For a college master application, I had to write a two pages note on the domain of fintech. I thought it would be interesting to share it here and have some feedback! Enjoy the read.

In March 2019, Apple teased its Apple Card. In June 2019, it was Facebook’s turn to announce the development of its own digital currency Libra. These two companies are far from being banks, but they step in the fintech industry. This year, China and Sweden announced tests for their digital currency, which could lead to the end of fiduciary money in these countries. Fintech is the use of technology to enhance financial services. It can improve payment methods, insurance, how we manage our investments, or how we receive a loan or financing. The fintech domain has known an incredible path of innovation during the last decades, from credit card and bills, we are now able to pay with our smartphone or our smartwatch. Currently, the way the industry will evolve is a hot topic. People are talking about AI, the Blockchain, digital currencies, and how it will change financial services. The question is, how can we understand the future development of the fintech industry? We first need to understand the past of the domain, how it developed through time, and with different conditions. Then we will need to focus on the current fintech markets, the actors, and the services provided. Finally, we will try to assess the various challenges and issues the industry will face.

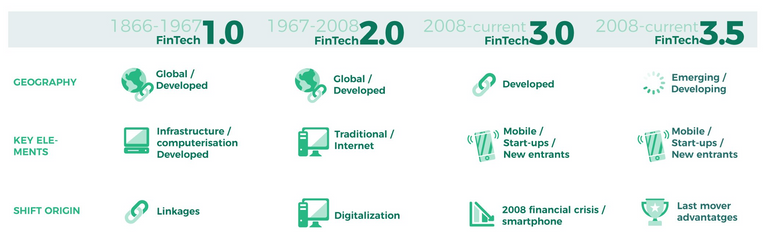

The historical point of view is a perfect start. It will enable us to understand how and why fintech evolved through time. The fintech evolution can be divided into three periods, according to the work of D.W Arner. The first one is fintech 1.0 between 1886 and 1967. It was the age of infrastructure. During this period, the electronic fund transfer system has been developed, the credit card was created (in 1950) and distributed to the world by banks (1958). The second one, fintech 2.0, between 1967 and 2008. It was the age of the internet. This period was rich in innovations, starting with the first ATM in 1967, the creation of the NASDAQ in 1971, the first mobile phone in 1983, and program trading in 1987. More than innovations, the financial crisis influenced the world. The Asian crisis in 1998, the internet bubble burst in 2001, and the Great Depression in 2008. The third period is the current one, from 2008 to today. Arner divided it into two parts, the first one for developed countries, and the second one for developing countries. The current era is the era of new actors and smartphones. These actors used technology to better answer customer financial service’s needs. This analysis gives us an essential key to understand the fintech ecosystem. Technology helped traditional actors in the past to reduce costs and improve efficiency. With the current period, new actors emerged to provide targeted services and focus on customer needs.

With the third period, we will look at how fintech was adopted in different parts of the world. Stakes are not the same everywhere, and we need to see how fintech evolved in different environments. In the EY fintech adoption index 2019, emerging markets lead the world in terms of adoption rate. The Chinese and Indian markets dominate with an 87% adoption rate, followed by South Africa and Russia (82% AR) financial hubs such as Hong Kong, Singapore, and South Korea (67% AR for each). While the adoption rate for financial hubs is pretty obvious, an explanation for emerging countries could be a leap-frog to better technologies. In 2010, India had 0,01 credit cards per capita, and China 0,15. In comparison, in the United States in 2008, this number was 3,5. At the same time, mobile payment started to take-off in 2014 from 5,992,5 billion yuan to 18,884 billion yuan in 2018. Developed countries like the US (46% AR), France (36% AR), and Japan (35% AR) lag due to already existing infrastructure and consumption habits. Fintech adoption differs because countries have missed the previous evolution and leapfrog to more advanced technologies. On the contrary, countries with already existing financial infrastructure will be slower to adopt innovations.

As a conclusion for this first part, I just want to underline what we have seen. First of all, innovation in finance was drive by traditional actors in the past. The outbreak of the internet has accelerated the innovation curve and finally, emerging countries seem to have better adoption rates of fintech due to leapfrog to most recent technologies!

See ya soon for part 2!

Looking forward to part 2

Great recap of what took place and a terrific lead in into what is coming.

Technology is driving so much these days and the financial arena is primed to take a major step forward.

This sector was progressing ahead for the last few decades so the upcoming jump should not be a great surprise.

Posted Using LeoFinance

Thanks! Technology does drive a lot of things and finance is no exception, but other trends will shape the fintech industry such as community-based services or regulation!