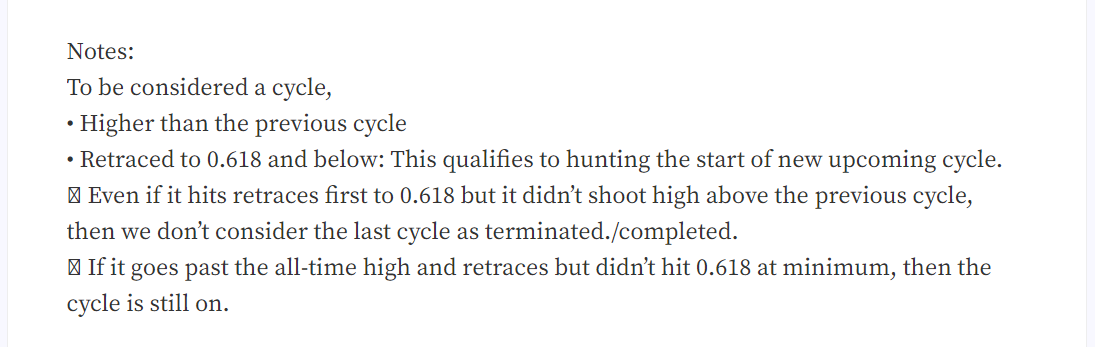

Interesting times ahead. Based on the rules postulated in my post 2 years ago,

https://hive.blog/hive-186328/@turpsy/average-buy-price-for-btc-is-5361-usd

These conditions are now met.

The cycle was higher than the previous cycle (69,000 USD is greater than 19,700 USD).

Retraced to 0.618 and below: this has now been achieved. This suggests that we should start hunting for the new upcoming cycle.

- It went higher than the previous cycle before it came crashing to 0.618 Fibonacci ratio.

- It already hit 0.618.

It can be stated that we should start hunting for the upcoming cycle.

How do we prepare?

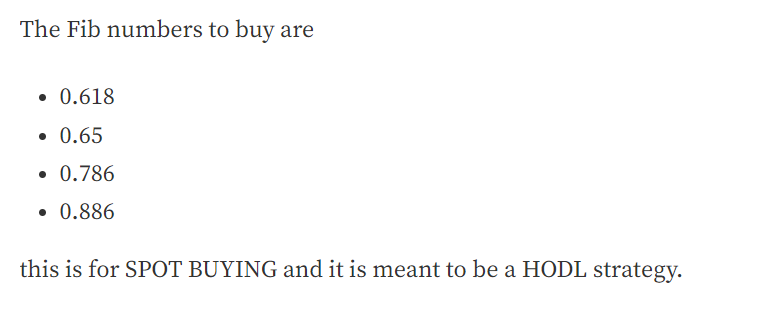

The goal is to get in at a fair price. This can be achieved by using the Fibonacci ratio. $Bitcoin mostly respect Fib ratio. The Fib ratios we are always aiming at are established in the post above.

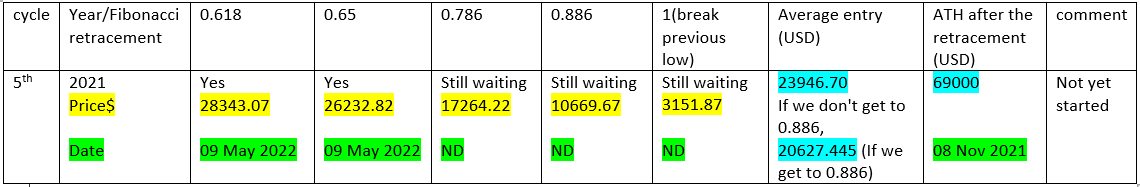

Some of the few details to note are in the table below

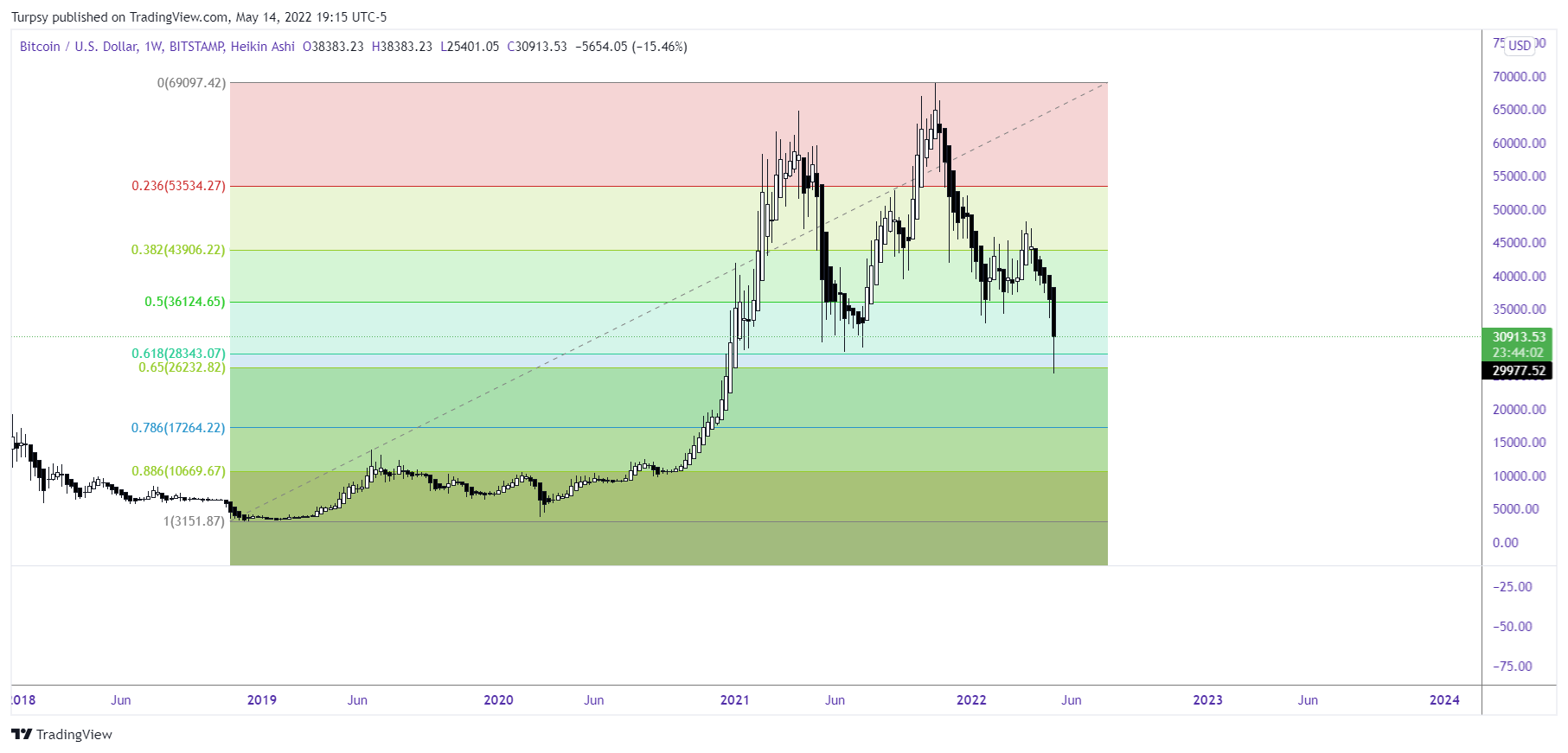

https://www.tradingview.com/x/YGecGe8G/

The chart is from Bitstamp exchange, with Heiken Ashi candle and a Weekly time frame.

Some thoughts:

- For the long term horizon: Btc is a buy at these prices: 28,343 USD, 26,232 USD, 17,264 USD, 10,669 USD. However, some of the prices may not be achieved.

- For us to look at another upside cycle, Bitcoin needs to go past 69,000 USD. However, we have to prepare for that and this is achieved by buying at low prices (using Fib ratio)

- It´s disappointing that the last upside didn't get to the expected Fib extension prices as proposed in this post. This suggests we are to be cautious on the targets for BTC for both upside or downside.

Posted Using LeoFinance Beta

Congratulations @turpsy! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Now trend