The global economy is facing some major headwinds. This is something the mainstream media has unsurprisingly overlooked. Nevertheless, it is a major issue and extends far beyond the last couple years.

We are seeing a global economy that suffers from continually slowing global growth rates. Most of your developed countries saw these rates move down starting around 2000. For Japan, the peak was even earlier, hitting their stride in the early 1990s. China is at the other end of the spectrum, just starting to enter it.

Nevertheless, this is the state we find ourselves in. Both the United States and Western Europe see the multi-decade move starting to rear its head. At present, we can see the EU about a decade ahead of the US, yet both are moving in tandem.

There are a number of reasons for this yet much of it, at its core, boils down to a couple issues.

Source

Quality Collateral

The world suffers from a shortage of high-quality collateral. We have US Treasuries as pristine collateral and that is it. Nothing else presently serves this role on a wide scale.

After that, we have high-quality collateral such as Mortgage Backed Securities and other assets that are categorized as such. However, as we learned a decade ago, what is rated as quality might not be.

This is a major issue in a world that is mired in debt. Many look at the level of debt in a vacuum. Leaving the servicing aside, which is a different matter, we need to focus upon what is backing the debt. If there was $300 trillion in global debt collateralized through pristine and high-quality assets, then we have no problem. This is obviously not the case.

Hence, we have a situation where a lot of the debt out there is backed by garbage. While assets prices are propped up, this is not much of a problem. However, if things start to reverse course, we can see where this can head.

As was written in the ideal use case for Bitcoin, it is possible this asset steps in as a second form of pristine collateral. Since it has a capped supply and is being scooped up by financial institutions, could we see a day when this is used to backed debt on a wide scale? It is not out of the realm of possibility, a move that would provide much needed stability to the global economic system.

USD Liquidity Crisis

Contrary to what people like Peter Schiff are espousing, there is not too much money out there. The Federal Reserve is not printing Dollars and flooding the economy. We need to understand the Fed does not print USD. Thus, they are not responsible for creating the currency.

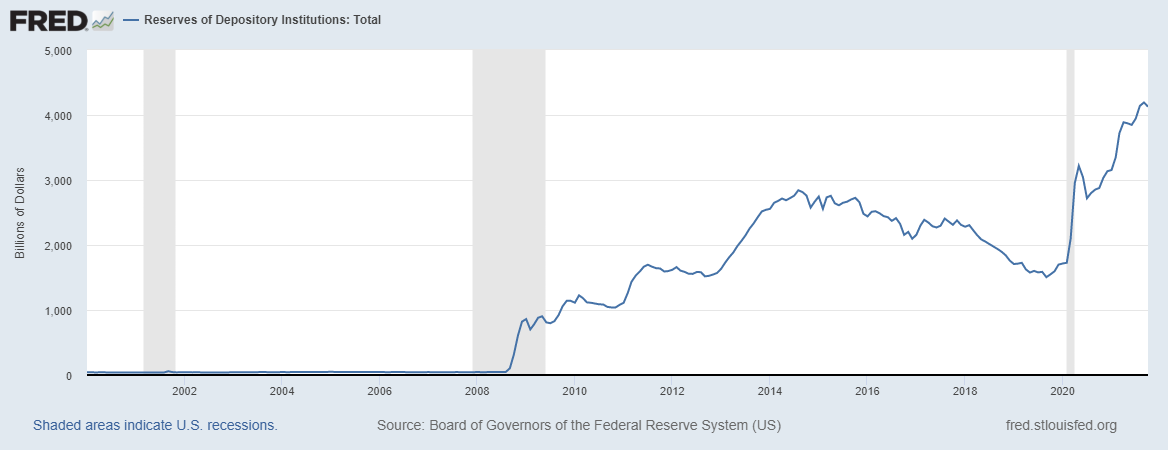

The Fed prints up Reserves. This is why the M2 money supply is becoming a useless indicator. Of the $21 trillion, almost 20% is made up of Reserves. These are financial instruments that are utilized by the Fed when interacting with depository banks.

