One of the many stupid trading behaviours I have (I should probably list them all out sometime) is that if I buy at x-price, I won't sell below that price, even if I know it is going to go lower. Similarly, if I sell at y-price, I won't buy above that price, even if I know it is going to go higher. I am not sure what the term for this silly behaviour is, but I am sure there is one and someone might mention in the comments.

Combined with me being impatient and buying too early (normally) or selling too late (nearly always), this means that I end up missing a lot of potential value, because in order to make gains, I require larger movements. For instance, last night as I watched HIVE go up, I knew that I didn't have any, because despite the drop from the recent highs, it was still mostly above where I had sold, so I hadn't bought any back. If I had, I would have bought less than I had sold originally, but selling at say 0.60, I would have made more than I had spent in total.

Am I the only one?

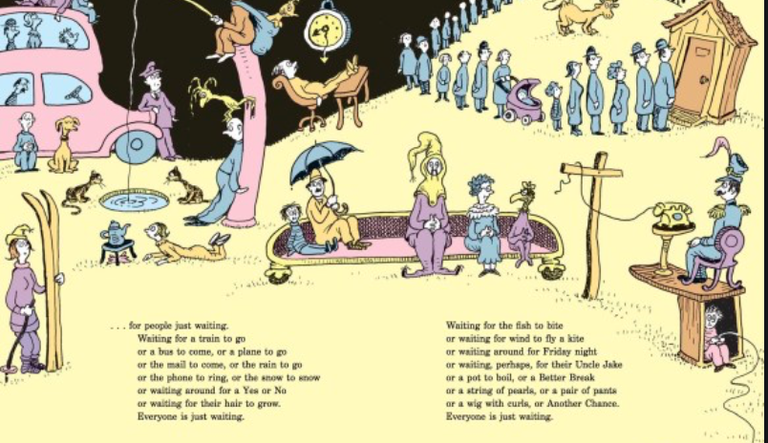

The only to admit it openly perhaps? Whatever it is, I end up in "holding patterns" far too often, where I cannot take off or land (buy and sell) frequently enough, because I need higher highs and lower lows to make the trade worth it. That is poor form in a spikey market, especially for the buybacks, as they tend not to drop low enough.

Anyway - true to form I decided to "roll the dice" and buy something else instead, Far too early. Yes, it was a dip, but in two days I lost 40% of the value I had bought with, because I was impatient. I can't win. I am patient when I shouldn't be, impatient when I shouldn't be. Everything I bought went down, the things that I would normally buy went up.

FML.

You know when you are at the grocery store and choosing a checkout line, and then no matter which you choose, every other line seems to be moving faster than yours? With trading, I have the data to show that more often than not, I am in the wrong queue.

Nothing to sell, nothing to buy with.

Just standing in the queue, waiting.

At least this time, I don't think it will be another four years of waiting for an opportunity. Though, my track record says something different. I think that a big part of my problem for this kind of trading is that I am looking for a little too much gain, rather than increasing the trade frequency on smaller percentages. Doing this means I am constantly missing opportunity to increase the stack, in the fear that I will miss the larger swings. This means that in those larger swings, I have less stack anyway.

One day I will get it right.

It just won't be today.

Taraz

[ Gen1: Hive ]

Posted Using INLEO

Oh I think we all go through that. Me for sure and all it has resulted in what traders call ‘bags’ when there is a downward bend at the end of an upward trend.

The tips I have used include not being hesitant to take profit at a level you sought when buying, forgetting the last trade, and that crypto goes /, then it goes , then it goes / again. Those bags will be worth selling again above where you bought it.

Just takes patience and it is worth it not to feel bad about short term devaluation while it is happening. We are in this for the long haul so let’s not punish ourselves with hastiness!

I have so many, it is like I have been put in the friendzone by 100 women! :D

This is what I often fail at, because I see the movement and move the sells up - often missing them.

For sure. A long way to go :)

With these swings we are getting, figure in 10% and don't get too greedy. I lost out on $200 this morning by holding out.

Yeah, I tell myself that and have done so in the past, but then it ends up going 50% on top. This is why I missed the first peaks... I was too conservative.

You are never going to get it at the top or bottom (unless lucky). That 10% is great compared to anything else esp. if it's a decent hoard. I have to dismiss these thoughts of .. 'if only I had...'. often.

I've always said, I will ride a coin down to zero before I sell at a loss. That's just how I am wired and a luxury I have since crypto isn't my main form of income.

You and me both it seems!

Hey, you're not the only one lol. I am not great at trading or guaging the market, my timing is all over the place and I have resigned myself to simply hodling.....for now lol

But...but.... we have been holding for so many years already! :D

lol I think my hands are permanently curled into the 'hodl' position :D

For me I often sell if the price drops too much and go for another coin or I don't sell at all. When buying the dips I don't go all in at once. I buy each dip with a percentage of my capital. And when I sell I only sell a percentage when the market rises significantly.

Is it working out for you?

Yes it does work for me.

