It's been an exciting few weeks on the Hive blockchain. The introduction of wHIVE showcased what is possible when you create a bridge between blockchains. Now, you can wrap your HIVE tokens and utilize wHIVE for ETH-based protocols like the Uniswap DEX.

Many of us who live on Hive and have experience using Ethereum have talked about the massive potential of connecting two blockchains. When you take the power of Hive and connect it to the vast ecosystem of Ethereum, magical things can happen.

That's why I'm excited to announce that we've begun development on Wrapped LEO with the wHIVE developer @fbslo.

In our 2020 roadmap, we mentioned plans for our new project dubbed "LeoFi" this year. The development of LeoFi is now far ahead of schedule thanks to the development work by fbslo. wLEO is the first step in that plan to bridge LEO to financial protocols on the Ethereum blockchain.

External Exchanges Here We Come!

One of the core visions for LEO is to bring in more users and investors. We want to continually make it easier and easier to buy, sell and utilize LEO on a daily basis - whether you're on Hive or not.

I've always believed that we would make it to a number of big external exchanges, but I thought that we would do it under the guise of an SMT. Now that we're launching wLEO, you'll start to see wLEO listed on exchanges like Uniswap - which just surpassed the daily trading volume of Coinbase as of yesterday.

This is something that I've explained to a few people about Uniswap and wHIVE - Uniswap is merely the first step. If you can gain enough liquidity in the liquidty pool and enough daily volume in terms of trading, then the whole world of DeFi opens up to you.

Many protocols and speculators look purely at the activity in your Uniswap pairings (i.e. wLEO-ETH) to see whether your token/project are "real" and worthy of investment and potential listings on DeFi platforms.

I managed to get into contact with a few people who have experience with DeFi protocol listings and also got a few packets of information about what it truly takes to get fully listed on exchanges like Uniswap, etc. The general consensus is more liquidty = more listings. Anything under $50,000-100,000 USD in your liquidty pool, and it's hard to get taken seriously.

