed GST from 28% to somewhere between 18% to 28%.

Thanks for reading...

This post has been manually curated by @alokkumar121 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @alokkumar121 by upvoting this comment and support the community by voting the posts made by @indiaunited.

Congratulations @wadhwas! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 300 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: