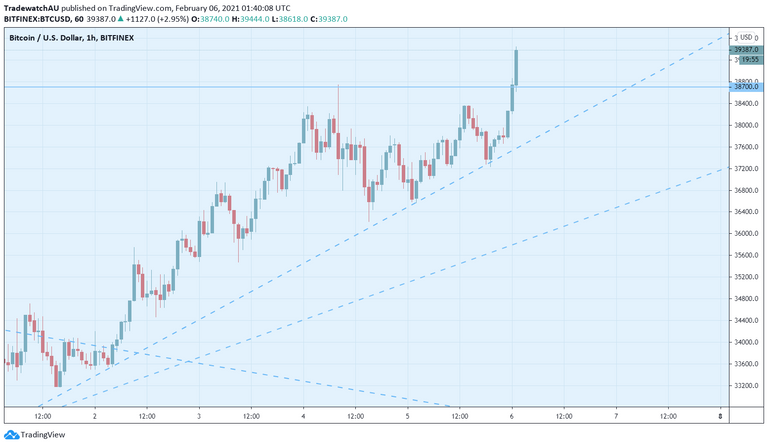

Bitcoin is looking mighty strong today with bulls pushing above Elon's high at 38700, currently 39300:

This is an ascending triangle formation and the break higher should lead to continuation.

Surpassing Elon's High

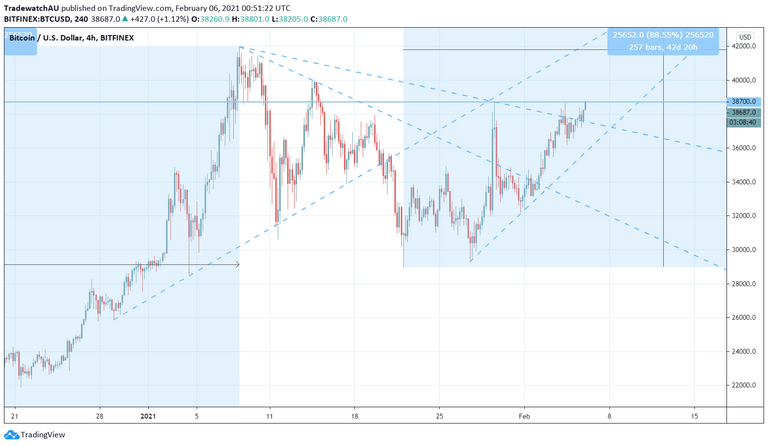

All downward sloping trend-lines have now been breached and closing power above the triangle top will open up the path to the mid-January highs at 40000, followed by the all-time highs at 42000:

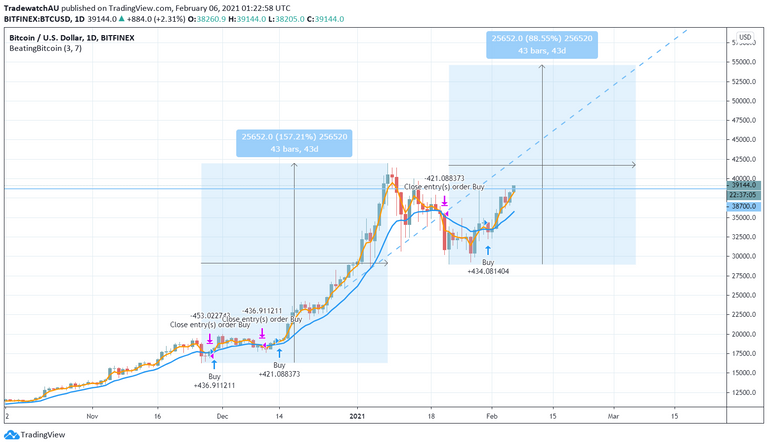

On our daily chart we have two objects suggesting we will breach 50K by late Feb / early March - a measured move from the last leg which was 43 days and more than 25000 points, the second is the former support line where Elon choked at the end of Jan and is now acting as resistance:

I especially like that second one as it's essentially a conservative target - we don't even need the trend to accelerate to get there!

Long time no chart

It's been a while since my last update, I've been bogged down with day job and an immigration matter (if you've never been bogged down with one of these before they are awfully fun, even more so than taxes - highly recommended!).

I did manage to do a bit of paid forex writing for my bud @forexbrokr between those, but beyond that, my own trading and a cheeky discord chart or two, didn't have the bandwidth for much else.

Remember I shared my strategy in Beating Bitcoin with a Simple Trend Following Strategy - Part 3, so you can always see where I'm at whether I post here or not.

That final and best post in the series where I revealed my "secret" largely went under the radar, so it's worth a look - I may remove the data from the front end some time soon, but you'll be able to find the data on the chain if you're reading this in the future and know where to look.

Strategy update

Either way, the strategy has performed exceptionally well in lieu of updates - it was long from 19K last I wrote, and issued a take profit signal right before the big sell off:

We then got a buy signal 10 days later on the 31st of Jan and I put my money where my mouth is and a substantial amount of skin in the game - I won't go into the details of my personal finances here (@ausbitbank ;)), but safe to say it's a level of risk I would not recommend to an inexperienced trader.

I'm very happy with how this position is evolving and it feels great hitting for the fences with a proven strategy reinforcing my resolve.