.png)

What we have is $4.1 trillion on commercial bank balance sheets that cannot go anywhere. The reason for this is the Fed's liabilities are not legal tender. Out of the 320 million Americans, the number who personally held a Reserve asset from the Fed is zero. It is M2 money that is effectively not in circulation.

The USD that is in circulation, however, is being locked in the US banking and domestic system. This was caused, in part, by all the stimulus that saw the selling of Treasuries. Since many buyers are from overseas, more USD was pulled from the international markets. Here we added the proverbial gasoline to a raging fire. There was already a USD shortage dating back to 2008, something that was never corrected.

For the past 7 years, many countries, especially in the EU were selling their US bonds. The reason for this is to raise Dollars. Most everything on the international markets is done in USD, hence these countries are always in need of it. With so much debt out there denominated in Dollars, this is only compounded.

Cryptocurrency As Collateral

We already looked at Bitcoin as pristine collateral but the question is are we limited to just that currency operating in this fashion? Is it possible for other cryptocurrencies, including HIVE, to eventually serve this purpose.

Obviously, outside of BTC, it will not fill the top role. Nevertheless, there could be a variety of cryptocurrencies that step in as high-quality collateral. If the network effects are powerful enough on some of these different platforms, the base coins could be used for debt backing.

Does that help to relieve the pressure due to a shortage of quality collateral? Unlike many assets that are used today, there is little question about the validity of a cryptocurrency. No rating agency is required and everything is transparent. It is known how many tokens are in existence, what the value is at any given moment, and we have 100% liquidity. Also, through the use of smart contracts we can see the removal of 3rd parties, reducing risk even more.

Debt is what helps to fuel expansion. This is something that most economies realize. The challenge is when the debt becomes too onerous from a cashflow perspective. On a personal level, this cuts down on spending in other areas. When we look at things from a national (or global perspective), we see how growth is stifled.

The other problem is when debt goes bad. This causes defaults which can bring down entire economies as we witnessed in the 2007-2008 crisis. When the backing of the debt is found to be lacking, major problems arise.

Could cryptocurrency alleviate this? As a platform like Hive grows and the value of the token increases, could that serve as a unit of collateral for expansive opportunities?

This could be the biggest use case for these base layer tokens. Since they are not truly being used as mediums of exchange due to speculation, we might as well look at how they can fill other voids.

The Need For Stablecoins

The regulators are coming for the stablecoins. This is something that looks like it is beyond dispute. It is only a matter of time before they target them on a massive scale.

In the United States, it is probable that the companies behind the stablecoins will be treated as banks. This is the indication coming out of the SEC and other organizations. Here we will see a massive transition in how these companies have to operate.

It will also open up the door to audits. If this takes place, we should be prepared to have an "Enron moment". Many question whether these companies have the USD backing the tokens.

Due to this, it is possible that algorithmic-based stablecoins become the norm. This is something that we see on Hive with the Hive Backed Dollar (HBD). We also see others appearing on the scene.

Could this be the answer to the global liquidity problem with the USD? Is there a way to fill the global economy with what it needs based upon an algorithmic approach that is outside the reach of the regulators?

Many will feel this is absurd yet there is more than 70 years of history where this took place. Many feel the USD is the reserve currency. The reality is that the Eurodollar actually served this role. That was an unregulated global ledger market among the international banking system which fueled the entire economy. There was an entire borrowing and lending platform that arose, with many forms of "money" created, none of which was under the central banks.

This is a situation that could be replicated with algorithmic stablecoins. A token like HBD could be used to facilitate global transactions. This, along with similar tokens, could provide the long-needed liquidity.

To truly have an impact on the world, cryptocurrency needs focus upon the core issues plaguing the global economy. We know the present financial system has a lot of holes, which is causing problems economically.

Here we looked at two components that are causing the strangling of the global economy. With growth slowing, it is getting harder for people to get ahead.