You are not the only one with this type of behavior. This is a typical portrait of the average cryptocurrency market participant. By waiting for more "convenient" extremes for buying and selling, you are essentially trying to predict market movements—a mistake. It is IMPOSSIBLE to predict peak price levels, and it’s unnecessary.

Change your approach. Don’t try to predict; instead, create a trading plan and allocate your risks wisely. Instead of making one purchase with your entire deposit, divide the allocated amount into 3-4-5 smaller portions. In this case:

But the target zones for purchasing should be predetermined (your trading plan). You must know in advance where you’re buying and where you’re selling.

You’re also making a huge mistake by changing your trading plan now. When you say it’s better to have more small trades than fewer large ones, that plan should have been applied during the accumulation phase of the entire crypto market, when assets were being accumulated by large holders. On HIVE, the accumulation zone is clearly visible from 2022 to 2024.

Now the participation phase is starting, where assets leave their accumulation zones—almost always sharply and by a large percentage. If you sell everything now, you might not be able to buy back at a lower price. Instead, you could end up buying back at a much higher price due to FOMO (and the psychological cycle repeats).

Don’t pay attention; this is just an opinion, not financial advice...

I am normally laddered into the market and have done this quite successfully over the years, but I am still setting buybacks too low, looking for a bit of extra gain. For instance on Hive, I moved my buys down, as I thought it would dip further. If I hadn't, I would have reclaimed about 100% of my sells at a 305 discount and then had a chance to sell another 60% up again. Instead, I bought nothing, so sold nothing. It is a double sting, and will compound.

I have been accumulating :)

Such a short phrase speaks volumes about the person who wrote it. 😊

On the other hand, you now realize that you didn’t buy at lower prices. But if the price had dropped and you hadn’t placed buy orders there, you would regret it even more while sitting in a drawdown on your deposit since you would have bought at higher prices.

Your approach is quite reasonable and rational, and there’s no need to regret trying to buy lower. The market cannot be predicted... If BTC crashes by 40% tomorrow, HIVE will return to the $0.2 zone, and you’ll have the chance to buy more. Meanwhile, those chasing FOMO and neglecting risk management will be stuck in a drawdown, selling at minimum prices while trying to buy back even lower.

I have been buying from 16c all the way up to 0.28, so I am still "up" for the moment at least on the trades - just not as much as I should be, nor as much as I want to be :D

It's not uncommon though - I think it's called price anchoring or loss aversion something like that. Happens to a lot of people, to me sometimes as well. But over the years, I tried to ignore and not let the buy or sell price influence my decision since theoretically it's not relevant. But of course, nobody is perfect and neither am I. Hahaha.

Yes, there is a term, but I just don't remember shat it is! :D

But I am perfect in every other way... except this ;)

😎

I think you should stop being stubborn with the market. No one is perfect in the financial markets. If you are doing ''all in'', instead make gradual purchases or sales. You will see that you will be more successful.

I am rarely all in on something. Though, I find myself often in the wrong position, either way :)

That is my behaviour too. Not sure if it is stupid as you are not in loss unless you sell. However, if trade with the money we need, we might sell below that price.

This is true also. At least at this point, I am not trading with anything I need to live my life each day. That would be far too stressful for me.

I bought half at 0.525 3 days ago. And I bought the second half at 0.465 yesterday. Thus my average price has decreased. But I couldn’t stand it and closed the deal this morning at 0.56. Tonight I will watch the Koreans.

You didn't get some more in yet?

No, for now I decided to rest. I'll keep an eye on Bitcoin next week.

I do tell my husband don't wait until you made the most gains, take what you can and position yourself for the next buy opportunity, this has worked for us many times in the past as it gives us the opportunity to make profit at higher frequency than if we waited too long to go sell at the highest price which we might ended up not making sales.

But funny thing is I went against my own advice last night and today I do not know yet if I made the best call as the price I wanted to trade my hive is yet to arrive.

I love the current behavior of hive token in the market as one can make gain easily though.

The waiting line can be very tricky!

Okay so "obviously" if you're feeling impatient wait a bit longer and if you're feeling patient/like you should wait a bit longer then do it now XD

You are definitely not alone in this. The old adage "Buy low and Sell high" is much easier said than done. First of all timing the market is impossible and secondly, like you described it's hard to take the emotions out of it. There's been several times I've missed out by selling too early - afraid it would drop and I'd lose money and buying too late - seeing an asset climb and not wanting to miss out, as well as holding too long - thinking there's now way it could lose more than this.

I try to let go of what could have been (though sometimes I still daydream about it) and move on to what I can control and try not to let my emotions get the best of me.

To “feed” my need to do something on the market and try to be the smart guy who sells high and after few days buy on lower price I use maximum 10% of my wallet to buy USDT

If the price goes up I will have “lower” win, and never lose.

If the price goes down I will buy again HIVE with those 10%, beat the market and wait again for the bull run.

I think that the big win will come with many small wins, instead actually one big win.