The elephant in the room from a crypto perspective is rather simple: what will be the settlement layer?

This is a crucial question to consider. When it comes to smart contracts, many feel Ethereum is still the network to beat. There is, however, a great deal of competition. The answer to the aforementioned question will go a long way of determining where value is pushed.

We can safely say that Wall Street and other financial institutions are starting to adopt blockchain. After years of resistance, 2025 saw the emergence of utility due to stablecoins and real world asset (RWA).

It is a topic I covered extensively.

People in crypto are conditioned to look at price. For years, that was the only metric. Today, that is no longer the case. In fact, as any market observer will tell you, markets are giant liars. They are great at price discovery yet awful at determining value. At times they will coincide but rarely.

For this reason, many are missing what is taking place. The real winner in the world of crypto will be utility. Those networks (platforms or applications) that provide this will do well. As for the rest, they might be trading vehicles at best.

Is Ethereum becoming the settlement layer? In this article, I will take a look at this.

Ethereum: The Settlement Layer

The financial system is dependent upon settlement. Anyone who took even a courtesy glance at the banking system will understand how there is a two-tier settlement system. The first is at the bank level. Here we see the amount removed from one account while deposited to another. Across two different banks, one will credit its customer while the other debits its.

Here is where the second layer enters. The banks have to settle between them. Naturally, they do this at end of day so it is a cumulative total. On a per transaction basis, the base that has the payor will pay the one that has the payee. This is usually done with reserves from the central bank.

Blockchain eliminates this. It is why stablecoins are becoming so attractive. Of course, with the banks operating as a front end (before having their own stablecoins), they are recreating the present system to a degree.

Nevertheless, there is a lot that occurs with crypto outside the traditional financial companies. With the increased usage of decentralized exchanges, transaction activity is spreading.

One of the advantages of blockchain is near instant settlement. Once a transaction is validated, it is complete. The tokens are coins were moved from one wallet to another.

It is an area that Ethereum is starting to excel. We also can see why price as a metric can be misleading.

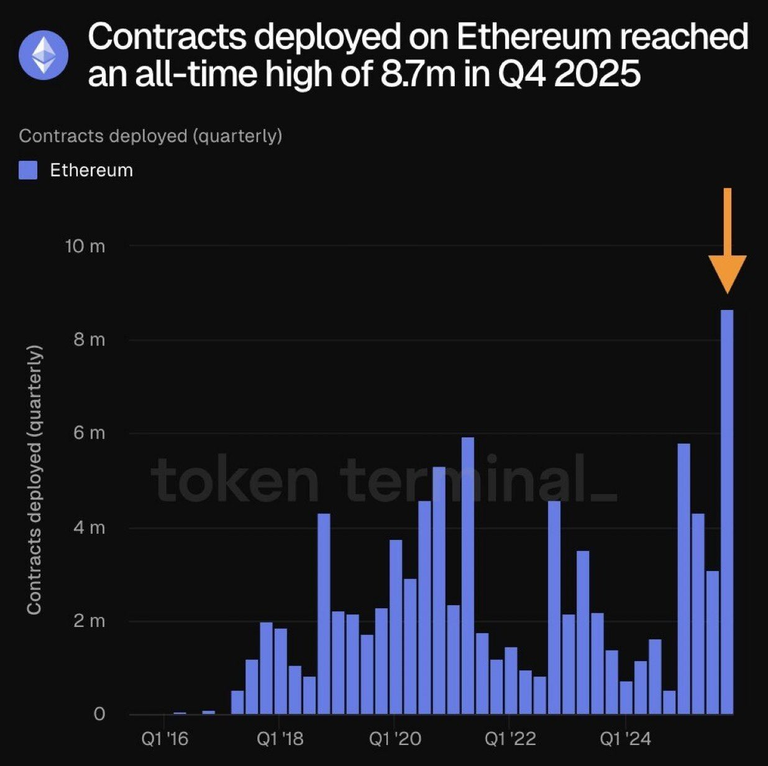

Despite sluggish Ether price action, developers are increasingly choosing Ethereum as a settlement layer, with the fourth quarter shaping up to be a record period for the network.

Data from Token Terminal shows that the number of new smart contracts created and published on the Ethereum blockchain reached an all-time high of 8.7 million in the fourth quarter.

Growth is something that every network seeks. Ethereum is starting to gain utility. In other words, we are far removed from the days when meme coins and NFTs were the bulk of the transactions.

According to Token Terminal, the increase reflects organic growth, driven by real-world asset (RWA) tokenization, stablecoin activity and core infrastructure development. The blockchain analytics platform noted that “Ethereum is quietly becoming the global settlement layer.”

The last sentence is an important one. If this continues, we could see Ethereum rival Bitcoin in market cap. To achieve this, we will have to see a great deal more scaling.

The Flippening

Starting about a decade ago, there was talk of "The Flippening". This was put forth by Ethereum supporters, much to the amusement of Bitcoin Maxis.

While there was a point where it was close, this has never really been a factor.

What is the Flippening?

This is a hypothetical point where the market cap of Ethereum exceeds that of Bitcoin. For much of the last decade, these two coins have been atop the crypto charts with regards to market capitalization. Bitcoin is long the dominant force, something that does not seem to be waning.

For now, this is still hypothetical. We are nowhere near this becoming a reality.

There is, nevertheless, an opportunity. If Ethereum becomes the go to network for global settlements, watch out. We could see things skyrocket with regards to the price. Even if that stalls, the value of the chain could explode.

My view is that eventually price has to follow value. It might take a year or more for the market to realize what is taking place but, when it does, things change rapidly.

Right now, Bitcoin has a cap of $1.7 trillion why Ethereum is just under $400 billion. This shows how there is a long way to go before the Flippening takes place.

All this aside, we could see the utility go exponential on this network. Bitcoin is fairly locked in with regards to what it offers. Ethereum is one that could have a growing amount of activity, led by some of the largest names in finance and banking. Firms such as Blackrock appear to be gravitating here as a default.

The next couple years will tell us where this is going. In my view, it will be set by the middle of 2027. There will be enough institutions involved to tell us exactly where the big money is heading.

Will Ethereum become the global settlement layer? This is the question that many should consider.

~~~ embed:ethereum/comments/1q0707t/ethereum_the_settlement_layer/ reddit metadata:fGV0aGVyZXVtfGh0dHBzOi8vd3d3LnJlZGRpdC5jb20vci9ldGhlcmV1bS9jb21tZW50cy8xcTA3MDd0L2V0aGVyZXVtX3RoZV9zZXR0bGVtZW50X2xheWVyL3w= ~~~

This post has been shared on Reddit by @davideownzall, @tsnaks, @uwelang through the HivePosh initiative.