Sometimes I can't help to shake my head.

Sadly the misunderstanding that is within the cryptocurrency is sometimes really stunning. This is further magnified by the fact many of the people who are afflicted with this are running projects.

There are a lot of myths out there. It is really sad that people within the cryptocurrency community buy into them. That is potentially why we get situations like UST and LUNA. People simply are unaware of how things operate.

How can we expect to build an alternative to the existing financial system when most do not even understand it to begin with? Since we have very little idea about money, how can we approach this in a way that is effective?

The sad truth most who are popping off on Twitter are just espousing ideologies, biases, and misinformation that are not very helpful. They have not taken the time to learn about what truly takes place with money or how the international banking system operates.

Let us take a look at this in action.

Dollar Shortage

There is a shortage in the US Dollar. This will come as a surprise to many and we will cover that in a moment.

Before getting to that, let us check in on Jared Tate.

Who is Jared Tate? We only need to look at his Twitter profile to find out.

We have to say very impressive. This guy must really know his stuff. You would think starting something like Digibyte shows a high degree of understanding. Of course, it is best to keep in mind this is cryptocurrency, so a 99% chance he has no clue how things work.

And sure enough, this is the case.

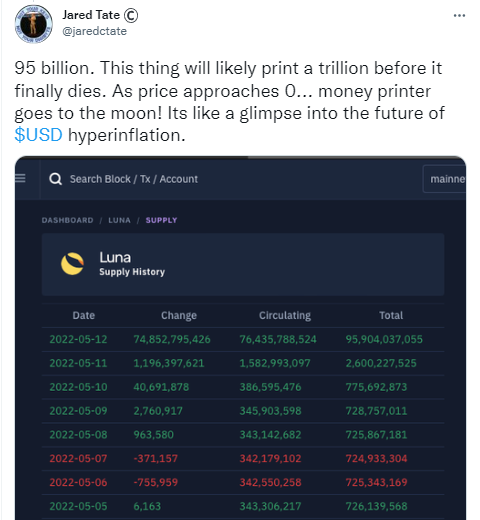

Here is Tweet he sent out.

Source

The problem is not in his assessment of UST. That is highly probable. It is where he throws in the hyperinflating USD. Now I will state, this is a guy who sent out Tweets in the past about the Fed's printing press.

A complete lack of understanding.

Fortunately, we can do some deep dives into the skeleton of the monetary system to learn the truth. It is something that few will embark upon but, for the sake of this article, we will do it.

Here are the results:

Despite being charged with managing the money supply, the modern Federal Reserve does not simply run new paper bills off of a machine. Of course, real currency printing does occur (with the help of the U.S. Department of the Treasury). However, the vast majority of the American money supply is digitally debited and credited to commercial banks. Moreover, real money creation takes place after the banks loan out those new balances to the broader economy.

Where did we go to do this deep dive? This is form an Investopedia entry called Understanding How the Federal Reserve Creates Money. Do you think these people know about Google or any of the other search engines?

Nevertheless, the statement is clear. The important factor is the last line. There, we see the term "real money creation" which equates to USD. Thus, USD is created when banks loan out to the broader economy.

Read that again. The Fed does not create USD but, rather, it is the commercial banking system who does this through loans.

So how will the Fed's money printer cause hyperinflation (or even inflation)?

Fed Money Creation

So if the Fed does not create USD, what do they create? This is where people get confused since the Fed does print something. However, we have to understand what is being "printed" and what the use case is.

So, once again, doing the extensive, round the clock research used to come up with the first bit of knowledge, we uncover this gem:

The Fed creates money by purchasing securities on the open market and adding the corresponding funds to the bank reserves of commercial banks.

We find this a couple paragraphs down in the same article.

So let us break this up. The Fed purchases securities from the commercial banks. What happens when something is purchased? Someone gets paid. In this instance the Fed is paying the commercial banks for the securities.

The question is what are they purchasing them with? Are they just printing USD and buying the securities? No, we just showed how the Fed doesn't print USD. However, what we see here is another indication of this fact.

If the Fed paid for the securities in USD, why would they have to add it to the commercial bank's balance sheet? After all, if the USD was paid to the bank, it would instantly be there. Yet there it is: adding the corresponding funds to the bank reserves of commercial banks.

The reason this is the case is because the Fed is not paying in USD. It enters the open (Repo) market with reserves, not USD. Hence, when it buys the security, it has to put the reserve on the commercial banks balance sheet.

