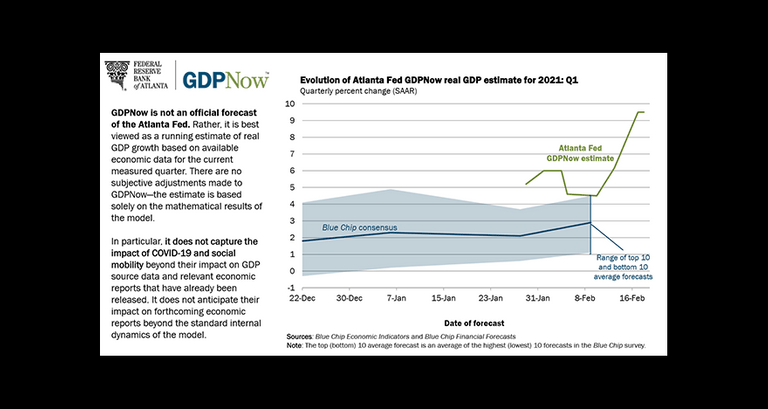

GDPNow is put out by the Federal Reserve Bank of Atlanta.

This is not an official stat though. Here is what the website says about it:

The Atlanta Fed GDPNow model also mimics the methods used by the BEA to estimate real GDP growth. The GDPNow forecast is constructed by aggregating statistical model forecasts of 13 subcomponents that comprise GDP. Other private forecasters use similar approaches to “nowcast” GDP growth. However, these forecasts are not updated more than once a month or quarter, are not publicly available, or do not have forecasts of the subcomponents of GDP that add “color” to the top-line number. The Atlanta Fed GDPNow model fills these three voids.

It is an ongoing stat that is constantly updated using the most recent data. The chart appears to be getting worse as time goes by.

The latest release was June 1st. On this date, the reading was a -52.8%. This is down from 51.2% on May 29th.

After the ISM reports, the news continues to get worse.

After this morning's Manufacturing ISM Report On Business from the Institute for Supply Management and the construction spending report from the U.S. Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and second-quarter real gross private domestic investment growth decreased from -56.5 percent and -61.5 percent, respectively, to -58.1 percent and -62.6 percent, respectively.

The numbers being bad for the second quarter is not a surprise to anyone. Since much of the United States economy (along with the global economy) shut down in April and May, it is to be expected that we will see a sharp decline in GDP.

Many areas started to reopen in Mid-May but the return was slow. Shopper avoided malls and restaurants are still closed.

The hope is that June is able to get things back to normal although that seems like a dream. Many industries, especially those related to hospitality, are still almost totally shut down. Even when they reopen, how quickly will customers return?

Investors seem oblivious to this as evidenced by the run up in the stock market. We are not far from all time highs which were reached back in February. The world is a much different place as compared to then. To believe that companies are on stable footing similar to then is not backed up by the data.

Are investors ignoring what is in front of them? While all acknowledge that the second quarter is going to be nasty, investors believe that there will be a rebound starting in Q3. Unfortunately, this might not be the case.

We will see how accurate GDPNow is going forward. The next release date is June 4th.

To read up on GDPNow:

https://www.frbatlanta.org/cqer/research/gdpnow

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance

it really looks like a bad situation