Score!

While I met my colleagues at the train station, I didn't book my ticket in a group like they did, so I am sitting in a mass of strangers, not having to talk to anyone, but able to write for a bit.

My wife and Smallsteps dropped me off at the train station and for the first time ever, Smallsteps was crying after she said goodbye in the back of the car. We will video chat and sends clips of course while I am away, but I think she is now of the age that these things affect her and it tends to translate into her being more difficult to handle and less willing to do as she is told. It actually started yesterday, as while we had a lovely day together just the two of us, once home, that deadline of me leaving was real and she started getting whiny.

I will miss her a lot.

My wife too of course, but it is easier to handle as adults.

Next week, the cards will be turned for a few days, while my wife goes away for a work trip. Smallsteps is going to like that even less, as they are very close and do a lot of everyday things together. Luckily, it is at the end of the week and through to Saturday, so I will be able to spend a lot more time with her and have some special adventures to keep her mind off of it. I might take a few extra hours off also, since I am travelling on a Sunday and working the evening today.

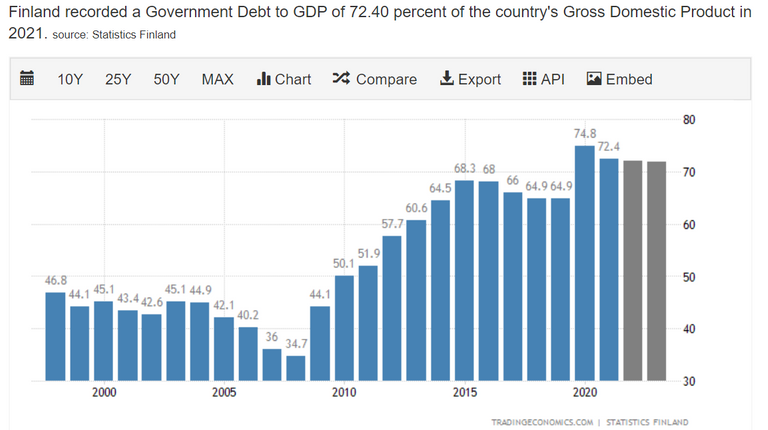

But on another note, I was reading how the debt interest payments of Finland are set to triple, as interest rates on borrowing increase this year. Finland is in "pretty good" shape in general in this area, with the 150B government debt being about a70% of GDP, but in a relatively small economy, those interest repayments take away from other spending, so adding around 2B in interest payments per year is significant.

As you can see, the debt level was in decline until the Global Financial Crisis where in the years following, massive government spending was added to bailout banks and companies, as well as other EU countries. But since then, it has steadily climbed, like the loosening of the purse strings meant they couldn't be closed again. A decline started about six years ago, but 2020 saw a massive increase to the highest level Finland has ever seen.

With the change in interest rates and the weakening economy, the outlook looks bleak, as the ability to export declines and spending keeps increasing, especially on aid for Ukraine and domestic military. This means that the debt to GDP ration will likely worsen further, increased austerity measures taken and more services get cut, or less spending gets made in places like healthcare and schooling.

One of the problems with a social democracy like Finland is that the country isn't set up for privatized schooling and healthcare, but with more and more globalized business extracting value outside of the country, there is decreasing potential to cover these things internally, no matter how high the tax gets.

In 2022, the Finnish Tax Office took in 81 billion euros. 35B individual tax and 21 billion in VAT. And the majority of the tax was paid by individuals, not corporations, as businesses don't incur the VAT, as they can claim it back as a tax deduction. That is 56 billion from people, but that doesn't mean the rest came from corporations it seems, as while I couldn't find the data in English and it wasn't explicitly said in the article I was reading, corporate taxes increased by 29% in 2022, but that was only an increase of 1.8B euros, which means that the corporate takes were around 8 billion. The rest mostly comes down to social security contributions.

But, as you can see, that isn't a huge amount of tax income coming in, so an increase of 2 billion a year to service government debt is going to make an impact, as the debt accounts for 3.2% of the tax revenue, rather than the ~1% it was earlier. What this means is that there will likely be cuts, but there will also likely be debt extension, which will exacerbate the situation further, setting up a spiraling debt cycle, similar to an individual who spend over their income, maxes credit cards and then moves to buy now pay later services to pay for essentials - until their credit rating is screwed and they can't secure any additional funding, but still have to service the debt portfolio.

The easiest way to manage debt, is not having any. However, Finland seems to be taking the US approach to debt more and more - just keep borrowing. This might be okay when interest rates are low on loans like they have been the last decade, but now that they are rising, these obligations are getting more expensive, as larger. As more income is going out of the country through a multitude of ways, the potential to pay back lowers and everything becomes more difficult for everyone, since there is only way for the governments to make ends meet - increased taxes and lowering of spending on services.

Debt really does make the world go around, and it affects us all, as we have seen in the last15 years since the global financial crisis, which was driven by debts and the inability to pay them back - sub-prime mortgage lending - loans to those with poor credit ratings with a higher interest. The low credit rating is for a reason, because they have decreased opportunity to pay obligations and, the higher interest rate increases the chances they will default. It is very much like a desperate spot from a loan shark, the difference being that when there is a default, the heavies break our legs.

Governments seems to be like the rest of us - the more money they have access to, the more they are going to spend. And like the rest of us, they predict that the future will see more income than the present, so they take loans under the guise of "I will pay it back next month". And once the cycle starts, it continues until when conditions degrade, the cost to lifestyle and wellbeing can be extreme.

I can't do much to fix the financial processes of a country, but what I can do is work myself out of debt so that when times get hard, my family and I don't have to be impacted quite as heavily as we could have been, had we extended our debt to the outer limits, as so many people seem to have done in the last decade and especially, through the pandemic.

Smallsteps might miss me through the week and the amount of work my wife and I do might not be ideal at times, but it also isn't ideal to not have the financial room to navigate troubled economies. Sacrifices need to be made as there is always an opportunity cost to every action and at least in my opinion, it is better to make constant small sacrifices, than get into debt and have to pay a very large cost.

Debt won't be missed - by those who pay heirs off, or by those who have it owing to them.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

Raising debt is like spending the money you don’t have and hoping some miracle will happen in the future. It is not sustainable with the interests going up for both individuals and governments.

miracles rarely happen in this world for normal people.

It's normal for little Smallsteps to miss you, especially if it's the first time you've parted ways... think when the roles will be reversed and she will maybe go to university, but life is like this, it flows forward quickly and, even these , which are special moments, you must fully enjoy them and impress them on your mind.

As far as small steps are concerned, you and I travel in harmony, many things we think in the same way.

However it goes there are sacrifices to be made, better small and a little at a time, in any case if reasoned and reflected and well planned, the sacrifices also bring due satisfaction.

Having made the tickets myself, it may have turned out to be a useful thing, not necessarily good but probably comfortable right?

You can write and maybe relax and sleep a bit during the journey, or maybe think a bit, when I'm on the train I always make great philosophical reflections 😁

We have been apart prior, but she was a bit younger, so it didn't have the same impact - time moved differently and was less significant for her perhaps. It is going to kill me when she leaves!! :D

I think the sacrifices we make are important. They help us better understand the world. Some people try not to willingly sacrifice anything and they end up paying an even larger cost.

This has been the "easy day" and I am only just getting a chance to reply! :D

When he goes his way, a part of you will suffer for it and how could it be otherwise for a father?

But I am sure that he will become a very nice person and he will spend your life and taking his path the pain will be mixed with pride.

We live and give all of ourselves to our children just to prepare them and be ready for the moment they will fly with their wings, to see them go sad but that's what they "worked" for a lifetime.

Did you have a good trip?

"Sacrifices need to be made as there is always an opportunity cost to every action and at least in my opinion, it is better to make constant small sacrifices, than get into debt and have to pay a very large cost."

