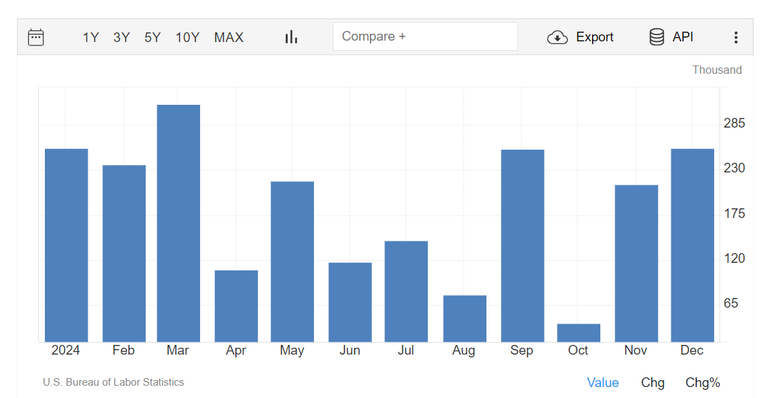

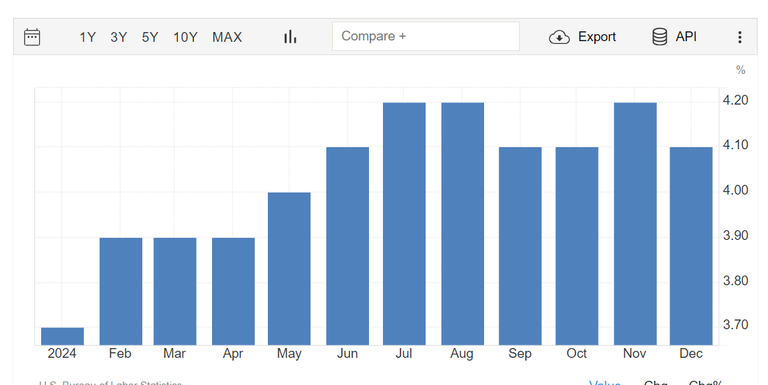

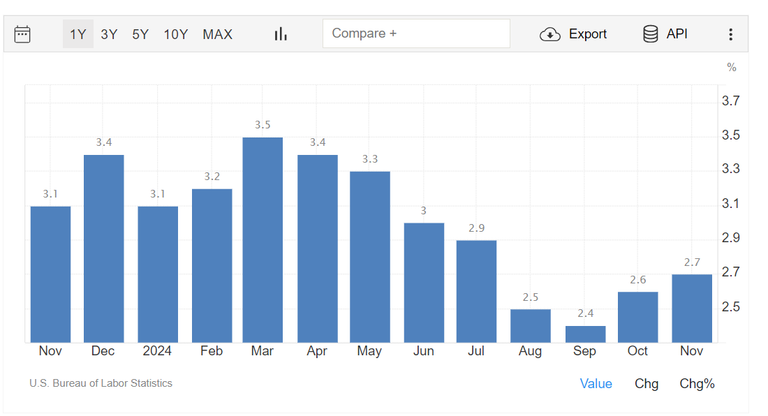

Friday's Non-Farm Employment Change and Unemployment Rate data reveal that the U.S. labor market remains strong. Job growth exceeded expectations, while the unemployment rate stayed at low levels. This data supports the view that the U.S. economy continues to withstand the Fed's interest rate hikes.

What This Means for the Dollar:

Strong labor market data typically strengthen the dollar, as expectations grow that the Fed will maintain or even increase interest rates to combat inflationary pressures. The dollar gained momentum as investors focused on the stable economic picture. This could negatively impact other currencies, such as the euro or the yen, creating opportunities for trading in the Forex markets.

What This Means for Other Markets:

Stock Markets:

These data points can put pressure on stock markets because a stronger dollar and higher bond yields make equities less attractive. Additionally, concerns about further interest rate hikes may weigh on corporate profitability.

However, if investors interpret the economic resilience as a positive signal, we might see recovery moves, especially in sectors benefiting from robust growth.

Bond Markets:

U.S. bond yields often rise following such data, as investors price in higher interest rates. This could lead to increased borrowing costs, affecting both businesses and consumers.

Cryptocurrencies:

Despite the dollar's strength, cryptocurrencies have taken a "dip" into liquidity pools, reaching critical support levels. This suggests that investors are exploring potential bullish moves, even in the face of today’s negative data.

What to Expect:

We’re watching to see how the overall market dynamic unfolds following today’s data. If technical indicators confirm scenarios, I may observe:

The dollar continuing to strengthen in the short term, adding pressure to U.S. exports and international markets.

Stocks recovering if investors focus on the economy’s positive fundamentals.

Cryptocurrencies rising, even against the dollar, if current prices are seen as attractive entry points.

In Summary:

The picture points to a strong U.S. economy, but market reactions will depend on how the data is interpreted and whether investors see opportunities to position themselves at key price levels.

No Rate Cuts??

As we all know, the U.S. central bank plays a primary role in maintaining economic stability. However, inflation has made things tricky lately because it remains higher than desired. As a result, the Fed might need to scale back or even abandon the planned interest rate cuts for 2025.

So, am I saying we might not see any cuts at all? According to recent statements, the Fed expects to cut rates twice during the year. But, of course, nothing is set in stone, especially with the uncertainty brought by tariffs affecting the bank's strategy. So, it's a "wait and see" approach, much like the Fed has been doing forever.

Posted Using INLEO

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP