With this said, total liquidity isn't being reduced which means prices of things cannot go town, which Neal alluded to in his chatter about this.

There is a liquidity crisis in the USD. This is evident by the fact that IR swap spreads are expanding, the USD on the exchanges is increasing and the demand for safe assets.

Here is the point missed:

Fed Liabilities are not legal tender

To pose otherwise is misleading the Fed does not print USD, that is the responsibility of the commercial banks.

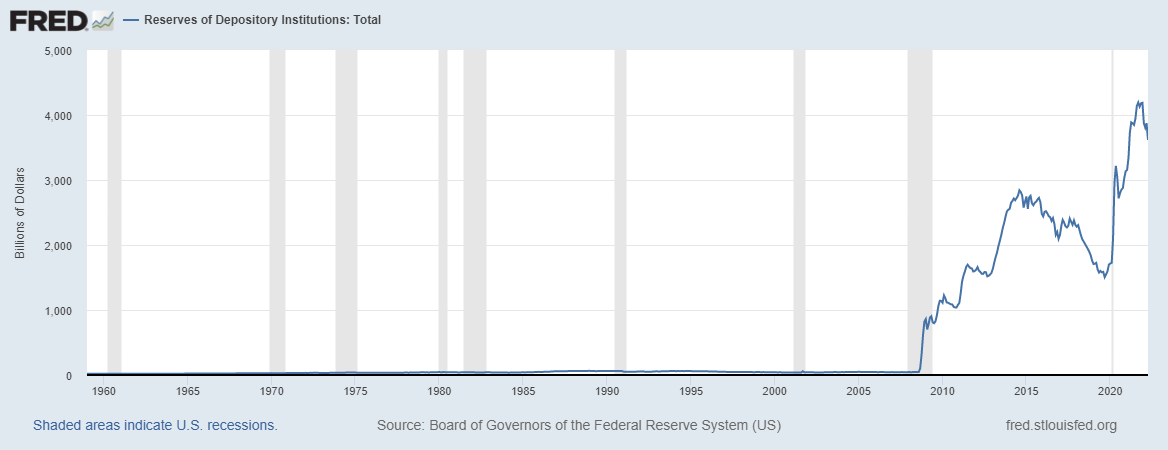

But if we are going to talk about the reserves, what the Fed really does print, they are down about $500 billion in 2022.

.png)

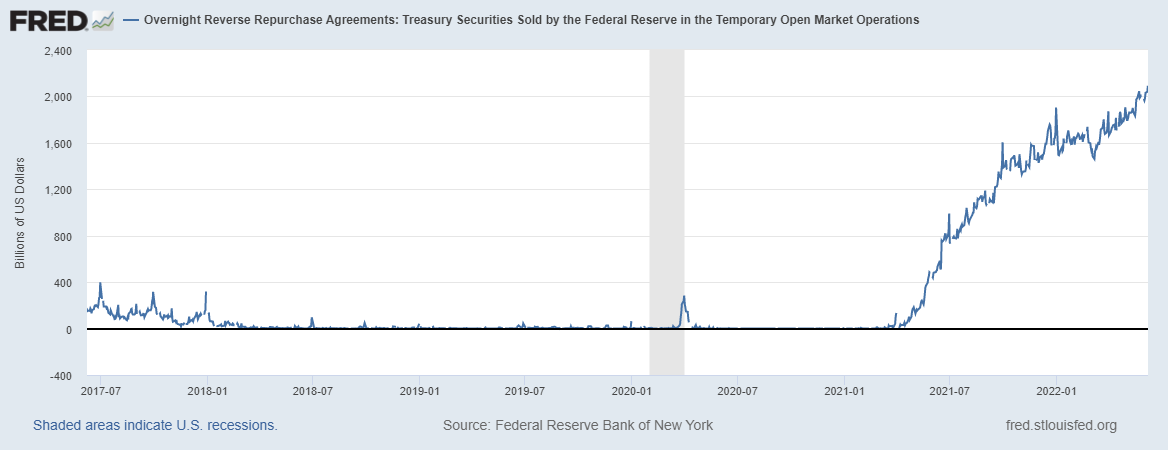

Then we have the reverse repo hitting an all time high.

.png)

None of this screams a liquidity. In fact, it is the exact opposite, the financial system is suffering from a lack of collateral. This means everything, including bank lending tightens up.

Posted Using LeoFinance Beta