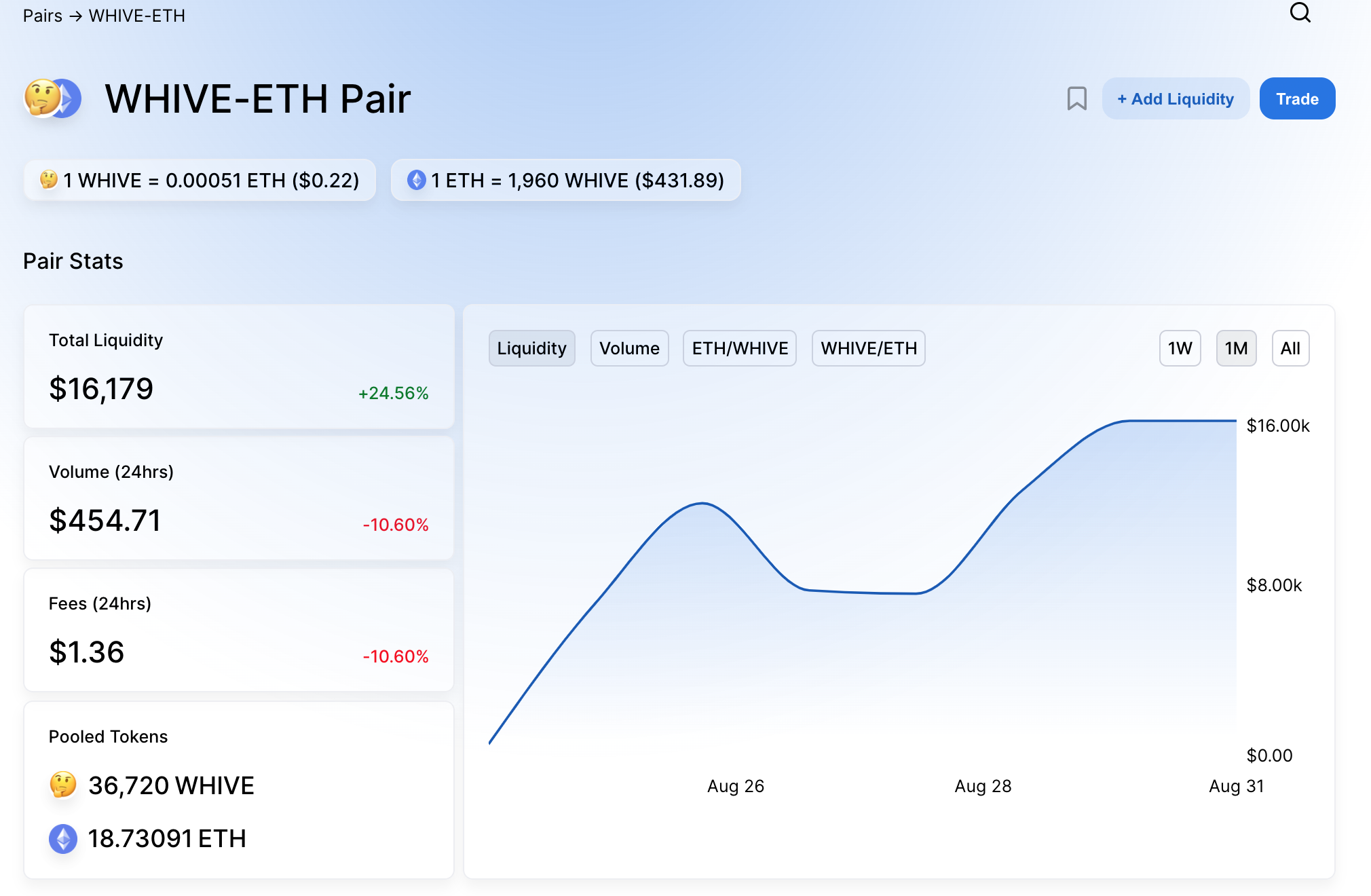

This is truly a game of liquidity and trading volume. wHIVE has done relatively well since it is so new and there is no real project head. wHIVE is 100% community initiated and funded and there is no central team out there providing liquidity/liquidity incentives.

This is where wLEO can shine in its own light. Here is a snippt from the Synthetix team which explains the importance of having deep liquidity pools on Uniswap (which is why so many tokens make this their main focus):

"A deep pool of liquidity enabling frictionless conversion between ETH and sETH will enable users to exit the system in a cost effective manner and provide confidence to the Synthetix.exchange." 1

As a rule of thumb, just think: more liquidity = more users = more attention = more listings.

$20,000 Starting Liquidity

Since the launch of wHIVE, I've spent a lot of time trying to understand this DeFi game and how tokens thrive on protocols like Uniswap. The key is liquidity and trading volume (as I've mentioned). I have also been paying attention to successful tokens and token launches as ERC20's on Uniswap and many teams are doing two core things:

- Providing an initial chunk of liquidty to get the ball rolling

- Providing liquidity incentives for users to get involved and build the ecosystem

To address point #1, LeoFinance will post an initial liquidity of $20,000 USD to our wLEO-ETH pairing on Uniswap. As things progress and new pools are added, LeoFinance will continually provide initial liquidity chunks to other pairings and protocols outside of Uniswap.

I was speaking with a few LEO community members and large stakeholders yesterday about how we can continually provide more liquidty to this pool. The ultimate goal is to get above $100,000 so that we can then take that visibilty to Uniswap for a full listing and ultimately show that to other DeFi protocols and ask for listings elsewhere. One problem that we have with LEO (which has been outlined by community members like @edicted) is that we actually have a lack of liquid LEO tokens.

Our community is a community of deeply entrenched HODLers. As you can see on the latest @leo.stats report, about 90% of all LEO tokens in circulation are actually powered up and therefore, not currently available for providing liquidity to protocols like Uniswap. The power down time for LEO POWER is 4 weeks (paid out in 1/4 chunks each week).

A new way to get paid for HODLing LEO: as of today, the only real way to earn an on-going ROI with your LEO is to stake it (power up) and curate content. Many community members have said that they don't like to curate content. They prefer to earn a passive yield and some also don't want to have to power up for 28 days. They'd rather keep their stake liquid.

Here's where having wLEO gets interesting. These authors and stakeholders can now take a portion (or all) of their LEO tokens that they've earned/bought over the past year and they can wrap it into wLEO. They can then take their wLEO on the ETH blockchain and provide it to the Uniswap liquidity pool (and other liquidity pairings as they arise) and utilize their LEO to earn a passive yield without powering it up.

We think that this is a major win for stakeholders of LEO because now you have a way to earn outside of LEO content curation. Not everyone wants to be a curator and that is totally fine. As far as I'm concerned, the more ways that you can utilize LEO, the better.