A portion of this exposure is via Binance's leveraged token BTCUP which essentially takes the degen and death spike risk out of margin - with your leverage decided and automatically adjusted by Binance's algos (capped at 3:1) and liquidation/margin call risk eliminated.

I will likely be more nimble with that leg of my position as it does still carry a substantial factor of risk over spot, but for the moment I am holding it while our strategy says hold.

Congrats to everyone else who caught this leg and give me a shout if you need some help following the strategy - essentially if you've missed a entry signal, any down day is a good day to enter while the strategy is bullish.

Good luck out there!

Posted Using LeoFinance Beta

Hmmm. If I have to be honest and this is just my own opinion anyway. The last time bitcoin was mooning it hits 41k ATH, and the whales walk into the park and cashed out their btc. Subsequently, causing the price to fall under 30k. It got stuck there for some time then slowly reaching the 40k mark again. Don't you think this is just a repeat of what had happened? Don't take it from me, I'm a simple guy, I work that way. Just be aware that if you buy, there are plenty of chances that it could dip again. Just my opinion. Either way, do whatever floats your boat. This is not a piece of advice, just an opinion from a simple guy. Enjoy the mooning period guys!

Posted Using LeoFinance Beta

Hey Luke, thanks for the question.

If you think about it, if markets behaved like that they would never move in any direction ie every time it got to 41K it would sell off, and every time it got to 30K it would rally.

This does happen semi-regularly, it's called ranging, but ranges eventually break one way or the other.

Trading/analysis is about assessing what potential outcome has the highest probability of occurring and, if that outcome also would yield an acceptable amount of profit vs the potential loss, acting on that assessment.

Posted Using LeoFinance Beta

Thanks for answering my question buddy. Really appreciate it.

Taking in the analysis and any possible outcome point of view, I know it would be the best possible prediction that it would hit 50k mark in price.

My follow up question if you don't mind. Looking at faith could actually affect the market, the question is how much of it could affect the price of bitcoin/altcoins?

I'm interested in this because in stock market "faith" could be overturned and causing mass depression which we could see in the past. There are enough pain caused by FOMO in the market that It will be very difficult to believe anything that looks like a pump and dump scheme.

Posted Using LeoFinance Beta

You're most welcome.

This is an interesting questions as in prior cycles pretty much the only driver was sentiment / faith / hype / mania.

This cycle we have a clear shift in market fundamentals ie just 2 million BTC on exchange, just 4 million in weak hands (including the first 2 mentioned I think?), institutions actually buying instead of just rumours, more active wallets than there will ever be bitcoin.

That side of things isn't really my strong suit, but I'd warrant with these new drivers combined with the longstanding undying faith, we'll be able to put in a comparable cycle.

You may have seen this video from the microstrategy conference, but if not, well worth a watch - either the whole thing or especially the last 20m - https://leofinance.io/@rollandthomas/microstrategy-s-bitcoin-summit-day-1

(via @rollandthomas)

Posted Using LeoFinance Beta

Oh, much appreciated there buddy! I'll take a look at the microstrategy. As always keep on writing and thanks for your time.

Posted Using LeoFinance Beta

BTC has topped IMO

Posted Using LeoFinance Beta

Care to elaborate?

You may well be right - I'm surprised by extent of recent weakness - but it would be an anomaly looking at previous cycles.

Posted Using LeoFinance Beta

50k is another step to mass adoption

Posted Using LeoFinance Beta

What do you think will happen to alts right now? Will BTC again suck at least some air out of the room?

Posted Using LeoFinance Beta

Looking at the ETHBTC chart and it looks awful heavy, could return to 0.036, they should continue to appreciate it $$$ terms as long as market wide sentiment is positive though

Posted Using LeoFinance Beta

50k by end of the month looks possible now. We're almost at 40k already.

Posted Using LeoFinance Beta

Yep it 's funny once the numbers start getting larger like this - 20% doesn't seem like much for Bitcoin, but 10K seems like a lot. This will be the psychological battle as we trend higher.

Congratulations @tradewatchblog! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Good to see you back writing again in the LeoFinance community, mate.

I love that you've shared your strategy here and as soon as I get some time, I'm going to delve into it and come back at you with some questions.

Posted Using LeoFinance Beta

Cheers mate, it's ridiculously straight forward, infuriatingly so in hindsight - it's just a buy side only MA cross :man_facepalming:

Posted Using LeoFinance Beta

The more simple the better!

Do you use risk:reward to tilt things in your favour? (Sorry if you've written about this in a past post).

Posted Using LeoFinance Beta

As the strategy isn't very accurate (37% win rate), there's probably all sorts of improvements you could do, but the problem is, the strategy out performs bitcoin because it captures every up trend and misses every down.

If you started picking and choosing entry signals, you could miss an up move (and a huge chunk of performance), and if you skipped a take profit signal you could cop a nasty down day like the one that occurred after the last take profit signal (potentially increasing max drawdown substantially and detracting from risk adjusted performance).

Having said all that, you could have a fall back or something, where if you didn't take a signal due to potentially poor R:R or whatever, you jump in a candle or two late if it moves.

Posted Using LeoFinance Beta

3EMA-7SMA

You can delete the secret now :)

Posted Using LeoFinance Beta

Too simple the slow should be smoothed ;)

Posted Using LeoFinance Beta