Disclaimer: Everything written in this post is purely my own opinion and should not be taken as fact. I am not a financial advisor and my opinions do not constitute financial advice. You must take responsibility for your own actions.

Introduction

I recently learnt about hive.blog and leofinance.io and my initial impressions are that it is like a less censored version of Reddit, that rewards its users and has potential to grow, so I thought I'd give it a try.

I have been dabbling in trading for many years, seen and tried many different ideas/products, but never really cracked it. During lockdown this year, I decided to use that dead time to give forex trading another try - the equity curve you see above is my year-to-date live trading performance.

I currently monitor 26 currency pairs using mostly hourly charts. As you can see from the equity curve, my performance in the 1st half of the year was terrible as I jumped from idea to idea and traded impulsively. At the lowest point I decided to focus on just 1 idea and wait for good trading setups and my performance improved. My account is now headed in the right direction and I just need to keep going to see if I can be a consistently profitable trader or if this is all just a big fluke.

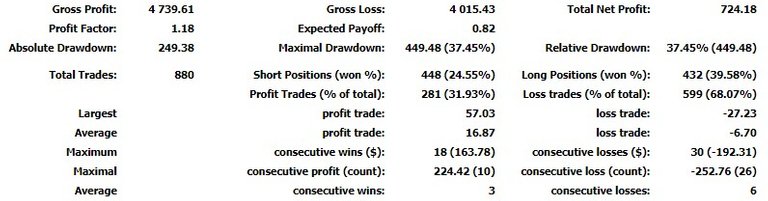

OK let's analyze some stats:

Analysis

- The number of trades is grossly inflated because each trade may have 2-4 positions, allowing me to take partial profits or losses at different levels.

- The profit factor of 1.18 is really low (gross profit/gross loss) - it means for every $1 traded, I average a return of $1.18. My target for next month is to get this higher.

- My maximal drawdown of 37.45% is unacceptably high but the graph shows that I have started to reduce the size of my drawdowns over time.

- I lose 68.07% of my trades!!! What this means is that a monkey flipping a coin to go long or short is more accurate than me in guessing market direction!!! :D Winning only 24.55% of shorts is particularly disturbing and needs further investigation.

- I keep my losses small and try to run my winners for more, which is how I end up profiting overall.

Main takeaways

- You don't need to be right all the time in trading as long as you cut your losses and run your winners. I used to think that I had to predict where the market was going and then take it as a personal insult when the market moved in the opposite direction. Now I find it incredibly liberating that I don't need to predict - I simply react to whatever the market decides to do. As long as your trading expectancy is positive, you can make money long term. Expectancy is calculated as (probability of win*average win)-(probability of loss*average loss) . In my case this = (0.3193*16.87)-(0.6807*6.70) = 0.825901. This means my average profit per trade is £.0.825901

- I have proven to myself that the main account killers are: over-trading and low quality trade setups. Taking less trades that are much more high quality is the key to profit!

- When in a drawdown, be patient! Trying to over-trade your way out a drawdown just makes the drawdown last even longer.

I hope you found this post interesting or useful. I was thinking about making future posts on my hard-earned knowledge about trading and the markets. If you have any suggestions or questions leave a comment below. Thanks for reading!

Posted Using LeoFinance

Welcome to LeoFinance. It’s great to see another forex trader sharing here.

I’ve given you a follow and look forward to seeing more of the setups you trade.

🦁.

Posted Using LeoFinance

Congratulations @upanddown! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz: