Trader

Trading in the financial markets involves buying and selling securities in an attempt to generate profits. It can be a challenging and fast-paced activity that requires traders to be constantly aware of market conditions and trends. Here are the most important things a trader should pay attention to:

Market trends: Traders should be constantly monitoring market trends and staying up-to-date on current events that may impact the performance of the securities they are trading. This includes tracking economic indicators, following news and analysis from reputable sources, and keeping an eye on the performance of other markets.

imgsrc

imgsrc

Risk management: Trading carries risk, and it is important for traders to carefully consider their risk tolerance and implement strategies to manage that risk. This could include setting stop-loss orders to limit potential losses, diversifying their portfolio, or using leverage responsibly.

imgsrc

imgsrc

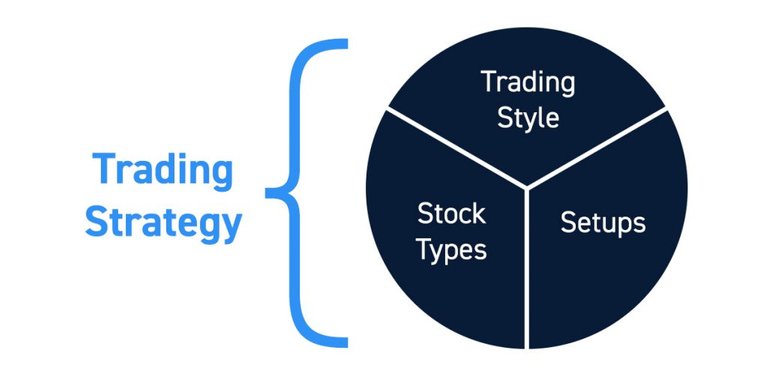

Trading strategy: Traders should have a clear and defined trading strategy in place before entering the market. This should include the specific securities they are interested in trading, their goals and risk tolerance, and the criteria they will use to make buy and sell decisions.

imgsrc

imgsrc

Execution: Proper execution of trades is crucial for traders. This includes understanding the various order types that are available, such as market orders and limit orders, and using them effectively to execute trades at the desired price.

Emotional discipline: Trading can be emotionally challenging, and it is important for traders to remain disciplined and avoid letting their emotions influence their decision-making. This can be achieved through the use of risk management strategies and having a clear and defined trading plan in place.

imgsrc

imgsrc

By paying attention to these key factors, traders can increase their chances of success in the financial markets. It is important for traders to constantly monitor market conditions and stay up-to-date on current events, as well as implement strategies to manage risk and maintain emotional discipline.

Investor

Investing in the financial markets can be a lucrative way to grow wealth, but it also carries risk. In order to make informed investment decisions, it is crucial for investors to pay attention to certain key factors. Here are the most important things an investor should consider:

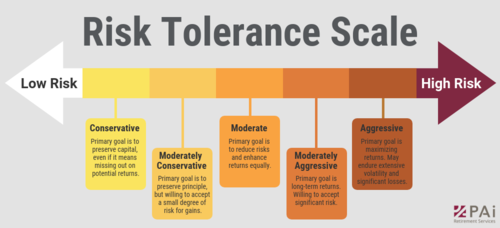

Risk tolerance: It is important for investors to understand their own risk tolerance, as this will help determine the types of investments that are most suitable for them. Some investors are willing to take on higher levels of risk in exchange for the potential for higher returns, while others prefer a more conservative approach. It is important for investors to determine their own risk tolerance and make investment decisions that align with it.

imgsrc

imgsrc

Investment goals: Investors should also have clear goals in mind when making investment decisions. This could include a specific financial target, such as saving for retirement or funding a child's education, or a broader financial strategy, such as diversifying one's portfolio or generating income. Having clear goals will help investors make decisions that are in line with their long-term financial objectives.

imgsrc

imgsrc

Diversification: Diversification is a key aspect of any investment strategy. By investing in a variety of asset classes and sectors, investors can spread their risk and increase their chances of success. Diversification does not guarantee a profit or protect against loss, but it can help reduce the impact of market volatility on an investor's portfolio.

imgsrc

imgsrc

Cost: The costs associated with investing, such as fees and commissions, can have a significant impact on an investor's returns. It is important for investors to carefully consider the costs of any investment before making a decision.

imgsrc

imgsrc

Research: Conducting thorough research is crucial for making informed investment decisions. This includes researching the financial health of a company or the market trends that may impact the performance of an investment. Investors should also be aware of any potential risks associated with an investment and consider them in their decision-making process.

imgsrc

imgsrc

By considering these key factors, investors can make informed decisions that align with their risk tolerance, goals, and financial strategy. While investing carries risk, taking the time to carefully consider these factors can help increase the chances of success.

Posted Using LeoFinance Beta