Liquid Hive Power. What kind of potential does it hold?

Before we get to that, we must explain what this is. It is a new project put together by @cardboard. There was announcement about the testing of the new system.

Source

To briefly cover the main points, many feel Hive suffers because of the 13 week power down time. This is something that will likely be discussed after the hard fork in a couple weeks. It requires a change in the base code to move it from that 13 week time period.

There are obviously pros and cons to each. However, from a user's perspective, the ability to power up and then trade is negated. Only liquid HIVE can be used to take advantage of sudden price moves. Many feel this puts investors off as well as penalizing active members of the community.

Cardboard came up a solution. There is now a token on Hive-Engine called Liquid Hive Power (LHP). This is designed to provide the liquidity while powering up.

So how does it work?

Basically, when one buys a token, the HIVE is powered up in an account. The same amount of HP is then delegated to the user for whatever duration of time the token is held. Upon selling the token, the delegation is removed and the HIVE is returned to the individual. Please note, that at this time, it can take up to 5 days since that is the time it takes for delegation to be returned. The goal is to have enough liquid to return the HIVE immediately to the user.

Here is the link to the full post:

https://peakd.com/hive-167922/@cardboard/liquid-hive-power-new-idea-you-can-test-out

So is this the answer that Hive is looking for? I am not sure we can say that but it does exemplify what is taking place here. With so many developers running around, when there is a problem someone tries to come up with a solution. There is no central entity that has to approve the decision.

In this situation, it looks simply like another tool in the Hive toolbox. It is a way for people to have the benefits of Hive Power without locking their HIVE up for 13 weeks. The voting power is increased, enabling one to increase his or her position on the blockchain and the reward pool.

As an aside, it must be stated this is a delegation program. Thus, no governance benefits are derived from holding the token. Since the token holder receives delegation, that does not go towards voting for Witness or Proposals.

Certainly, we are going to have to address the power down scenario at some point. In the meantime, this is a bridge to get to the ultimate conclusion. Whatever decision the community eventually comes to, this will fill in the void for a while.

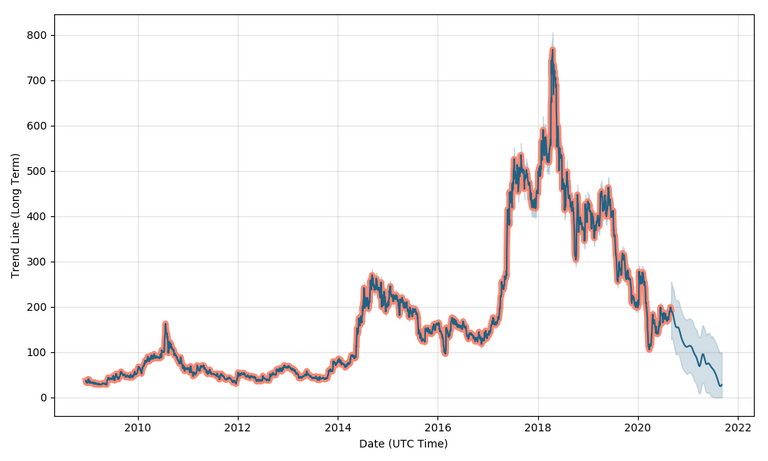

Crypto is known for its pumps. A token can take off at anytime. We see this over and over. Most of it is absent anything resembling fundamentals. Instead, the market gets an itch for a certain take which sends it mooning. Of course, situations like that tend to be short lived. It is a traders paradise as well as being an opportunity to profit.

They key is why should people who support Hive through their powering up be exempt from taking some profits when the market offers them? The extended power down period definitely prohibits that.

Liquid Hive Power is a workaround. One is essentially liquid (if you can consider 5 days liquid) while getting the benefit of interacting on the blockchain with increased voting power. If there is a pump, or even periods of volatility in the price of HIVE, the holder is then able to take advantage of the short term gyrations in the market before returning to the previous approach.

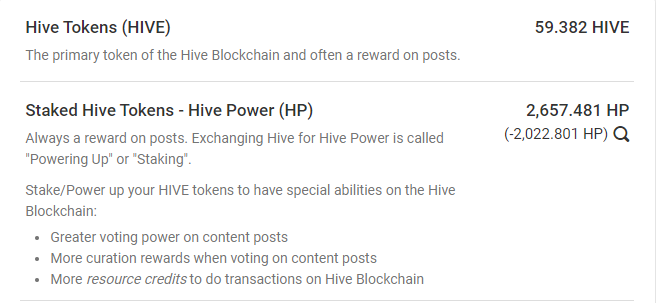

In conclusion, this is not the Holy Grail of Hive, nor do I believe it was meant to be. It is an experiment in innovation. One had an idea that can somewhat solve what many perceive as an existing problem on Hive. Looking at the wallet of the account behind this, we see a couple thousand HIVE already being used.

For now, it seems like a good middle-ground until some larger decisions are made. Hive users can now increasing their voting power while also maintaining a certain degree of liquidity to take advantage of market swings.

An interesting project to check out.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance

If hive was liquid I would drink it

🤣🤣🤣🤣

I found it pretty simple to test out, my concern though is when it comes time for me to convert my HLP back to Hive. Will I still get the almost one for one or will I be taking a loss, the market for the token will be the overriding factor. So far I have 2 Hive I converted, and the delegation part was very quick. Like any token though the selling may take time, or be at a loss.

I don't know @taskmaster4450, every time one of these discussions come along, I find myself thinking that it's once again flying below the greater "story arc" that we have never clearly defined what this place IS. Namely, we seem to have an eternal identity "tension" between those who are promoting community and the blockchain, and those who are purely investors. And what's attractive to one, isn't necessarily attractive to the other.

Personally, I am perfectly content with the 13-week powerdown period. It shows someone is committed to the venue. Heck, I was even content with the very early two year powerdown. But I can also totally see how that would be unattractive to someone who just wants to make a quick "get-in-get-out" profit.

Short term/day trade type "investors" (I put that in quotes because I think of them more as opportunists/gamblers than actual investors) can be found in all areas of investing. The difference here is that when you day trade DELL computer stock, your actions don't have squat difference on the operations; the two are completely disconnected.

The true investors — the long-term holders who are there for value appreciation, stock splits and dividends (eventually) don't care what you can and cannot do over a 13-week period.

The thing I keep coming back to is to treat it a bit like vesting in a retirement program, or early withdrawal from a 12-month CD at the bank. Sure, you can have your money right away, but there's a penalty/fee of maybe 2%, 3%, 5% or whatever for immediate non-notice withdrawal. In our unique situation here, maybe that fee gets burned.

The thing that's a bit incongruent here is the fact that community building is a long term process, and immediate access to your stake... well, that's short term thinking.

Yes, I realize there are no easy answers here...

Totally agree. I think the vested (now HIVE) saved this platform many times. There should be a price to pay for total liquidity, whether that is time (as now), %fee, or reduced posting rewards. If this platform was as popular as some mainstream social media sites, it probably would not be an issue. In its current state, it would be a very fragile state. Even from a financial standpoint to the "little man", this platform exceeds opportunities of major sites like youtube. If you are in it for the fun like me, you still want to see interaction and good posts. If enough Hive is dumped, the content and interaction will go down. A staked token to me seems riskier to me than having to wait weeks if you decide to leave. I guess time will tell.

Maybe part of the "starting point" has to exist at the grassroots level; the level where we are telling our friends and colleagues about Hive. Do we tell them they can come here to "make money" or to "build a stake in a social media platform?"

Ultimately, those two statements describe the same thing, BUT one is get the money and cash out oriented, while the other has a longer term perspective.

Admittedly, I'm here because I enjoy blogging and the whole concept of gamified social media. It's nice to be "rewarded" but I see that part more as a potential very long term "drip savings account" than anything I am currently trading back and forth.

Few months ago there was similar post: https://ecency.com/post/@good-karma/single-token-simplification

I need to read more about it, but I think I like the idea. After the steemit debacle, I experienced what a hassle it is to power down over 13 weeks (I had never powered down before). I haven't powered up since - I've been using my liquid Hive to invest in Splinterlands - that way it doesn't sit useless in my account, and I can get to it whenever I want to.

This system might make me go back to powering up...

Yes @simplymike. It does seem like a good way to maintain some liquidity while also getting the voting benefit of having Hive Power.

I have a feel the discussion over the next few months will be the 13 week power up time.

Posted Using LeoFinance Beta

really interesting idea. I have to look a bit into it as well. One thing I am hoping for one of the next HFs is I a decrease in the time for a power down as that should bring in more investors as well

That will be in the conversation I am sure.

Posted Using LeoFinance Beta

I thought it looked like a interesting idea too.. I went ahead a bought some..

Just to point out, owning HP and owning delegated HP its not the same, like it doesn't count for witness voting

Yes it does not count to governance issues.

Hence this paragraph:

Posted Using LeoFinance Beta

Until nobody want to pay to affect their trending ranks, Hive isn't going anywhere.

This post was promoted on Peakd, so that's a start.

The content here is currently not worth committing to voting 10 or more times per day.

Your current Rank (34) in the battle Arena of Holybread has granted you an Upvote of 17%

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Interesting.

Posted Using LeoFinance

Liquid versus safety is ongoing discussion

in the mind of everyone.

Reducing the 13 to a lower number

may entice but at what cost.

#Hive price is moving sideways for a while now.

This program will fill the gap till we have other concrete ways to have more liquid.

There are merits to that debate on both sides. Personally, I don't think you need 13 weeks to provide safety. A 4 week power down time makes a lot more sense to me. Still have a week before any of your HP becomes liquid in case there is an attack.

As for the price, I am not sure changing the power down time will truly do much for the price. That is always an argument presented when looking at making changes, such as the EIP.

In the end the price is going to do what it will do.

We will see how this all unfolds. It will be an interesting debate.

Posted Using LeoFinance Beta

So far the community should decide

on that matter pretty soon. More posts about it

will oblige a change.

Clear sense of mind your answers are right on point cause

it will benefit more people to power up and down quicker.

In the dev sense of mind, not much I can say, I thought it was a security move to leave it at 13.

As we move forward, ideas should mingle and the community will be a winner.

Kudos to your articles.

oh yes 4 weeks is a cool idea

Awesome work by @cardboard, that is a difference I noticing with HIVE when somethings needs doing it gets done unlike the situation on STEEM which used to drag on forever.

On the Power down issue, yes I think 13 weeks is too much, I wouldn't prefer 1 week power down duration either, duration from 2 to 4 weeks should be fine.

good idea and I went on the dex to check the market. turns out LHP is ill-liquid for now. How do you plan to address that?

Informative post thanks for it

I agree that this is used in the interspace when 13 weeks of powerdown or less will be discussed, we will see what experiences will come out of this.

I think 13 week powerdown is important for stability. Steem just pulled the plug by lowering to 4 weeks. My advice is to just hold liquid hive or hbd , and power up what you want vested.

I really don't get this. Some terrible news hits, and it's going to be a race to the exits. Is the service going to hold liquid Hive 1:1 with HP?