Liquidty Incentives

As many of the initial liquidity providers of the wHIVE pairings have noticed, the initial rewards of providing liquidity to a newly launched Uniswap token are not very high. This is a chicken and egg problem.

When you have a new pairing, it has low liquidity and thus, low trading volume. When you have low trading volume, you have low fees being collected. When you have low fees being collected, LP's (Liquidity Providers) aren't able to earn much.

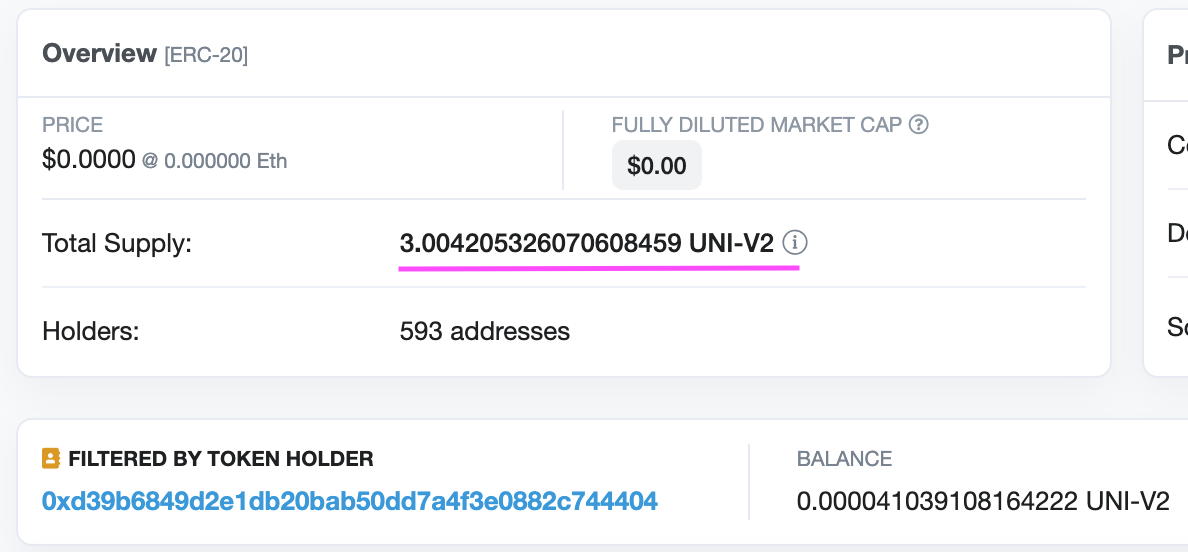

To solve this issue, it is common practice for new tokens on Uniswap to provide additional liquidity incentives via their token or other tokens airdropped to LP token holders (when you provide liquidty to a Uniswap pool, you receive LP tokens - see the below screenshot of wHIVE-ETH LP token details).

LeoFinance will provide initial liquidity incentives for the first 90 days of the pool from our bounties fund as a trial period. If this incentives program proves to be beneficial in gaining more liquidty, more LEO/wLEO token investors and more trading volume, then we will look to divert a small % of the total LEO inflation purely to liquidity pool incentives (a tiny % coming from miners and a tiny % coming from author/curator rewards).

I think I've clearly outlined the incredible benefits of providing liquidity to the wLEO token pairs. Some may be concerned with using a very small % of inflation to reward liquidity providers, but this is likely one of the most beneficial ways that investors can contribute to expanding the LEO economy and opening up our platform to more eyeballs and ultimately (what we all want): more Hive accounts created and daily active users. As we see the results from this program, we'll release more details.

Liquidty Incentives:

The LEO Bounties fund has a total supply of 3,000,000 LEO tokens. When LeoFinance (formerly named SteemLeo) was launched over 1 year ago, the plan was laid out which stated:

"Ongoing bounties will help to distribute 3 million LEO to active users over the coming years. This LEO will be distributed slowly and carefully to users that we believe will add value to the

SteemleoLeoFinance network in the long-term."

After more than a year, we've barely scratched the surface on this fund, as we have had a few small initiatives to release the tokens to users who add value to the growth of the network. Our new liquidity incentive program will distribute 10% of this bounties fund over the next 90 days to users who provide liquidity to the Uniswap pool. The value of building this pool and getting LEO listed on external exchanges/ETH-based protocols cannot go understated.

