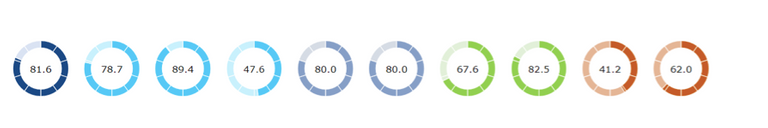

Ease of doing business is defined as the regulatory environment and protocols in a country to start and operate a business. Each year, the World Bank compares the business environment among 190 countries in its report titled ‘Ease of Doing Business. In the recent data of the year 2020, India stood on the 63rd rank with a score of 71.0/100. The rankings are based on a country’s performance on 10 broad parameters such as starting a business, getting electricity, resolving insolvency and the other is mentioned in the graph below.

In India, these rankings are based on the business environment in Mumbai and Delhi. A lower rank indicates better performance on that parameter, whereas a higher rank indicates worse performance on the indicator. India’s ranking improved in six out of the 10 parameters over the previous year, while it remained the same or fell in the remaining namely, enforcing contracts and registering property.

The 15th Finance Committee, under the leadership of the Finance Minister, Ms. Nirmala Sitharaman had passed the Lok Sabha as the Finance Bill, 2021 on March 23, 2021. The passing of the bill means that the financial proposals of the central government for the financial year 2021-22 are in effect. The passage of the Finance Bill by Parliament marks the completion of the budgetary process in India for the current financial year. The budget stresses and focuses on three major issues, ‘Self Reliability’ (Aatma Nirbhar), Healthcare and Wellbeing. Self-Reliance is possible with increasing domestic production and ramping up the secondary and tertiary business sectors and in order to achieve this, the government has tried to increase the ‘Ease of Doing Business’ score by the following initiatives and provisions.

- Extension of tax rebate for startups

In 2021, the Finance Minister extended the eligibility period to claim tax rebate, as compared to the previous budget, for the startups to March 31, 2022. The startups were in deep anticipation of such a step by the authorities as both the need to encourage entrepreneurship, as well as help startups, to deal with the impact of COVID-19 on their business. The startups were expected to claim a deduction for the first ten years of operations.

- Capital Gains Tax exemption for investing in startups

In another announcement that may benefit the startup ecosystem, the government has extended the eligibility period to claim capital gains tax exemption for investments made in startups by one more year to March 31, 2022.

- Support for MSMEs

The government has taken initiatives to bring about changes to benefit the smaller business men running the micro, small, and medium enterprises (MSMEs). To help the MSMEs, the government proposes to set aside Rs 15,700 crore for MSMEs in FY 2022.

Further, the Ministry of Finance plans to increase the duty on steel screws and plastic builder wares from 10 percent to 15 percent, and rationalise the exemption on import of duty-free items. This has been done to incentivise exporters of garments, leather, and handicraft items since most of them are made by MSMEs.

Since 2014, the aim to create a conducive business environment by streamlining the existing regulations and processes and eliminating unnecessary requirements and procedures has been taking a shape in India and with the growing startup trend in India, along with the governmental initiatives, India is definitely on the rise.

Posted Using LeoFinance Beta

💲💲💲💲💲

Congratulations @ukiyo.dev! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!