Welcome to this weeks update from the @spinvest-leo account. This wallet manages a small portion of the overall @spinvest fund, and sends HIVE back to @spinvest each week to contribute to the pool of funds for dividends. This wallet is managed by @jk6276. The main focus of this account is to generate yield to contribute to the weekly dividends for holders of SPI tokens. 50% of the income generated each week is sent to @spinvest to contribute to the weekly dividend. Primary holdings are positions in SPS liquidity pools, other BeeSwap pools, along with some Hive engine based investments. We have also moved into the Cosmos, with an initial position of some staked DYM (Dymension) plus some liquidity pools on that new platform.

Position changes this week:

Been a big drop in values this week, as most would no doubt be aware. I have not changed anything much, except I've added another liquidity pool on Dymension. It is $DYM paired with $stDYM, a liquid staked version of $DYM released by Stride. This will generate us more $STRD over a 6 month airdrop allocation, in the same way we are qualifying for $STRD in the $DYM/$stTIA pool. This pool is simply being built from the yield generated in the other two DYM pools.

No other changes this week - considering moving out of the SPS/ETH pool next time there is strength and decent value there, but don't want to do it at current values.

Current holdings:

SPS/HIVE pool - $411 - down $85

SPS/ETH pool - $1102 - down $211

SPS Staked - $689 - down $213

SIM/HIVE pool - $450 - down $54

ZING/HIVE pool - $415 - down $81

Staked BXT - $764 - down $81

Staked LEO - $44 - down $9

HIVE Power - $360 - down $45

DYM/stTIA - $382 - down $31

DYM/ATOM - $377 - down $35

DYM/stDYM - $9 - up $9 (new position)

DYM stake - $552 - down $53

Asset exposure

Using the above values, and splitting pool positions into their components, we can calculate the total exposure to each asset for this wallet.

SPS - $1446 - 26.02%

ETH - $551 - 9.92%

HIVE - $998 - 17.97%

SIM - $225 - 4.05%

BXT - $764 - 13.75%

ZING - $208 - 3.74%

LEO - $44 - 0.79%

DYM - $941 - 16.93%

stTIA - $191 - 3.44%

ATOM - $189 - 3.39%

Commentary:

Looking at those numbers, any commentary on the above would seem like all doom and gloom. The market had a big correction, and SPS in particular got clobbered. Everything is down, with our bag $900 lighter than last week on paper.

Let's look at a bright spot instead of focusing on all that.

Our DYM wallet has qualified for its first airdrop.

How much will that be worth? No idea, we will find out in a couple of weeks. DYM stake is likely to receive numerous airdrops, and this $NIM one is likely just the first of many. What is NIM all about - something something AI and gaming. They use all the current buzzwords, modular, AI, gaming and so on. Anyway, we shall see when it launches what it is all about, and if it's worth holding, staking, adding to LP or dumping. Note that this will be our minimum allocation, and we could get more.

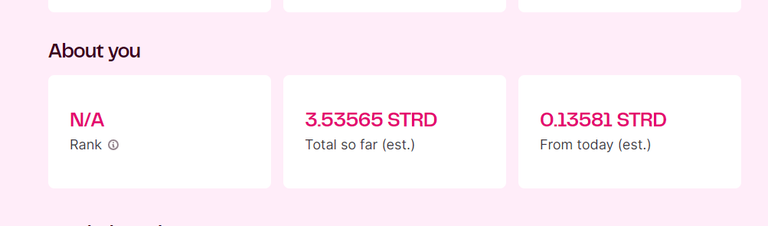

Don't forget we are also earning $STRD which gets released after 6 month.

There will be more airdrops to come.

Totals and conclusion:

- Total asset value last week: $6454

- Total asset value this week: $5555

- Weekly gain/loss: Down bad. 😭 $899 down from last week.

29.684 HIVE sent to @spinvest for weekly dividends.

Thanks for taking the time to read our weekly update. If you would like to learn more about @spinvest, and the $SPI token, check out the main account and review the weekly update post.

This post authored by @jk6276 on behalf of @spinvest-leo. 50% beneficiary set to @jk6276

Posted Using InLeo Alpha

There will be better times for sure! Thanks for your work :)