And, for those who understand double-entry accounting, for each asset added there needs to be a liability. In this instance, the Fed's balance sheet is receiving an asset (the security it bought), thus it needs a liability. Here is where the reserve shows up, as a liability.

Which also proves that what the Fed creates is not legal tender. Fed liabilities are not legal tender. In the United States, the USD is legal tender. Since the Fed does not create legal tender, it has to be printing something other than USD.

The last part requires a truly deep dive by reading the Federal Reserve Act of 1913 and the Banking Act of 1933.

So once again, how can the Fed create hyperinflation when they have nothing to do with the supply of USD?

Signs Of A USD Shortage

Sometimes a little common sense goes a long way. How do you know if there is a USD shortage? Simply consider the supply/demand implications.

In short, there are three factors that tell you exactly where the situation stands. Where there is a shortage of USD globally, we see:

- Interest Rate Swap Spreads worsen

- USD rises in exchange value

- Demand for safe assets

Since there is less USD out there, the ability to acquire US Treasuries, especially TBills, is reduced. With this being pristine collateral in the Repo Market, firms are paying up. The shortage that we saw post Great Financial Crisis is only worsening. This means that USD is increasing in scarcity.

Of course, if you believe the Fed prints USD, this makes no sense. However, understanding the Fed just creates essentially a token that can only be help by depository banks allows us to see that it is the commercial banks who would have to be making loans like there is no tomorrow.

In fact, the response to the pandemic led to a 20 month period (April 2020-December 2021) where the USD supply grew by 2.5%.

Not exactly hyperinflationary.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

It's incredible how misinformed people have so much reach these days.

Posted Using LeoFinance Beta

For the average person, I can understand because most do not care. After all, I am not concerned about how a smartphone works.

However, if I was developing a project that was going to compete with smartphones, I would think understanding how a smartphone works is one of the first priorities.

Posted Using LeoFinance Beta

It's information like this that adds to my, and everyone's, better understanding of how banking, finance, market, money, etc. actually work. Refreshing to have content like this. Thank you taskmaster, always enjoy your posts.

Understanding the basics is sometimes very valuable.

Posted Using LeoFinance Beta

I think you should go more in depth on the repo market.

I've been looking it up a bit and thinking about a post.

Posted Using LeoFinance Beta

Welcome to the rabbit hole.

We could have a year worth of posts with that topic and still not get very far. Talk about the gateway into the shadow banking system.

And what you are looking up, is about 1/100th of what is known. It is so convoluted that not even the players know all that takes place.

But even a general understanding is what allows people to see how crypto is similar.

Posted Using LeoFinance Beta

I don't really keep track of the interest rate spreads but is that common to look at? Or does that mean lower interest rates due to the dollar shortage?

Posted Using LeoFinance Beta

The easiest way to understand it is nterest rate spreads are what people are willing to pay in Repo as compared to the stated rate.

So when people take a 4 week T-Bill and have a 21 basis point premium they are willing to pay, it shows they are have other motives than just getting the return. After they are losing money on the spread.

Why do they do that? In Repo, it is the collateral that is more important.

Posted Using LeoFinance Beta

Thanks for clearing that up. I had also the same false understanding.

Central banks depends upon it. They use words that make everyone think they are doing one thing when, in reality, they are doing something else.

Posted Using LeoFinance Beta

would love to hear your thoughts on Peter Schiff' view on money supply in the next Cryptomaniacs podcast!

Like all, It shook the earth beneath me, especially when I heard few took their lives as well because of this. You said it right, and learning before investing is very important.

First of all, if I don't have any info about a thing why should I be talking about it in the first place.

Posted using LeoFinance Mobile

That is okay. Hopefully you are starting to learn now.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.That is true, you have to know how Cryptocurrencies really work to make formal competition with the large holders of money worldwide. When we were beginning to have enough strength at the different levels of the economy, this happened with Terra/Luna. It makes me believe that there is still a lot of work to be done to reach and reach the level we are looking for.

It is more about knowing how money works.

Posted Using LeoFinance Beta

Frankly, I did not know that the system works like this, it was a very useful post. There is a lot of misunderstanding and lack of information. Especially in the crypto market, most people do not examine the inside of the project, many people seek to make a profit immediately, which can lead to bad results. Before investing in a project, it is essential to understand how things work.

Posted Using LeoFinance Beta

That is amazing growth of only 2.5%. Can this misconception be due to confusing the inflation of the USD with rising prices of basic goods?