This is a great food for thought!!! Thanks for sharing this wonderful piece

Something to think about at least and perhaps, even act upon ;)

Since the financial crisis all countries have been in lockstep with the US.

No country wants the currency to be too strong and hurt the export.

If Finnish governments didn’t do the same, economy would be weakened (weak export, less

Government spending, both are part of GDP like it or not) and that is perceived to be more problematic.

Have a good trip.

Funny how following poor financial processes is the best option, isn't it? :D

I watched a movie named "The Big Short" this weekend and it's based off some events that took place during the financial crisis of 2008. It was worth the watch👌

I can't remember that we were much effected during the 2008 crisis, im not sure, I was a bit younger back then but I can't remember my parents ever complaining about some problems 🤷♂️ im sure I would have picked up on something..

I think things have been slowly degrading to shit in my country nobody really notices any real crisis taking play in our economy... I dunno... Doomed for failure I would say.

Doomed for failure is pretty much the economy as it is always. People seem to think that the constant crashing is just the way economies have to be, rather than questioning if there is a better system.

I agree having no debt by doing small sacrifices will pay off many times over long term. I have had no debt for years now besides a mortgage, but nothing on credit as it is not worth the pain. If the recession hits like many think it will then you will be far better off than the majority who are already in debt.

I wish I was completely debt free - perhaps next run?

We are in the same situation, and there is upcoming election. This means that there will be much more public expenses for the government to win it again. I can't imagine the how these expenses will be compensated after the election, no matter whoever wins.

Buying votes with people's own money - that doesn't sound like a scam at all. :D

I always tried my best to avoid debts but sometimes there is no other way to manage

Sometimes it is necessary, though it seems to be getting more necessary for many people, where they are buying everything on debt, including luxuries they don't need.

You should called me, I would have hung out with her for a while. That's what uncle's are for.

That was the plan. We ran out of time and stuff. Drop her a message though, she will love it.

Yeah, I will. Might do a video for her.

I saw the other day that the US still hadn't come to a decision on the debt ceiling. I feel like we deal with this every year. I don't understand a ton about it, but it seems pretty silly and dangerous to me.

I reckon they will let the market sweat and perhaps let it crash a bit, before approving at the last minute.

Sounds about right!

The good thing is that now everyone has a video call on their phone. Even 20-30 years ago it seemed fantastic. If in the 90s I would have called someone via video link and shown another country, it would have been a shock.

Pretty amazing really, isn't it? Just think, it wasn't that long ago that when people died in a war, family didn't know for months.

Smallsteps will really miss you a lot which is the emotions attached to someone very loving and special to her life.

Will be nice to get home again :)

„The easiest way to manage debt is to have any.“ !LUV that! 🙌🏻😅

@tarazkp, @borsengelaber(1/1) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

A rise in interest rates is very stressful for many because it drags their financial institutions into losses. Because their spending power increases. However, due to the current global financial crisis, many state-owned banks have taken such distress, which is very alarming for many medium and hungry traders.

Congratulations @tarazkp! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

I was watching something today, well numerous somethings, about how pathetic and fragile this all is if something catastrophic happens to the earth like a meteor or something. All of this is based on electricity, computers and hardly anything firmly tangible anymore. If we get into a serious bind, what the hell is going to happen? Billions of people are going to die because of how woefully unprepared we are for a scenario where computers go down for even a month. Crazy shit. Governments are pissing away money at things that really don’t matter while not doing the important things like infrastructure. I think there’s a reason why we haven’t the slightest clue about how Egyptians moved the stones for the pyramids: they didn’t use lasting materials to write that part of the shit down! Lol

I was trying, but failing to tie that into your post theme here, besides governments being a load of shit these days. Hope small steps is doing good with you being away!

Debt is only good if it's helping the economy or you grow. Otherwise, it hinders people. For example, if you're paying 3% interest but making 5% then it's ok. The problem is that the economy isn't growing and they are still increasing the debt.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Interest... I like to receive it, but I ain't gonna pay it!