This week saw a slew of new articles pertaining to events surrounding the crypto-sphere that are showing how this asset class is moving into an entirely different light.

The progress is amazing and this is something that might not slow down for a while. In fact, it could accelerate.

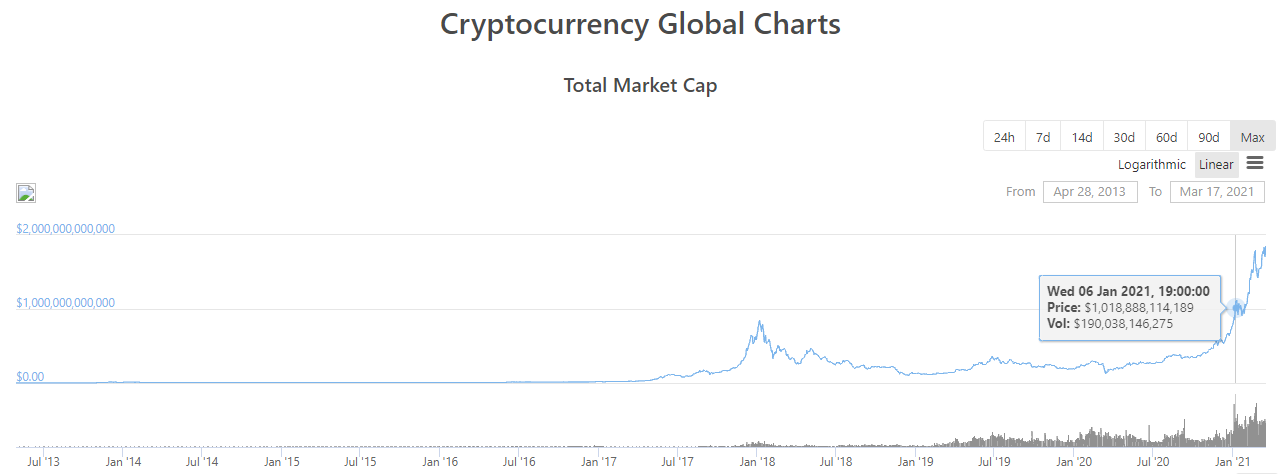

It took a very long time for the market cap of cryptocurrency to reach $1 trillion. This happened in January of this year. Over the next couple weeks, it is possible for us to see $2 trillion, less than 3 months later.

Coingecko.com

So what is inciting this run? It looks like we are nearing the time when there is a lot of mainstream, institutional acceptance.

First, we see another technology firm, Meitu purchased $49 million worth of Bitcoin and Ethereum. This is an ongoing trend that we see across the world and the Chinese companies see it no different than here in the United States. Placing some of a firm's reserves in Bitcoin (and others) makes sense.

This comes after Morgan Stanley became the first major bank to offer access to Bitcoin funds to its major clients. This is a remarkable turnaround from a few years ago when the banks were bashing Bitcoin at ever turn. The FUD at that time was fierce, probably assisting in the "Crypto-Winter" the market suffered through.

Grayscale decided to launch 5 more crypto products as the SEC is confronted with another Bitcoin ETF application. BNY Mellon got into the game with more than $133 million in funding for a crypto-security firm.

Finally, the legislature in the State of Kentucky passed a bill, sending it to the Governor for signature, which would provide tax breaks to crypto mining companies in an effort to attract them to the state.

These were just some of the headlines that appeared in the last 24 hours. That is how quickly things are moving.

Source

The threshold of $2 trillion for the market cap could be an important one. We are to the point where cryptocurrency is roughly 25% the total market of gold. This is moving it towards a time when we see the appeal expand greatly.

It is a fact that was not lost on the aforementioned Morgan Stanley. An investor note states that it still considers Bitcoin to be a speculative investment yet it could be getting close to being an investible class.

This is a major shift from even 6 months ago and should open the door to a much wider array of investors. If the major banks start to promote it to their clients, a wave of new money will flow in.

Growth of the asset class is vital since each layer up attracts different levels of investors. This is something often overlooked yet it is why, even though the market as a whole gets larger, the pace of acceleration actually increases.

When a market is small, it does not take a lot of money, relatively speaking, to move it. At that time, however, the investors are the speculators in the truest sense of the word. They want to be in the game long before everyone else. The risk/reward ratio is extremely high with a chance of total loss. It is akin to the wildcatters in the oil industry.

These people enjoy the Wild West atmosphere. This does not appeal to most groups of investors, especially institutions.

As the market grows, more investors with different degrees of risk tolerance are draw in. We saw that happen over the past year as companies such as Microstrategy, Square, and Tesla all got involved. Yet we still see the major banks, insurance companies, and pension funds on the sidelines.

