It's been long days to writing something about crypto. My semester final was running(still ongoing), so it's hard for me to do activities. However, now I can write and provide informatics topics and experiences that would help you.

Last month after the market crash, I had some BNB coins in my waller, and I have no plan to sell them in losses. So, I decided to provide liquidity in the BNB-SFUND pair. I mentioned the reason here

why I provided liquidity in this pair.

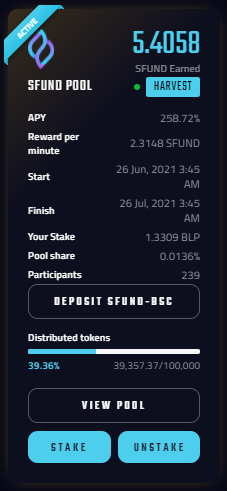

SFUND will run ten months of allocated rewards for providing liquidity. Now it's running four-month and this month's allocated reward is 1.000.000 SFUND.

They start on 26 dates every month. The previous pool will store in the closed pools. Users can unstake them and put the LP tokens into the new pools.

The APY decreased for allocation rewards. Now it's like 200%, and participation also increased. So the pool share is now a little less than the last month. However, it's a good passive income besides leaves the BNB in the wallet.

The staking also decreased from the previous month. Now it's around 40% APY. If anyone bullish on any coin and wanna store them for the long future, then staking is a better option to earn from those coins.

Follow Me on publish0x: @saikat

Legit Bounties and Airdrops: My expectations in Airdrop & Bounties that will help me to get a good return

YT Channel: Hustle Bridge

Posted Using LeoFinance Beta