With technology, there are a few different ways we can look at things. It is always difficult to pinpoint where any single technology is. However, we can figure out ranges where things to monitor the progress.

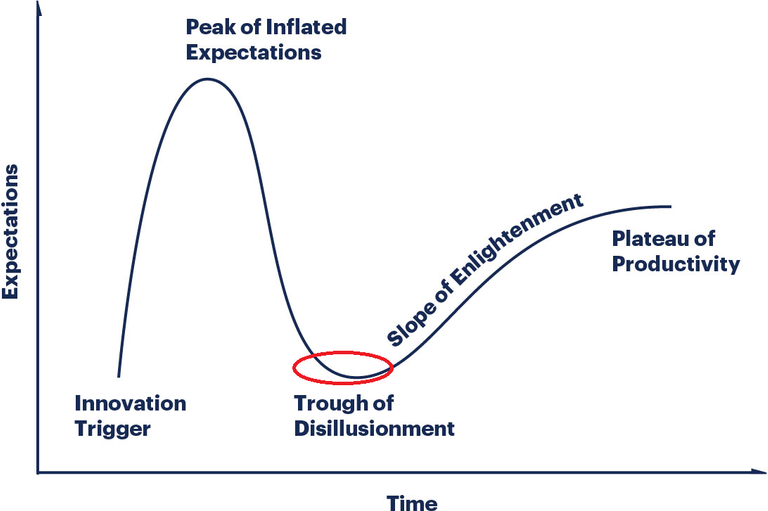

The first chart we can use is the technological hype cycle. This stems from the idea that technology passes through a number of phases on the path to success. Of course, at any point during the process, failure can result.

If we think back to the path of Steem (all cryptocurrency actually), we can see the different phases.

The innovation took place with the release of the blockchain. We saw, in 2016, the release of a new use case for DPOS. By blending the concept of social media in with blockchain, we witnessed the unveiling of a new innovation.

Over the next couple years, as the cryptocurrency market in general took off, we saw the expectations inflated. This is where a lot of publicity is cast upon the entire sector. Steem received a lot of attention from the crypto "news" sites. People were believing we would see an overnight collapse in Facebook.

Of course, that did not happen. Being tied to the market, once the price of cryptocurrencies turned at the beginning of 2018, the expectations collapsed. The multi-year bear market means that most turned their back on this industry. There is a lot of negativity being spewed, pushing the idea that this is about dead.

Hence we find ourselves in the Trough of Disillusionment. This is the crossroads. It is here where the decision of success or failure is made. Things will either keep going down which means failure or there will be a reversal. I believe Steem is going to fall into the later category.

There is one way out of this phase. It is not sexy nor glamorous. It is the opposite of the hype cycle meaning catchy phrases have little impact. The solution is basic "nose to the grindstone effort". It requires going back to basics and developing the technology to the point that users will be attracted to it.

For some projects, this can be a rather quick turnaround. For others, it can drag on for years. Thus, just because Steem is at the base of the next phase, it could be some time off in the future. This phase can last years as in the case with Apple.

[Wikipedia}

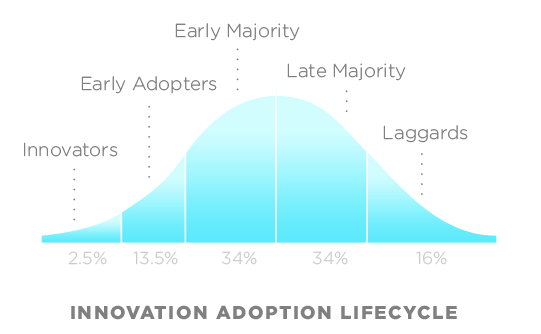

The Innovation Adoption Curve, also known as the Roger's Bell Curve, provides us some insight. As we can see the cycles that a technology goes through is based upon quantified users. Under this scenario, the first phase is in place until 2.5% of the population embraces that technology. Stepping back, we realize that we are still in this phase in cryptocurrency. With less than an estimated 100 million users globally, we are under that market of people who are on the Internet.

That said, we could see us move from the innovator phase to the early adopter in 2020. This, of course, is dealing with cryptocurrency in general, not specifically Steem.

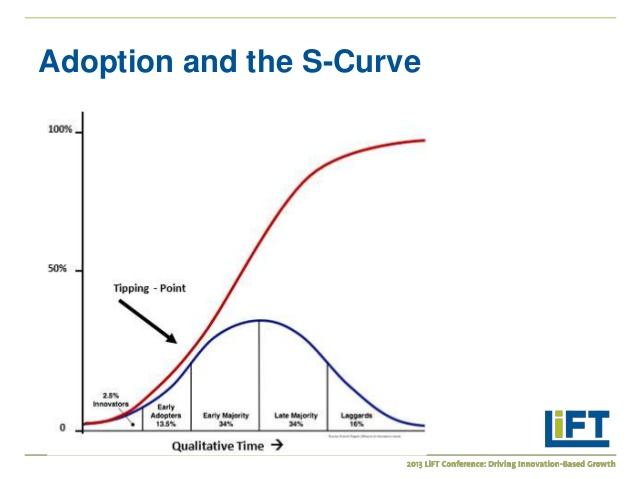

Another way to view this is to over lay the technology S-Curve on top of the bell curve.

The technology S-Curve tells us there is a period of incubation that all technologies go through. During this time, improvements are made and adoption creeps in. As development continues, we see it hit a phase where rapid growth takes place. Ultimately, technology reaches maturation at which point, newer technologies are vying to start a new S-Curve.

A great example of this is the mobile phone. It is in the maturation phase and will be replaced at some point. There are a number of innovations that are seeking to be the replacement over the next decade.

