You've probably heard about life insurance at some point but not sure of what exactly it is and why you should consider buying one.

WHAT IS LIFE INSURANCE

Life insurance is a contract between two parties ( known as the insured and the insurer ). Once the consideration is paid by the insured, the insurer promises to pay the beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. Life insurance benefits may include other expenses, such as funeral expenses.

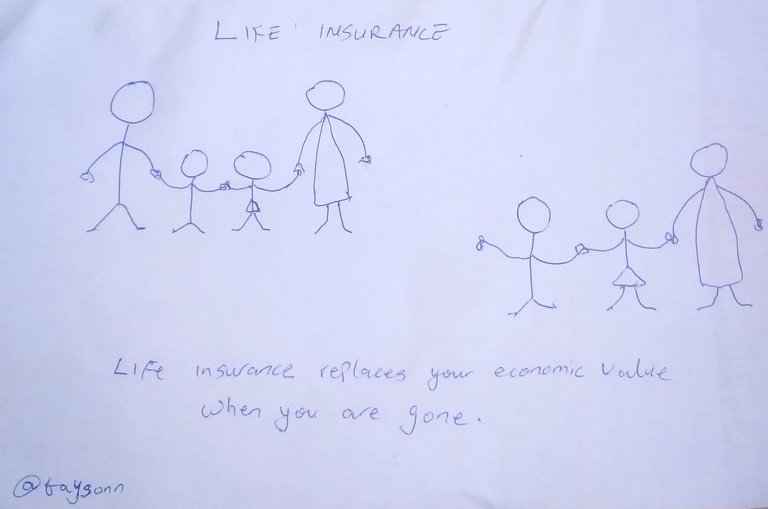

When you lose your money, you lose nothing, but when you lose your life, you've lost everything. And this could pose a devastating consequences on the life of your dependents ( family ). But the least you can do is to secure your family's financial future. One of the most important financial decisions you can make is buying a life insurance policy, then you can be rest assured because a good plan is in place.

Savings and investments are also a very good financial decision, but there are some coverage of Life insurance policy that have the components of savings and investments.

Life insurance is an important part of financial planning. Getting one is not necessarily about you, but rather shows that either in death or life , you're with your family and ready to support them.

Below are the reasons life insurance policy is needed in every home

PEACE OF MIND: No one knows when he will pass away. It could be today, tomorrow or X years from now. it is inevitable, it will eventually happen. Having life insurance comes peace of mind, even if it is a small policy, there will be no cause to worry about, because you know you have done your best to help them tide over hard times.

LIVING BENEFIT: Most people believe that life insurance is meant for their loved ones only, but this is not so. You can benefit from life insurance while you're still alive. There are so many life insurance coverage that can be enjoyed while a person is still alive. These includes but not limited to the following; permanent disability cover, critical illness e.t.c

PAY OFF DEBTS: There is no one that will wish or want his family to deal with financial liabilities. In other to avert such liabilities, if you buy the right life insurance policy, it will take care any form of outstanding debts, like the mortgage, auto loan, personal loan or a loan on credit cards.

LONG TERM GOALS: Life insurance is an instrument that keeps you invested for a very long period, and also help you achieve your long term goals such as buying a home, planning your retirement. e.t.c

LOOKING AFTER YOUR LOVED ONES: This is the most important aspect of life insurance that one needs to consider especially in a scenario where you are the bread-winner of the family, i.e your loved ones are dependent on you for their livelihood, then life insurance is most pertinent, because when the inevitable happens, it will replaces your income, pay for your child's education, and making sure your loved ones get the needed financial freedom.

NOTE: Be sure to read the fine print to be fully aware of the potential risk and returns of a policy. Perhaps if you don't Know the type of cover that is good for you, consult an insurance brokers.

WHEN YOU DON'T NEED LIFE INSURANCE

If you don't have dependent or your loved ones can cover end of life expenses with your existing savings or investments, a life insurance may not be necessary.

Congratulations @taysonn! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next payout target is 50 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!