If we truly are going to accelerate the innovation curve, we need to ensure the resources are available to fund it. At present, we know this is not the case. Instead, we are suffering on both the liquidity and collateral fronts.

Cryptocurrency could alleviate this in a major way. With the correlation between HIVE and HBD due to the conversion mechanism, we could see it expanding to take on a very important role in both these areas.

It is also unique to have this operating at the base layer.

What are your thoughts on this? Let us know in the comment section.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Wow mate @taskmaster4450

Brilliant post buddy

Very impresssive knowledge you have mate

I am not sure about specifics but i think over the next few years we will see some interesting things happening.

We certainly need stablecoins, like you said in the last Cryptomaniacs, it is difficult if your selling things online to not have to be changing your prices every minute or sometimes taking a lost cause of market value changes.

I dunno where this will end up but it seems everyone, their company and their goverment wants a coin.

Just like printing money constantly i don't think creating coins is the way forward either unless it has actual use.

There is certainly going to be crack downs, regulations, battles, losers and winners.

Thanks for watching the show. It is interesting to see how things are going.

Posted Using LeoFinance Beta

While it’s a possibility, I don’t think the FED will ever use Bitcoin. They will create their own coin to have more control over it. They are trying to figure this whole scenario out, that’s what is taking them so long. They was a token they can control or manipulate at their will. That’s not what true crypto is about.

Central banks will end up holding Bitcoin if it does become a recognized store of value.

As for CBDC, that isnt for the central bank, it is more for politicians and bureaucrats. This is a control mechanism and that is of most interest to politicians.

Posted Using LeoFinance Beta

Institutions are already buying Bitcoin. That will just increase over time.

Unless there’s something that they can somehow manipulate they won’t approve it.

HIVE and HBD could potentially solve so many problems that the world is facing. Will it? Only time will tell.

Made me happy to see that old HBD➡️HIVE graphic. I thought that was so cool back in the day when I designed that. It still holds up today and serves a purpose.

Just shows that something you believe in may take longer than you expect to finally be realized by others.

Posted Using LeoFinance Beta

It is a lot easier to see where things are going than to time it.

We are seeing things progressing but the HBD situation was overlooked for so long, that hindered it a great deal.

Posted Using LeoFinance Beta

I support HBD and have been tucking a little away every month. My only concern is that it is tied to the

Fed Reserve Note all be it through software. I think that at some point in the future HBD needs to be tied to the price of a basket of currencies and assets.

It isnt tied to the USD. That is a misunderstanding many have. It is simple a denomination.

Posted Using LeoFinance Beta

Sorry, out of BEER, please retry later...

~~~ embed:1466180328146538500 twitter metadata:UmVhbE1hbm5pTWFufHxodHRwczovL3R3aXR0ZXIuY29tL1JlYWxNYW5uaU1hbi9zdGF0dXMvMTQ2NjE4MDMyODE0NjUzODUwMHw= ~~~

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Are there any other decentralized stablecoins besides HBD? I am starting to realize just how important it is going to be to hold as much HBD as possible. That is why I have been stacking all of my rewards lately.

Posted Using LeoFinance Beta

There are some algorithm based stablecoins as part of DeFi 2.0. I dont know how decentralized they are since we are not dealing with base layer tokens. Nevertheless, the projects might have some validity if they are built upon decentralized applications or DEX.

I havent looked close them enough to be able to answer fully.

Posted Using LeoFinance Beta

Ah, okay. No worries! I was just curious!

Posted Using LeoFinance Beta

I wonder if having these stable coins will help the velocity of money in the economy. After all we know that the Fed just keeps eating up a ton of dollars due to QE.

Posted Using LeoFinance Beta

I would think that will help economic expansion. Certainly having money not locked into the banking and financial sectors will help to speed it up.

We also have the massive debt servicing costs that also feeds into that.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 1170000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Holy 💩 Batman. Thanks again for the education.

!BBH

Posted Using LeoFinance Beta

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work