For a college master application, I had to write a two pages note on the domain of fintech. I thought it would be interesting to share it here and have some feedback! Here's part 2!

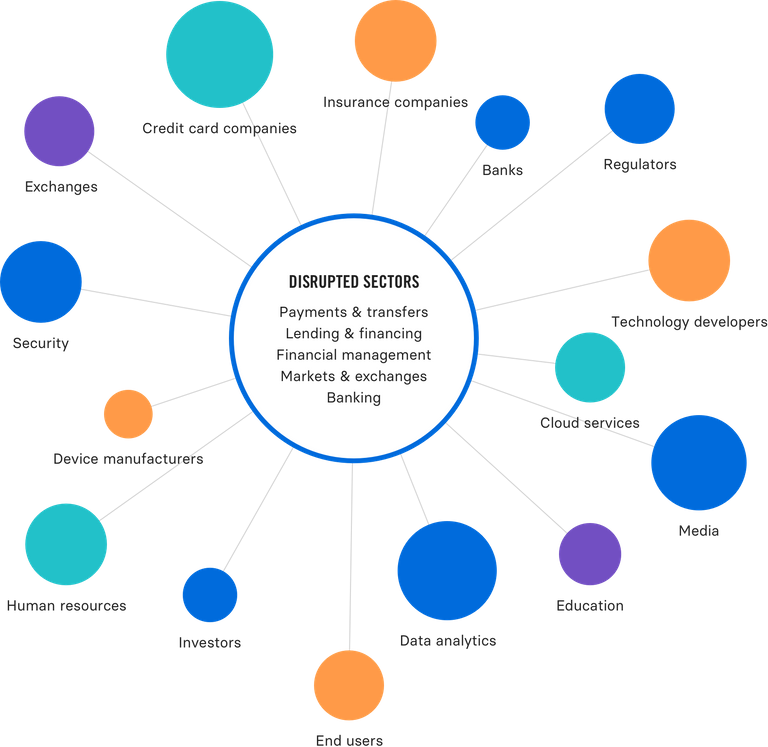

In the last post, we have considered the historical evolution and geographical adoption fintech. We will now deep into the current market. In order to analyze it, I have split it into two parts: the actors of the markets, and the services and benefits they provide. Understanding the roles of actors is essential because they are the ones that pushed the market in the next decades.

Before the 2008 financial crisis, only traditional financial actors, such as banks and insurances, provided financial services. During the period post-crisis, startups and technology companies enter the industry. Technology companies used their important community to deliver financial services, like Apple with its Apple card. On the other side, startups became so important that according to Dealroom data, 18,926 fintech startups have been created from 2010 to 2019 in Europe, Asia, and the US & Canada. Accordingly, investments to these startups reached a peak of $111bn worldwide in 2018.

Traditional financial institutions are still contributing to the fintech domain. They invest massively in startups or accelerator programs and do partnerships with startups. For instance, corporate venture capital was multiplied by 6x between 2014 and 2018. Moreover, they try to adapt their services' offers.

Finally, governments rule the game. They push innovation and protect consumers with regulations. They guarantee consumers protection and prevent any abuse from companies delivering services. For instance, in the United States, the SEC has sued several crypto-companies that have done Initial Coin Offerings in 2017. The institution accused the companies to have misled consumers. Governments also invest in startups. For example, BPI France, the French public bank of investment, invested €1,3bn in startups through its innovation funds. Such investments allow startups to raise more funds easily.

Finally, governments create the first layer for the development of fintech. As mention in the previous post, China and Sweden are developing their digital currency. This development will be key in the future of finance for these two countries.

We have seen that actors are key to the development of fintech. We can now analyze whatis the added value offered to understand the next big innovations in fintech.

We can begin with the cost reduction and convenience offered by fintech companies. These companies offered a pay-as-you-consume business model. In China, you only need one or two applications to deal with your personal finance. With these applications, you can pay, manage your expenses, or ask for a loan. Alibaba and Tencent, through their application AliPay and WeChat, offered the possibility for millions of users to put the entire personal finance experience at their fingertips for free.

Technology also brings a myriad of new services. Advancement in Machine learning, for example, enhance the possibilities in investment with the use of robot-advisors in asset management or trading. In 2019, the top 5 robot-advisor managed $239bn assets, and the total asset under management by robot advisor was estimated to be $1,44 trillion. Advancement in machine-learning algorithms is now used for credit rating in lending platforms and financial coaching.

As a recap, we have seen why actors were key in fintech because they provided the resources needed for innovation but also created the innovation. Fintech brings convenience, costs reduction, but also performance. We are now able to look forward and analyze the challenges and stake for the future of fintech.

Posted Using LeoFinance

Congratulations @sounexpected! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Vote for us as a witness to get one more badge and upvotes from us with more power!

In the United States mortgage industry, fintech outpaces the traditional enterprises. More mortgages are started by the likes of Quicken then those such as Bank of America.

We will only see more of this in the states as alternative financial products and services take hold.

Posted Using LeoFinance

People, especially in HIVE, deride the Chinese fintech scene because "It's coming for muh libertehs!" But I, quite frankly, love it because I just have so much more free time due to the fact I do have to deal with Big Banks less and less. These days, my money is "liberated" from the Big 4 banks in China and the Bank of America level big boys in the US, where I only have to keep a minimum of cash in there in order to avoid fees. Unfortunately, that is like $1500 for new accounts, which proves my point!

@sounexpected, thank you for supporting the HiveBuzz project by voting for @steemitboard as a witness.

Click on the badge to view your Board of Honor.

Once again, thanks for your support!

Do not miss the last post from @hivebuzz: