Hello everyone,

Being a huge crypto enthusiast, I recently discovered that this wonderful community exists on hive, and I was really happy that I have some place to share my cryptocurrency knowledge and analysis! This is going to be my first post on this community so I hope you like it!

Introduction

The recent conviction of Sam Bankman-Fried, the co-founder of FTX, on charges of fraud and conspiracy has sent shockwaves through the crypto industry. Bankman-Fried, once hailed as the "Crypto King," pleaded not guilty to all seven counts against him but was found guilty by a federal jury in New York. This verdict has raised questions about the future of the crypto industry and the need for stronger regulations. In this article, we will delve into the implications of Bankman-Fried's conviction and its potential impact on the crypto market.

The FTX Collapse and Charges Against Bankman-Fried

FTX, a prominent cryptocurrency exchange, suffered a dramatic collapse almost a year ago, causing the price of Bitcoin (BTC) to plummet. Bankman-Fried was accused of improperly diverting billions of dollars in customer assets to an affiliated hedge fund, Alameda Research, without their authorization or knowledge. The collapse of FTX and the subsequent charges against Bankman-Fried have shed light on the risks and lack of regulations in the crypto industry.

The Impact on the Crypto Market

The conviction of Bankman-Fried has left many wondering if the crypto market can recover from this blow. While crypto prices have started to recover since the collapse of FTX, there are still concerns about the lack of regulation and investor protections in the industry. The FTX saga has highlighted the need for guardrails that can prevent similar incidents in the future. Without solid regulatory frameworks in place, crypto investors remain exposed to potential risks and fraudulent activities.

Can Crypto Overcome the FTX Saga?

Many individuals within the crypto community are eager to put the FTX disaster behind them and move forward. They argue that fraud can occur in any industry and that crypto itself is not to blame for Bankman-Fried's actions. While it is true that fraud exists outside the world of crypto, the lack of regulation in the industry has made it easier for incidents like the FTX collapse to occur. Crypto investors have fewer protections compared to traditional banking systems, making it crucial to establish regulatory measures that safeguard their interests.

The Need for Regulatory Measures

If you are considering investing in crypto, it is essential to understand the risks involved and take steps to mitigate them. Here are some measures that can help reduce the risk associated with cryptocurrency investments:

1. Diversify Your Portfolio

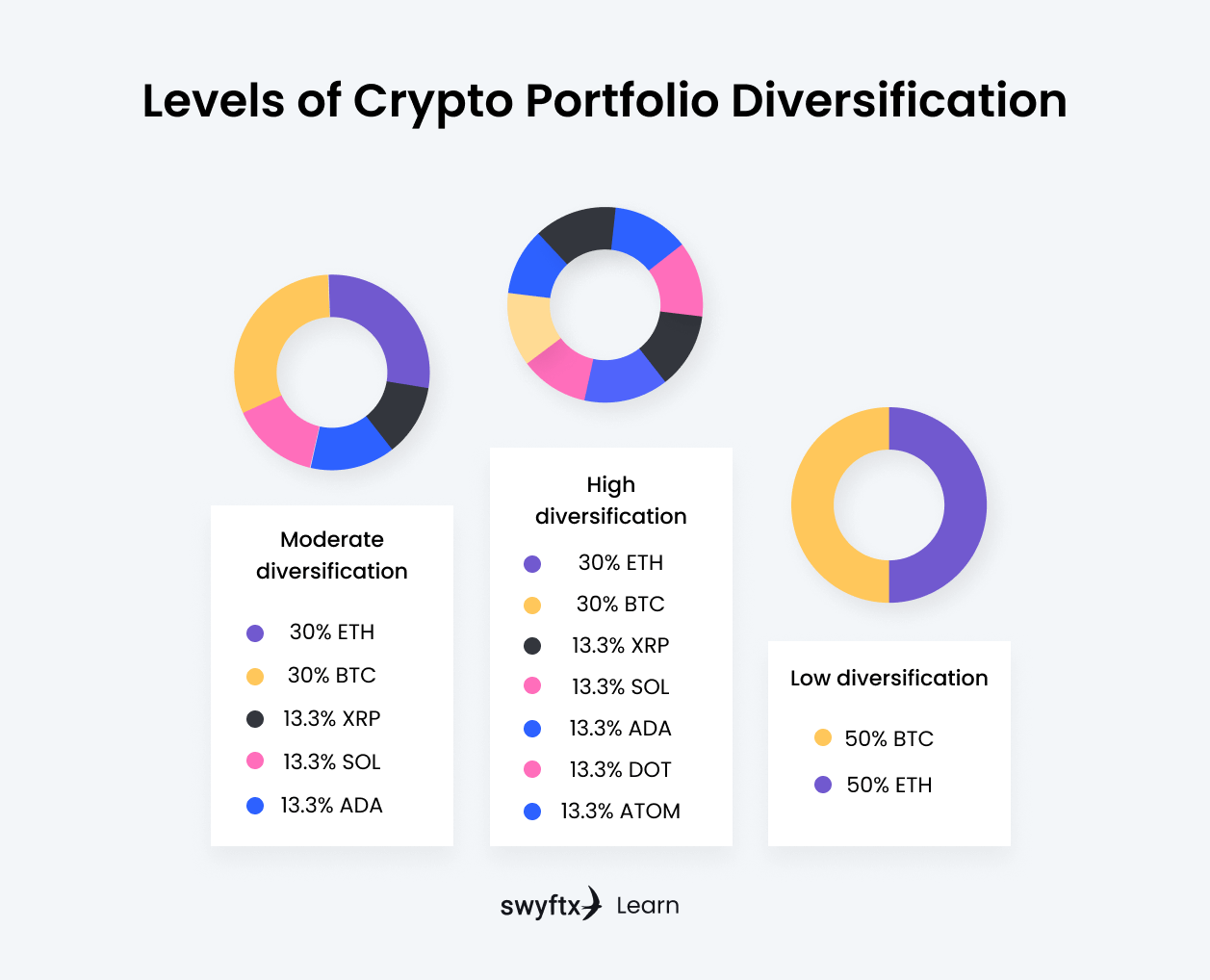

One way to mitigate risk is by ensuring that crypto investments only make up a small portion of your overall portfolio. Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate the impact of any potential losses in the crypto market. By spreading your investments, you can minimize the risk of being heavily impacted by the volatility of cryptocurrencies.

2. Safely Store Your Crypto

Keeping your crypto on an exchange exposes it to the risk of platform failure. The collapse of FTX serves as a reminder of the importance of using a crypto wallet to store your assets.

A crypto wallet gives you control over your private keys and ensures that your investments are not reliant on the stability of an exchange. While using a crypto wallet carries its own risks, such as the potential loss of access if you forget your security phrase, it provides an added layer of protection against exchange failures.

3. Choose Reputable Crypto Exchanges

The FTX saga has highlighted the need for investors to choose reputable crypto exchanges. Conduct thorough research on the exchanges you plan to use, looking for those that undergo third-party audits of their deposits and keep assets offline in cold storage.

Additionally, consider exchanges that are licensed and regulated by reputable authorities, such as the BitLicense in New York. Stock brokers that also offer crypto trading can be a safer option, as they already adhere to SEC broker-dealer rules.

The Uncertain Future of Cryptocurrency

Bankman-Fried's conviction does not solve all the issues faced by the crypto industry. The lack of confidence caused by the FTX collapse and the ongoing legal battles with regulatory authorities have created uncertainties about the future of cryptocurrencies. While cryptocurrencies like Bitcoin hold the potential to revolutionize the financial industry, there are still hurdles to overcome, including regulatory challenges, investor confidence, and questions about their long-term viability.

Conclusion

The conviction of Sam Bankman-Fried on charges of fraud and conspiracy has brought the crypto industry under scrutiny. The FTX saga has exposed the risks and lack of regulations in the crypto market, emphasizing the need for stronger investor protections and regulatory measures.

Despite the challenges, cryptocurrencies continue to attract investors, but it is crucial to understand the risks involved and take precautions to safeguard investments. The future of the crypto industry remains uncertain, but with the right regulations and safeguards in place, it has the potential to become a legitimate and secure asset class.

Information Sources: https://www.bloomberg.com/news/articles/2023-11-03/sam-bankman-fried-is-guilty-what-does-that-mean-for-him-and-crypto

Dividers created by @libertycrypto27 from hive.io!