Throw out enough predictions and one is bound to be right.

Right?

I don't speculate that much about the price of things openly, but I do throw the odd attempt into a chat with a few friends to test the waters. I have no idea how to read charts or anything like that, but sometimes I get a "feel" that something is going to happen - though it is 50/50 whether it is going to happen upwards, or happen downwards - so it isn't very useful.

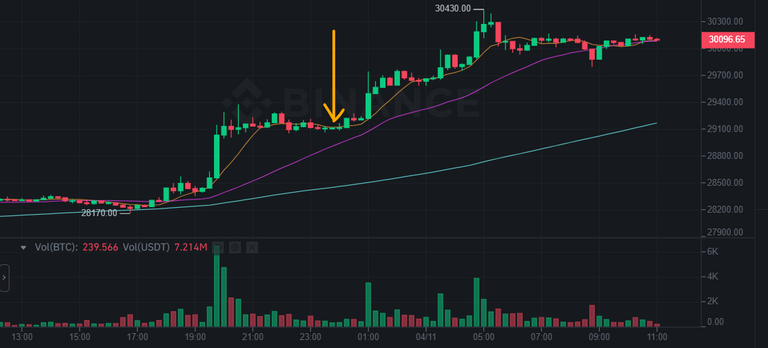

Last night I felt upward.

Not too bad!

While this is the first time Bitcoin has broken 30K USD since the start of June last year, it also represents an almost 100% increase since the low at the tail of 2022. Which is quite a significant gain on Bitcoin and will likely see more in the future, which will flow into other cryptos too - as ships are lifted on the tide.

None of this really matters though, unless you bought enough at the dip or hold enough Bitcoin or other cryptos anyway. So, while the media is talking about it breaking through the critical barriers, most people reading that headline, don't actually hold any crypto. And, they likely haven't been encouraged to hold any, because the media has been conveniently relatively silent on it for the last six months, after fudding for the six months prior due to the FTX scandals.

It is definitely a "DYOR" investment, because no one (especially the media) is going to give you objective advice, because they are too invested - either in loving crypto or hating it.

Noticed that?

There aren't too many who take a middle-road approach on crypto and instead, it is all very polarized with people who are head over heels in love, or hate it more than Pepsi hates Coke. This means that both sides are likely in a poor investor mindset, however one side is still willing to invest. So, while they run the risk of losing what they put in, they also run the risk of what they put in paying off massively.

Which side do you want to be on?

It is interesting, because while most crypto enthusiasts recognize that the fiat system is heavily flawed and will likely collapse at some point, they are also obligated through life to still be a part of it. This means that crypto people have a hedged position, whether they like it or not. However, the people who hate crypto and therefore don't own any, are betting that the fiat economy is going to survive and even thrive. If it does, all is well for them, but if it declines, they can lose everything. It is funny because it is the crypto people who are seen as the crazy investors, when in actual fact, it is the "all eggs in one basket" people of the current economic situation that are actually the least diversified.

For me, I have feet in both world like most people ere, where I live a fiat life through my jobs, retirement contributions, housing and what not, but my investments are mostly in crypto. This is risky, because if crypto fails I don't have investments to fall back on, but it is a calculated risk, where I assume I will be able to find employment to make ends meet in the fiat world, if everything goes to hell. And, if everything goes to hell in crypto, it is likely that the global fiat economy is going to be struggling too, which will mean that even if I had investments there, they would be similarly impacted.

I definitely don't have enough in crypto to feel that I have enough in crypto, but I am trying to slowly gather more when I can and hopefully, the "tide" will lift what I do hold. If it is a significant lift, it will be fine and perhaps at some point, I would take a little out to put into the fiat world. Not to invest into fiat-backed assets, but physical assets, like an investment property or clearing the mortgage.

Being debt-free would be a huge mitigating factor, because it means less of an employment income is required to make ends meet. Other than being completely financially secure, a good situation would be being able to cover the costs of living with a very basic job, like stacking shelves or flipping burgers. This would mean that anything above that would be disposable income and I back myself not to have to flip burgers again.

But, who knows!

Would they hire me to flip burgers?

I used to be very good at it.

The last years have been hard on my family and the last couple have had some unwelcome challenges on top, which has made me even more determined to ensure that my family is okay. There are no guarantees in life and while we can predict what we think will happen, more often than not, we are proven wrong. From a financial perspective however, there is one thing that is certain.

Gotta have skin in the game.

It doesn't matter if you are for or against crypto, all the speculation is academic only, if there is no actual holdings. When there are people arguing against crypto who have no investments in the fiat economy, what does that actually tell you? If they are struggling to understand how to make the current economy work for them, what are the chances of them understanding an emerging industry?

But, I am someone who thinks that stacking shelves is a worthwhile job. So don't listen to me.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

I think anyone who thinks some jobs aren't "worthwhile" hasn't imagined what would happen if that job wasnt done. But would probably have a tantrum when they personally were inconvenienced by it XD

I still have all eggs in one basket, or I guess technically it's two, probably a good thing J doesn't x_x

Are you no longer good at flipping burgers? I thought you wrote previously at some stage that you were good at grilling :D

I feel your pain on the challenges of the last couple years and having horses in both races. As a business owner during lockdowns and recessions, it was all I could to to keep my guys paid and cover the mortgage. Add to that a business deal coming up empty after years of being misled makes for some great skill in digging out of a hole.

I am a little divided on the crypto vs fiat thing and don’t think it has to be a revolution where 1 wins outright. Fiat fuels the value of crypto and crypto gives some relief to the world who is not very well served by fiat which is run by capitalistic forerunner interest for the most part. If fiat dives, it will drag crypto with it and the transition will be devastating for folks who are trying to provide for families in the traditional system. Plus, the wealth is controlled by self-preserving powers that would make that bandaid very damaging to tear off.

I simply love the concept of income diversification for the opportunity and peace of mind. People can have horses in both races simply by monetizing some of their time and attention (like we are doing) if they have no excess fiat to buy a stake.

I really thought I had missed the boat on accumulating a stake back in 2017 and half of me is glad there have been bear markets and dips to buy. The other half wants that boom so I can travel the world and make my blockchain connections real and in person.

Covid sucked for small business - a boon for the big.

Where I think the value of crypto comes in is not as a currency, but a mechanism to reimagine value as a whole and ownership. I think that as it starts to hit its stride, more businesses will be built as crypto first and capture as well as generate new values. In this way, self-preserving powers can have their power lessened, as to be part of the decentralized economy, they will have to give up absolute control and find a more middling path, than outright maximization.

The dips and bears are great at this point, Stability will come and people will say how they missed their opportunity when it was there. It is some time off though :)

When the stimulus cheques were coming out in 2021 I remember reading about a guy who found out about his young hairdresser retiring because Solana had absolutely rocketed. SOL wasn't on my radar at all so I was surprised that some young dude had enough value to never need earn new money again...

Of course, crypto is full of those stories, but SOL has is now $20 off its highs of $250. Did the hairdresser cash out at the top, which means it was only ever an investment vehicle and he didn't care about the tech at all... or did he keep his SOL expecting higher highs only to watch it drop... did he ask for his old job back?

If you had enough crypto to retire, and you're expecting fiat to collapse, how much do you diversify? I honestly think that unless we're willing to get back into fiat then you can only retire if you have enough crypto in the deepest, darkest bear market.

That period was filled with numerous stories of young people making mint with their crypto holdings and living the life. But like any investments whether it's crypto or shares, it's only when you cash it out do you realise the gains or losses.

Unless you have the discipline to sell at the high and not be greedy expecting for it to go higher, I won't be surprised 90% of this stories did not have a happy ending...

Exactly. Too many people go "full crypto" at the highs, as if it will never go lower again. It is silly and leads to a massive waste of potential, as they haven't the fiat coming in from a job to cover their lives, so keep bleeding token mass.

It is harder than people think to sell the top - most don't - I know I didn't.

You know... I've never thought about it in such a manner.... If Fiat grinds to a halt I'll still have my crypto... Won't be much but ill have something... And if crypto grinds to a halt... Well I'll still have a job producing Fiat currency.

So either or I am kinda safe 😂 in a positive mindset at least. BUT. when the world really falls into chaos because of a Fiat downfall... And the lights go out what would it really matter then hey? Then all that matters is survival..

I hope that if it is going to be a nuclear apocalypse, that the bomb lands on my house. :)

It's becoming hard enough find people who are qualified enough to stack shelves...but the worse thing is, it is becoming increasingly more difficult to run a business which makes any profit from stacking shelves. Cause the talking heads are trying to convince us that high prices can be lowered by increasing regulations and going after the shelvestackers' employers so that the criminal governments can at least say their increasing deficits are not entirely their own responsibility. And the listening heads have no idea of the magnitude of them being robbed.

The listening heads are the worst of the heads. The consumer has a lot of power in the supply and demand of all things - we can only blame ourselves. We are what we eat.

Agreed. And the leaders' behind-closed-doors justification would always be 'that's what they deserve'. God forbid 'we should educate them'.

This is why it is important to learn about risk management and it is very important. I have learnt over years not to put all my eggs in one basket.

It is good to invest in cryptocurrency and also invest in something else.

Who knows the future of cryptocurrency? We are just predicting but the truth is that no one knows. I hope we all get favored no matter what result cryptocurrency brings out

If it all goes to hell - so be it! :D

Throw out enough predictions and one is bound to be right.

Right?

The good old Twitter trick - a crypto 'influencer' wannabe creates two tweets, the first saying that xy currency will pump, and another tweet saying that very same currency will dip.

Afterwards, they just delete the wrong tweet and voila - he is a Nostradamus! 😁

It is also the way that spam prediction emails catch people out, as they are never wrong :)

Just for the diversification is interesting enough to keep part of your wealth in crypto the same way it is savvy to have two income sources for a family when possible.

I also believe there is an additional benefit to having some wealth in crypto which sometimes is not remembered, it is your ability to take your investments with you wherever you go. That is something you can not do easily with fiat wealth, even if it is cash (you are not allowed to travel with more than $10K) or bank holdings.

Fiat has become a system of control, just try to withdraw $3K from your bank account and you will realize how many questions you will be required to answer. Your privacy is gone for any transaction coming or going into any financial institution. Keeping your privacy plus the ability to move anywhere with no barriers is an amazing asset.

A massive point. If at certain points in history this was possible, history would look very, very different. I think there are some old posts of mine that might dive into this :)

It is only going to get worse, whilst the visibility on governments, companies and financial institutions get worse. There is a massive asymmetry.

Is your privacy not gone by transacting on public blockchains like Hive, BTC, ETH, etc?

Depends how it is set up - but full privacy is very difficult.

in a way, it is, as everything is registered on-chain, but you do not have to link your identity to any of your accounts, you can use several accounts for different purposes, use a VPN to connect from different IPs, etc.

So although anyone can check your wallet and know your assets and transactions, you have no way to directly contact the owner if he/she wants to stay anonymous as there is no email, phone, or anything to directly establish contact unless he/she wants to do so.

That's the case now... but I assume we're only one corporate breach away from linking people to their BTC wallets.

Being debt-free means that you might be able to save and invest. I have been investing in HIVE little by little, and I hope it will also make an increase towards $1 after BTC.

Exactly. it is about expanding disposable income and disposing of it by spending investing :)

1 dollar doesn't seem too far away :)

It’s important to have the basket mindset in that we don’t have all of our stuff in the one, be it crypto or fiat and stocks. I’m glad to have things diversified but I wouldn’t be completely opposed to bitcoin staying down for a little while longer :D it doesn’t look like that’s going to be the case but who knows. A pull back would be good, hoping to get some more time for the goal on the bitcoin end!

I think it will see a pullback again, but not all the way to 15 - perhaps to 24?

I don't put a lot of stock in what people think the price of something is going to be anymore. I used to follow it pretty closely, but over time I have come to realize that everyone is just guessing. They have zero clue no matter how confident or knowledgeable they seem.

The price is more about the meta of the global economy, rather than any real specifics that people pick from charts I think. Everyone guesses and hopes - I am guessing that crypto will outperform buying a car :)

Not if you bought the last batch of locally

producedassembled V8 Commodore. :D Also with the supply chain issues during COVID, used car prices were actually higher then the RRP.I think that is a general enough guess that you will probably be right. :)

I should start an investment firm.

I remember one of the guy who recently created his own token under Ethereum. He used to create 10 of the sock puppet accounts. He used to pump the price by showing partnership with other brands. In reality all of that was fake. It got caught, meanwhile he sold the stakes and price dipped. Works like charm for most of the rug pulls.

Plenty of rug pulls out there - that is why it is better to choose something a bit more stable, a bit ,ore decentralized.

Do you think that after such a rise in Bitcoin, the probability of HIVE rising increases? And the likelihood of a beehive pump also increases? Maybe the time is very close when the big money will be made.

My friend, make yourself some liquid HIVE.

Yes. It is normal, isn't it?

Beehive?

It's unavoidable. The probability of this event is almost 1.

HIVE. I inattentively looked at how the translator translated.

:D

Haha... This is quite comical. If you do get employed to flip burger, I should probably get my hands ready to make and style people's hair too.

Things aren't nice out here, but the amazing part of it is that we know who we are doing what we do for and the future we hope for in either Fiat or Crypto World.

I have flipped burgers, it is fun!