I view the launch of wLEO as a kind of "IPO". LEO and LeoFinance have been built into a box as a subcommunity on the Hive blockchain. With the launch of wLEO on Ethereum, we're opening up the floodgates to a whole new pool of investors, bloggers and potential users and use cases for the LEO token economy and LeoFinance platform. This launch will take us from being a subcommunity on Hive to being a more legitamized project in the world of crypto. Making our community's true purpose more achievable: onboard more users to LeoFinance and Hive.

The Structure:

- LP token holders will receive a proportional % of the total incentive pool based on their share of the pool (i.e. if you own 5% of the total liquidty pool, you'll receive 5% of the incentive pool)

- LP bounty rewards will be paid out 1x a week for 90 days (~12 weeks)

- Changes to your LP balance will reflect in the following week payout period (i.e. if you add to your balance in the current reward period, it won't take effect in your additional bounty payout until the next week)

- If you remove liquidity from your address in the current week reward period, then that will make you ineligble for the incentive fund payout for that week (prevents abuse)

- Rewards can either be paid out as wLEO or LEO (which will dictate whether they're paid to your ETH address or to your HIVE address)

- A minimum of $100 in liquidty provided will be required to receive additional incentives from this bounty fund (prevents spam abuse)

Please note: This structure is likely to stay in place, but is subject to small changes before the actual launch of wLEO. On launch day, we'll lock in the final details so that you know exactly what the LP rewards look like before you jump in.

