Bitcoin (BTC) looks poised to pursue a run-up towards $100,000 as its price breaks out of a classic bullish structure.

Dubbed as the Bull Pennant, the setup represents a price consolidation period with converging trendlines that form after a strong move higher. It ultimately prompts the price to break out in the direction of its previous trend to a level typically at length higher by as much as the size of the initial large move.

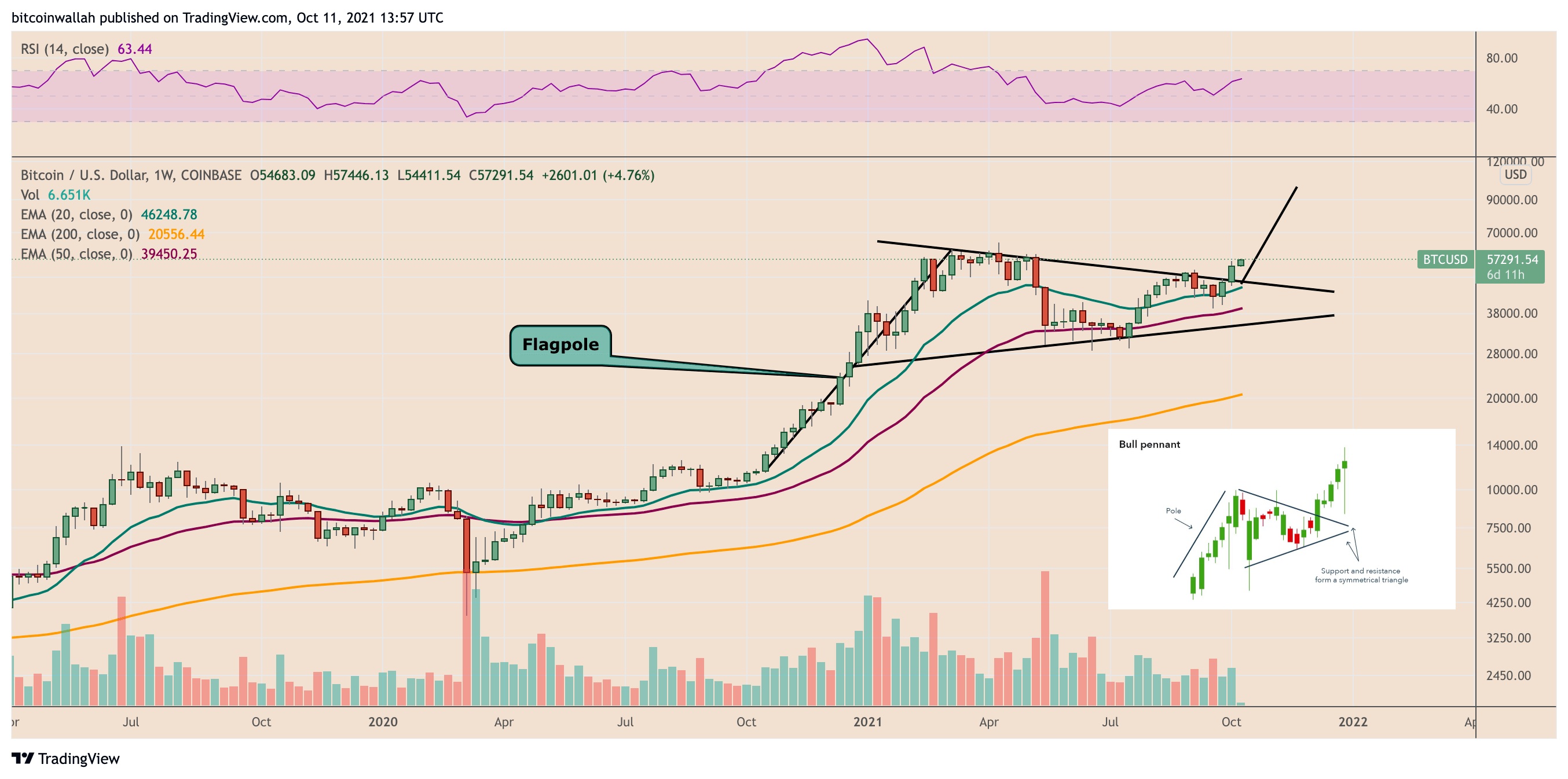

On Bitcoin weekly charts, the cryptocurrency appeared to have been trending inside a similar consolidation structure, with its price fluctuating inside a triangle-like structure following a strong move higher (Flagpole).

BTC/USD weekly price chart featuring Bull Pennant setup. Source: TradingView.com

Last week, Bitcoin broke above the structure's upper trendline as it rose by 13.5%, with rising trading volumes to boot. As a result, the cryptocurrency's breakout move indicated its potential to rise by as much as the size of its previous trend (nearly $50,000).

Measuring from the point of breakout (-$48,200), the Bull Pennant's upside target thereby comes out to be another $50,000 higher, i.e., almost $100,000.

Source:Yashu Gola(cointelegraph.com)