The investor note points out that this is still considered very speculative but it does open the door to another group of investors. Portfolio allocation might mean that some firms decide to put .5%-1% of their reserves into cryptoassets.

For many of these firms, even half a percent is a very big number.

Source

At the end of the day, it still all comes down to development. The money flowing in is forecasting future moves in the markets. However, that will be short lived if there is not the activity to substantiate what is taking place.

We are dealing with technology and the technological hype cycle is well known to many. New ideas often capture the imagination of investors, attracting large sums of money. This can lead to speculation about entirely new industries forming, only to find the hype die down when the results do not match up.

It is likely that cryptocurrency and blockchain are passed this point. We went through that a few years ago. Nevertheless, projects still need to be rolled out to attract the users, kicking off the Network Effect.

This is a different time we are living in. Through tokenization, coupled with the fact that coding knowledge is spread so wide, we are seeing innovation coming from across the planet. This is going to provide the breakthrough applications that are required to substantiate what is taking place in the financial realm.

All this mainstream money is a double-edged sword. Are we getting into bed with the Devil as they say? It is just a natural progression. Wall Street is not going to disappear overnight. However, it is vital to be mindful of mainstream, traditional finance. They have motives that are not conducive to freedom and growth.

Nevertheless, the funds flowing in will stimulate a lot more development. It also will enrich those who are at the core of all this, assisting in their efforts. This will make it very difficult for the big money players to come in an assert control. As the Steem conflict from a year ago, communities of developers and users do have options.

The traditional money game is changing. Wall Street knows something it up, just not exactly what it is. For them, it is business as usual.

There is nothing usual, however, about what is taking place.

We are embarking upon an entirely new arena that is going to change everything.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I definitely agree. Their total balance sheet is probably in the hundreds of billions or trillions. Just 1% of that would be able to boost the size of the crypto market by quite a bit.

I know the feeling since some of these new companies don't even have a prototype and its hard to tell if the numbers are correct. I think PLUG was revising their numbers back from 2017 or 2018. So they definitely fudged their numbers to impress their investors.

Posted Using LeoFinance Beta

I definitely think that the institutions are going to be a lot more careful than many of us were back in even 2017. We have already seen that they are tending to be very meticulous about the things that they invest in. Even Grayscale was almost solely BTC until just recently they have filed but only tested a couple of the alt markets. At least that is the way I understand it.

Posted Using LeoFinance Beta

At least they are very transparent about their holdings. There's no cheating on the Blockchain anyway.

Will be interesting to see how Sharks will behave after further crypto adoption has taken place. We shall never underestimate WallStreet, they have some brilliant minds there.

cheers !BEER

Yes, those are great points! I am sure if there is a way to subvert things, they will find it. Hopefully it won't be easy for them! I doubt the community would allow it!

Posted Using LeoFinance Beta

That's a very good question, will we and what will it look like.

A professional trader is like a Whale by Delegation and Free Lending, wouldn't you agree? His job or 'faculty of work' would be to increase the wealth of others, his benefactors. By doing that the broker/Pro-Trader can create a fair or even great profit for himself as well.

So a smart Pro-Trader will always be of use to a system that supports his skill and greed. The difference is, this time around WE the people are the BANK, because by the power of ourselves (our keys) and BlockChain FiNTech/DeFi we can employ the professional trader directly ourselves. In some way, we already do that with 'Curators'.

I never fully trusted Curators btw, even if some of them do a good job. It's just too easy to play the system in favour of your buddies or alt accounts.

I'd rather delegate to a professional Bullshark than to a curator pool full of Lemonsharks.

I think there is something to be said for supporting the people you have "grown up with" on the blockchain. As long as they are consistently putting out good quality content, you shouldn't be ashamed of upvoting the same people all the time. It is whether or not you spread your vote past that organic circle that has formed that makes a difference.

Posted Using LeoFinance Beta

Jack Dorsey is already on it! lol

They've declared with a number of big backers that they're running tests to improve Bitcoin.

These guys want centralization. How will it turn out you think?

AI Brute force attacks on weakpoints will likely begin happening sometime this year.

Further on, we should keep an eye on microchip shortages as this will cause mining costs to skyrocket or become impossible. Chips need replaced. If Nvidia bows out or the like, to pressure from military - and the more China siphons off to itself the remaining production capacity.... Mining could cause everything to stand at a halt.

Especially, consider: if BTC adoption hits 4B wallets.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @bozz, here is a little bit of

BEERfrom @manniman for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Well, I see that we are on the right path, with so many entities entering, the income will soon be massive,

wow, that is wrong, I think that if taxes are important of course not in the average that always but something should be paid no, but if this state is trying to attract cryptographic companies then welcome, everything is for development.

Morgan Stanley walked in, and it appears as a good omen for this, well here we go

jaaaaaaaaa wall Street loves risk, they see it as fighting a bull that must be tamed and tamed and it is a challenge for them for now, so soon they will enter we are in it for sure.

That's the great thing about Bitcoin right now, the high level investors are still not touching it. I don't think you'll see the really "big" players come in until it firmly establishes itself at maybe half of gold. $5 Trillionish. And like I said, establishes itself there. Not go parabolic and dump. I'm talking like maintaining that level for a few months. Even years. The saying is that people buy bitcoin where they deserve to buy bitcoin. Those entities will be perfectly happy buying it at those levels if they feel it has truly established itself as an asset class that will be around for the long term.

Posted Using LeoFinance Beta

That is a 5x from here. Still a pretty big run based upon your forecast.

And there are bigger runs in a lot of other tokens.

Posted Using LeoFinance Beta

Yes, but none of them are Bitcoin. The really big money is still way on the sidelines in my opinion. Bitcoin is the only crypto they will probably ever buy. And it's going to be quite some time yet before they even consider dipping in. I'm posting a two-part article tomorrow and Saturday about why I think this. You may not agree with me because you can see the bigger picture better than I can, but I think we're still quite a ways away from any other cryptos being viable competitors of Bitcoin.

Posted Using LeoFinance Beta

This is a harbinger of what is to come on a much wider scale. The state of Kentucky is economically one of the least well-off states in the US. The legislators of the state have seen an opportunity to attract new business into the state to help them mitigate the problems they're having.

We're going to see many more governments, local or national, grab the opportunities present in crypto.

Posted Using LeoFinance Beta

I agree. There is going to be a race to draw more tech firms to these different states. We are going to see a lot of laws like this one passed in short order.

There will be a constant devaluing of what is required to get started in these states. That is only going to help kickstart some things.

Posted Using LeoFinance Beta

Getting governments onboard will remain an uphill battle in some regions. It's fascinating to observe how different different governments deal with crypto. Pakistan is crypto friendly whereas India is flirting with banning the whole industry.

Posted Using LeoFinance Beta

It is amazing how much the world's approach to Bitcoin and cryptocurrencies has changed.

Until a year ago, no one would have bet that everything we see today was ever possible

Posted Using LeoFinance Beta

Microstrategy certainly broke the mold with that. Their entry made it a lot easier for other companies to justify entering.

This is only going to keep spreading out as the different market cap levels are hit. The more money that this is worth, the more likely it is to attract more.

Posted Using LeoFinance Beta

I agree it is still regarded as speculative but compared to 2 years ago it is a lot more solid. Hopefully it can move up another level and be considered an investment asset. Next we have to see the list grow as just having two main coins is not great and the next step is for some alts to benefit surely.

Posted Using LeoFinance Beta

The entry of institutions certainly make it less of a risk than it was the last go around. At least we believe Bitcoin is on more solid ground although it can drop a large percentage like it always did.

As more entities enter, as well as individuals, we will see a lot more excitement generated, diminishing the risk (if the development is there).

Posted Using LeoFinance Beta

It seems that we have every chance to see the growth of the capitalization of the world of cryptocurrencies in geometric progression.

Posted Using LeoFinance Beta

That is the epitome of exponential growth. We will see the massive explosion when we get to the elbow of the chart.

I do not think we are there yet.

Posted Using LeoFinance Beta

I agree, we have just started moving near the middle of the diagram.

Posted Using LeoFinance Beta

It is really cool

The good news is in crypto's favor every day

It seems that the world has not been able to control itself and 2021 is the year of the explosion and the launch towards crypto

I remembered the saying "First they mock you, then ignore you, then they walk after you"

Posted Using LeoFinance Beta

We're coming stronK and full of MEMEs :))

I still #hodl to my 30% prediction.

I mean with it's high volatility and sudden swings when will bitcoin not be speculative investment? it could go back down to $20.000 in a couple of months and then bounce back

Posted Using LeoFinance Beta

As the market cap grows, volatility tends to diminish, at least historically. But in this era of automated trading and such, who the heck knows. All markets are subject to some wild swings these days.

Posted Using LeoFinance Beta

I remember back in 2018 when some financial institutions has expressed negativity towards Bitcoin or crypto as a whole. As popular people diving in to crypto, some of those institutions are slowly following.

Posted Using LeoFinance Beta

with more and more big companies are getting a hand on crypto and bitcoin it will really become a mainstream finance. not to mention the money from wallstreet, i think they already having an eye of the growth, and waiting the time to move in.

meanwhile most of government are issuing Digital Currencies it will lead to other crypto usecase and adoption. who knows?

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.cheers !BEER

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @manniman for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Definitely working into all mainstream media.

Posted Using LeoFinance Beta