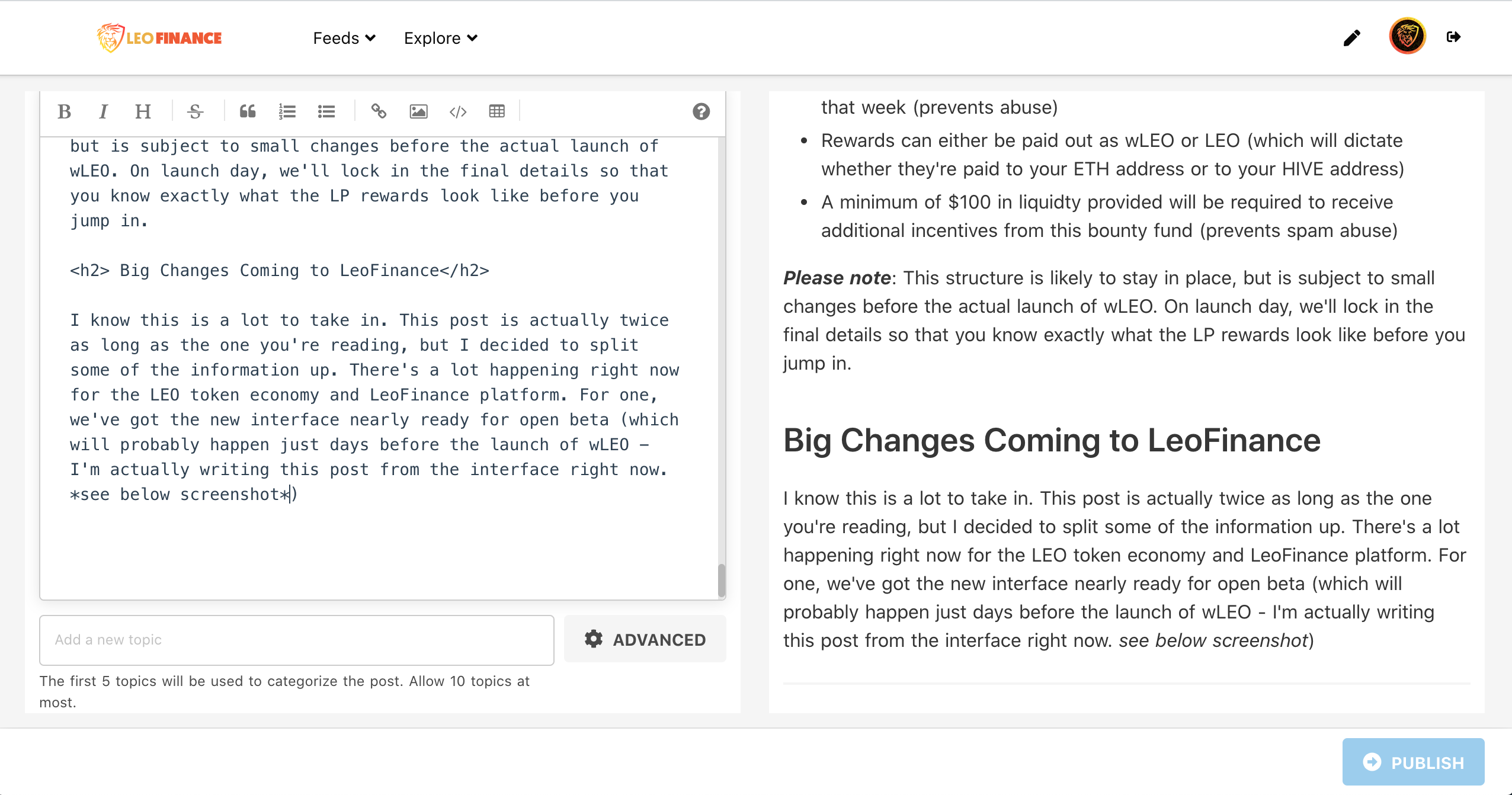

Big Changes Coming to LeoFinance

I know this is a lot to take in. This post is actually twice as long as the one you're reading, but I decided to split some of the information up. There's a lot happening right now for the LEO token economy and LeoFinance platform. For one, we've got the new interface nearly ready for open beta (which will probably happen just days before the launch of wLEO - I'm actually writing this post from the interface right now).

wHIVE was a lot for people to take in as well. When you're accustomed to using a blockchain like Hive, it can be a little confusing to jump over to a chain like Ethereum which has vastly more dApps, users, fees and tx wait times. Hive is an incredible blockchain in terms of usability, 0 fees and 3 second transactions. That's why it's the best platform for LeoFinance to be built on.

The key is that we're keeping all the benefits of having LEO and LeoFinance on Hive, but now we're using wLEO to plug-in to the multi-billion dollar industry that DeFi has exploded into.

Our dream of having LEO listed on external exchanges like Uniswap (DEXs) and also Bittrex, Binance, Huobi and others is closer than ever. As an ERC20, wLEO can be listed on any pretty much any major crypto exchange out there. The first step is getting this Uniswap gateway funded and utilized. From there, we'll take our platform to greater heights with the new interface and onboarding programs and from there, we'll take this community to the moon as we contact major exchanges and ask for a wLEO listing.

The future is exciting. Will you join LeoFinance and our mission to grow our platform and expand the Hive ecosystem?

Please leave any questions you have about anything in this post below. I'll take the top questions and turn it into an AMA video this week.

Join Our Community!

Earn LEO + HIVE rewards by creating crypto/finance-related content in our PeakD community or directly from our hive-based interface at https://leofinance.io.

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

Posted Using LeoFinance Beta

By the way, please consider adding

WHIVE - WLEOpair, this way making trades onETH - WLEOwould also generate volume onETH - WHIVE(with routingWLEO -> WHIVE -> ETH).I forward you request onto the powers that are at Leofinance @cardboard.

Great suggestion.

Posted Using LeoFinance

This.

Posted Using LeoFinance

That’s a good idea and will help both Leo and hive. We’ll definitely get that rolling too

Posted Using LeoFinance

👍

I am an idiot.

Is there a simple step by step guide on how I can add to the liquidity pool?

There will be a step by step video posted by @khaleelkazi when wLEO goes live. It will take everyone through the process.

Posted Using LeoFinance

Cheers thanks! It is pretty exciting around here at the moment :)

It certainly is @tarazkp. We are seeing some exciting stuff starting to roll off the computer of developers.

I get really excited when I think of where we will be in 6 months. Hard to believe we just passed Hive's 5 month in operation.

Posted Using LeoFinance

If the devs are on the ball with timing, it could work out very well across the board.

It will be an identical process to wHIVE. I made a written/video guide for that if you want to check it out: https://leopedia.io/complete-guide-to-wrapped-hive-on-uniswap/

I’ll put out more guides as wLEO launches and we add other exchanges outside of Uniswap as well :)

Posted Using LeoFinance

Cheers mate. Looking forward to it all.

I am speechless.

:)

Posted Using LeoFinance

I need to buy a shit ton of Leo Tokens now!

xD it’s gonna be fun to see the next 2 weeks as this all comes to fruition alongside the new interface

Posted Using LeoFinance

I am sure it will be amazing! You guys are killing it over there and I figured that out a bit too late :p

I did manage to buy 300 Leo or so a.few.daya back :p

Exciting is definitely the right word to describe all of this.