People should be using all of their skills available to trade for something of value :)

Hehe... That's good

@tipu curate

Thanks :)

You're welcome!👍😊👌

Upvoted 👌 (Mana: 45/55) Liquid rewards.

I have a very limited knowledge about crypto and I have a very few crypto holding but I am also hoping it will rise.

if it rises, you will want more then :)

I have been investing in HIVE little by little, and I hope it will also make an increase towards $1 after BTC.

I am hoping for 10-15 on it :)

When shit hits the fan, it’s probably going to be gold (for large transactions) and junk silver for day to day almost immediately.

Thinking we will have access to the internet to access crypto when fiat collapsed and when everything is a mess.. and what crypto? BTC? Have fun paying the transaction fee.

To hedge is to have a bit of everything.

Hey @tarazkp!

Actifit (@actifit) is Hive's flagship Move2Earn Project. We've been building on hive for almost 5 years now and have an active community of 7,000+ subscribers & 600+ active users.

We provide many services on top of hive, supportive to both hive and actifit vision. We've also partnered with many great projects and communities on hive.

We're looking for your vote to support actifit's growth and services on hive blockchain.

Click one of below links to view/vote on the proposal:

I usually choose a balance approach, geting 50% of the profits, and leaving 50% to grow.

Congratulations @tarazkp! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 60000 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

Lots of mainstream people have been avoiding crypto because they think it's correlated with tech, which is in a bear market.

It's only since those bank crashes three weeks ago that bitcoin uncorrelated itself and started moving independently.

If bitcoin remains uncorrelated to stocks and bonds, more financial types will see it as a good hedge if things go wrong in other markets.

!PIZZA

$PIZZA slices delivered:

@stokjockey(2/5) tipped @tarazkp

Good post.. I'm somewhat in the middle. I have stacked for a while now.. I just wish it was easier to trade it for goods.. Its getting there though. There are some things available to trade. Having some metals would be a good idea for diversification as well. Good for local trade. Cover all the bases. :)

Most of my retirement is in fiat or government employ retirement systems. I could be easily screwed at the click of a button, or a vote from a politician. Right now I am looking at precious metals and crypto and putting a little bit at a time into each.

Honestly, I am going to die on the hill that calls BS on all the crypto market analyses. I took the effort to learn all the day trading tricks, bollinger bands, rolling averages or whatever. I learnt enough to realise that it's all just hocus pocus astrology for money.

Ultimately, as you said, 'feeling' serves just as well if not better, short of having a supercomputer making a billion microtransactions per second. Because the only thing you can contend with is the feelings other humans are feeling when they look at the market. As the pros take advantage of FUD and FOMO, so should we.

Eg., when you see the price going up to a landmark number, chances are high there will be a temporary dip immediately before it, as people set limit sells at nice round numbers.

Wake up to a random plummet? Check the news. If it's some BS article about Elon Musk trolling doge, just ignore it and buy the dip. If it's something like Binance being arrested for buying ivory backscratchers with investor's money, maybe pay a bit more attention to that dip.

Disclaimer: This is financial advice

I think both fiat and crypto will co-exist. At this point, crypto is still new technology and I doubt fiat will be going away forever. Fiat might lose part of it's control but it's not like we live only in the digital world. The digital world is expanding and I do think we are moving in that direction and the physical world is not going away. So I think having some stake in crypto is a pretty good choice.

Posted Using LeoFinance Beta

Even a broken clock will point the correct hour twice per day. Still, I think that predictions are not meant to be correct but meant to give an edge on probability, managing it with a correct money management.

Nice that you eventually made nice profits with the correct prediction, anyway. It's always nice (for me) seeing people making money.

Interesting sharing. I am in a similar situation as you:

It's just one of the many places or assets that I allocate.

I've been quite happy with my reinvestment in BTC near $18K in early 2023, so this is a very welcome rise, but I think it is a little to early to be celebrating about regaining support at $30K. There is some really bleak macro/financial news on the horizon that I think can spook all markets, crypto and fiat/equity, so I took a little profits here around $30K and will wait and see what happens next. Prfots into

For BTC anyways, I think thew fireworks really start to happen in early 2024 as we get ready for the next halving and that will roll over into ETH/altcoin season. I don't really think we will see a major altcoin rally in 2023.

Specualtion aside, I think you make a very wise point about crypto people being hedged while fiat people are all in on governments/central banks preserving their monopoly over the monetary supply. I know which camp I prefer to be in and I'm glad that many of the bad actors have been excised from the crypto space over the past 12-18 months. I'm just hopeful that we can get past the LUNAs and FTXs so that mainstream media doesn't have so much ammunition to attack the crypto space every chance they get.