Looking at this chart, knowing we are in the innovator phase according to the bell curve, we can see how far away we are from the tipping point (at least graphically). This means that the blast-off is still down the road. While it can happen at any time, it is going to require a great deal more development to get us to that point.

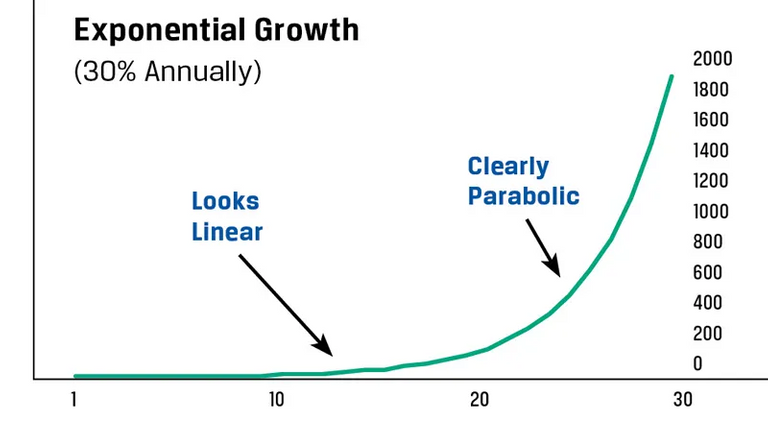

The last chart is a classical exponential growth chart. I chose this one because it shows how misleading things can be. I am not so much concerned about the 30% annual growth as the trajectory path. Notice the period of flatness in the early stages. On the chart, it looks like nothing is happening. Isn't this what we hear people saying about Steem?

Yet, it is interesting to see how "trudging" through that phase gets us, ultimately, to a period where things blast off. With technology, this is due to the massive progress made from a development standpoint. By the way, one of the major areas that requires improvement before hitting the elbow of the chart is to make things simpler to use. This is one area that cryptocurrency is starting to address.

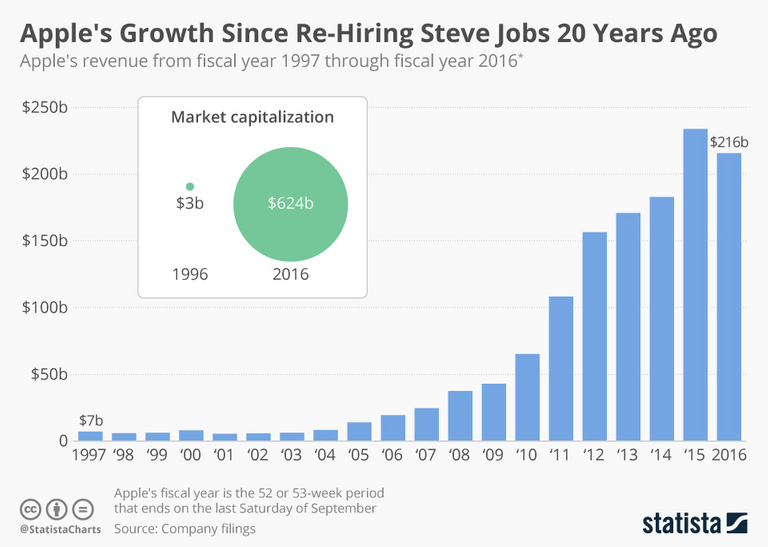

This chart is using real world numbers for Apple. Look at how the progress during the early 2000s seems almost flat. Here is it easy to see when Apple flipped from consistent numbers to explosive growth. The entire trajectory of the chart change. By the way, this is also a similar chart to what smartphone technology looks like. Prior to the late 2000s, there were few of them out there. This changed around 2010 when, in addition to IPhone sales exploding, Android stated to make considerable progress.

When we use this lens to look at a platform like Steem, it is easy to determine that, even after 4 years, it is still very early in the process. The technology simply is not ready for prime time. Progress is being made which is a necessary step. Unfortunately, there are few shortcuts to this. What is being offered to the general public needs to reach the stage where they will readily embrace it. As mentioned, ease of use is one of those factors that always needs to be addressed for technological adoption.

Thus, the attacks that this is dead or going to zero really do not hold up. In fact, simply because this is lurking under the surface tells us all we need to know about the progress being made. We are following established patterns that all technologies before navigated. Nothing we are seeing with Steem, nor cryptocurrency in general, is any different.

Things are unfolding in a pattern that has often led to success. Unfortunately, sometimes it takes 10 years to become an overnight sensation.

If you found this article informative, please give an upvote and resteem.

Posted via Steemleo

No steem price chart?

The Kiss of Death for the Stock Market, ......Barron's Headline Cover

Posted via Steemleo

Will steem hit $10 by the end of this year?

Posted using Partiko Android

nobody can tell you.

it might be. it might not happen at all.

and the truth lies somewhere in between :-D

another great post!

Eye-opening. wow

That last line!!

hmmmm.... well, I will be around :)

👍👍

Congratulations @taskmaster4450!

Your post was mentioned in the Steem Hit Parade in the following category:

Hi @taskmaster4450!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 6.138 which ranks you at #275 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 85 contributions, your post is ranked at #2. Congratulations!

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

6 more years.

Everything is good ... but it's sad when the people who used to love this platform keeps going away .... everyone will deny that people will come people will go but i have seen lots of creative content makers leaving this just because of the power influence and it got even worse after HF 21 there used to be a feed with lots of content now hardly 20 posts per day and in the comment section full of tokens automated comments giving beer coffee is that what steemit we wanted ....

Thank you, @taskmaster4450, for sharing your thoughts about where Steem is! It is very interesting and useful post to read!