In all honesty it's developments like these ( as well as the community feel and amazing friends that I've made on here in the last couple of years ) that make me decide to stay active on this platform and the blockchain, in spite of all the drama.

Thank you also for informing us in such a way that I can finally 'wrap' my head ( somewhat ) around the whole DeFi thing, as a non-tech guy.

Keep up the good work!

Posted Using LeoFinance

This gave me an erection

Posted Using LeoFinance

#metoo

LEO team is moving forward with such a speed

Posted Using LeoFinance

🚀 2020 is a great year for us. Can’t wait to unveil what we’ve got in store

Posted Using LeoFinance

Love It

Ohhh yeah

Posted Using LeoFinance

WARP speed :)

oh, no I meant WRAP speed

Is a guide coming on how to provide liquidity?

Asking around, much of the DeFi stuff is going over many peoples heads - perhaps leopedia will tell me more? :)

LeoPedia has you covered my man! https://leopedia.io/complete-guide-to-wrapped-hive-on-uniswap/

When wLEO launches, the process will be identical to wHIVE :)

Posted Using LeoFinance

Sweet,thanks.

I will be getting involved, and looking at the LEO price action this morning it seems others are too. Good luck!

This is incredible! I just spent few minutes only thinking about what possibilities this opens in future...

Posted Using LeoFinance

The potential is endless. We’ve been researching a few top exchanges on ETH that we’ll start with and then likely chase after the big names like Binance/Bittrex sometime next year

Posted Using LeoFinance

These are tremendous news and as a LeoFinance user I can only be happy for what this opens for us. I am a Dolphin heading for Orca and hopefully my rank will get better and be able to bring more value to the finance community from here.

Posted Using LeoFinance

Congratulations on your growth on the LeoFinance community. Keep scaling.

Posted Using LeoFinance

Much appreciated, I keep on climbing and found some really supporting people in the LeoFinance community that help me on the way. I just need to see what else I can do on top of that and how the scheduled changes can bring more value.

I will be doing a video on this, discussing things from the author curator perspective.

Smaller accounts likely just got a whole lot more powerful if some of the larger accounts start to power down to add to the liquidity pool.

Posted Using LeoFinance

This is really going to be the case. Got same insights too.

Posted Using LeoFinance

Interesting aspects on which I wouldn't have thought on. Will tune in once you have the video ready, I still try to wrap my mind on what is happening and if without liquidity I can be involved in any way...

Posted Using LeoFinance

Great deal. Glad to see this. It is exciting to be branching out in such a large way.

As more LEO is tied up in wLEO, the price in USD terms should increase. Since the values on Uniswap (and other exchanges) favor using USD, that will only help. The 3.5 cent price will make it a lot easier to reach those number when the price moves up to 3 or 4 times that.

With such a tight float and more LEO looking to be staked (albeit in a different manner) this should not be difficult to do.

Posted Using LeoFinance

Certain.y, with this development, it seems quite difficult for one to buy into LEO as an investor because things will double and triple.

Posted Using LeoFinance

Hi @steem.leo this looks to be the best piece of news in 2020 so far from our community.

This would surely make our community token a hot token and its price would go up multiple X in no time

So when you say

What amount of leo tokens do you have in mind

At 5 cents price, its 2k, at 3 cents 3k tokens :)

Yep as @dalz said here: depends on the price of LEO at the time. The more the price goes up, the less LEO tokens it will require

Posted Using LeoFinance

Thanks @khaleelkazi & @dalz for the quick response. I have started accumulating some Leo tokens in my piggy bank to reach the $100 mark.

Sorry to run faster than the curve and ask how soon can I start providing liquidity to the pool.

2ndly how much time does it take to unstake the staked leo's from ones accounts

Posted Using LeoFinance

Another great add would be defibox.io pair. That would link you into EOS ecosystem with free & instant transactions.

Congrats on the Uniswap listing. Indeed liquidity is king!

Posted Using LeoFinance

Impressive! This is a great initiative!

The polibilities are endless. Super excited!

Posted Using LeoFinance

Can you ask HIVE core developers to copy LEO model for providing liquidity? 😄

@fbslo @cardboard @taskmaster4450le @khaleelkazi Just an FYI, you guys should really consider also making wLEO and wHive trading pairs on https://exchange.sushiswapclassic.org/#/pool.

Sushiswap has much better liquidity (lower slippage) and prices than Uniswap for a lot of trading pairs.

You can also contact pools like https://bit.ly/DeFiYield in order to get wLeo and wHive on their liquidity pools list. It would help the Hive ecosystem a great deal.

You can also use https://bit.ly/DeFiYield to earn great APY yields on your unutilized crypto assets by allocating them to a pool(s) of your choice. *NOT FINANCIAL ADVICE *DYOR

Great news! Thanks!

Exciting times..Well done!

Posted Using LeoFinance

Woot :)

100$ minimum for liquidity providers will be around 2k to 3k LEO, depending on the price.

I have a very simple question: how will the DeFi payouts be funded when the day comes when there is no new money coming in? With the .25% trading commissions?

Who wants to pay 3$ in Ethereum fees?

Quite an interesting news. I have been emotionally down in the last few days due to a bereavement. Reading this news spiced some energy within. Great to see this growth around LEO and the LeoFinance Community. Things getting faster than was planned.

Posted Using LeoFinance

Sorry for you bereavement and hope better times will come in time.

Sorry to hear, mate. Stay strong ✊🏻.

Posted Using LeoFinance

Here we comeeeeeee!

cool

I will keep an eye on it!

Had a look at the beta, looking much cleaner, I can't wait to start using it on the regular :P , I do hope some of the stats and metrics from the main site can ported over, I enjoyed that about the site, looked like a mini trading desk :P

Ooh that's going to be epic for LEO, there is so little liquidity having it spread over more exchanges will put some real pressure on it and maybe even more users as they find out about the token

Unfortunately ethereum is not usable due to terrific fees. A bridge to eos would be a lot better, especially since defi is starting to warm up there

Posted using Dapplr

...or that one blockchain that made HIVE a reality.

This is really impressive. Isn't now the time to buy a truck load of LEO?🌝

Posted Using LeoFinance

Some seem to think that @gamsam.

It is up to you to decide for yourself. I added some more after the announcement.

Posted Using LeoFinance

good to have LEO there

It is amazing the capacity as LEO surprises us every day. We are presented with several updates and so many others will also come with the same goal of improving the LEO ecosystem.

Now we have this wonderful ad. The only certainty I have is that the Moon will not be so far away for LEO anytime soon. Keep working guys! You are sensational.

Mars is right there ... 🚀

Posted Using LeoFinance

When Lambo

Wow... That's great, LEO team!

You know I'll be front and center for this!

Awesome news - made my day.

Now this was some fantastic news to wake up to this morning. Great work as always, Hive and LeoFinance just keeps on building!

Just to add to the discussion, I've shared my thoughts on wLEO from a LEO investor's point of view.

Spoiler alert: This LEO investor is excited about the possibilities for price here.

Posted Using LeoFinance

And there we go... LEO is up almost 100%! We're living exciting times!

Posted Using LeoFinance

I will join the liquidity supply

Posted Using LeoFinance

Congratulations @steem.leo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

This is awesome! Great work!

Love to see the progress being made @steem.leo / @khaleelkazi in the LeoFinance community. Provides some hope and encouragement about future prospects!

As a result, this transaction was completed minutes ago:

The 49 MVests under my control now voted in support of your Witness.

All the best to you and the LeoFinance team for an even better tomorrow! 🙂 👍

@khaleelkazi You could also make Balancer pools with weights like 50% wHive/30% wLeo/20% ETH (just an example). And you can also change the weights later on if you need to. The more exchanges we have a listing on, the better I think. Also check out Mooniswap and 1inch.com.

Also, if someone stakes Leo tokens and curates, to they get a yield on both their staked LEO as well as HP?

@fbslo We definitely need a decentralized wHive token to bring credibility to the trading pairs in order to get serious liquidity from the DeFi community.

Thanks!

Great post

My friends here on hive invested a lot in alt-coins and may be a little more sceptical. At least you have a running community with daily content.

just started powering down... Should have 6k leo to help out soon

Posted Using LeoFinance

I love the perspective you have with the Leo token and that you are opening up new opportunities to enter the great industry of Defi. 🚀🌟

I will summarize this post for my Hive news video.

a bit late to the discussion here. Is it going to be total USD20,000 for the pair or USD20K each side? I agree that a tiny LP will be subjected to bigger slippages.

Posted Using LeoFinance

So, the focus will be on the wLEO-wETH pair. Do you think there'll be demand for a wLEO-wHIVE pair?

Posted Using LeoFinance