Ethereum

...is the second largest cryptocurrency by market cap, and famous throughout the world as being the birthplace of Smart Contracts, the computer code constructs which underlie the biggest thing in cryptocurrency today Decentralized Finance.

Source

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

.

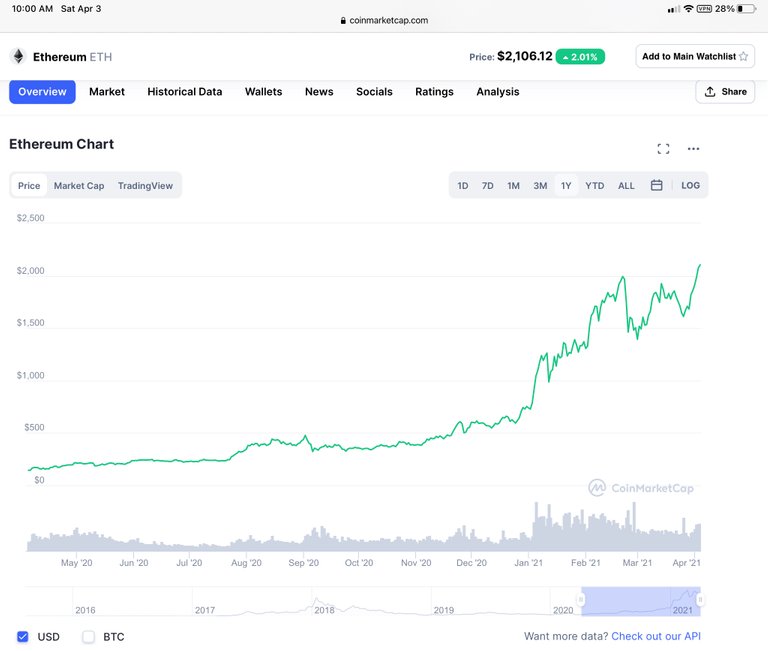

Ethereum recently broke out to $2,160.00 a 20x in a year.

Ethereum’s Chart looks beautiful...

Ethereum problems

Most traders know about Ethereum being a victim of its own success.

Ethereum has the lion’s share of DeFi platforms on it’s blockchain.

But Ethereum has issues with transaction speed, transaction cost and current structure is near transactional capacity.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

.

The Layer One Solution: ETH 2.0

The Famous ETH 2.0, the Ethereum blockchain with Consensus from Proof of Stake, is a departure from the current Proof of Work method of consensus. But it’s currently estimated to be 12-18 months away.

But there is short term help on the way, the second layer solutions.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

.

.

Ethereum Second Layer Solutions

We are familiar with side chains from our experience here with Hive-Engine, and I have written previously about Bitcoin’s famous Sidechain The Lightening Network, which solves Bitcoins issues of low transaction speed, high transaction cost and limited transaction capacity.

The concept is to create a software construct where the transactions can be diverted4 to and where price, speed and capacity are improved. Then transactions diverted to the second layer are brought back to the first layer for settlement, or recording on the blockchains ledger.

Ethereum unlike Bitcoin doesn’t have one second layer solution, it has several, and while you may have not heard of them, they are real, functional and solving real world Ethereum problems.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

A List of Ethereum second layer projects

Connext

xDai Chain

POA Network

Optimism

Synthetix

Fuel

zkSynv

Argent

Loopring

StarkEx

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

That’s a long list, are some of them even working?

Yes.

Optimism

Notable projects: Uniswap, Compound,

zkSync

Notable projects: Curve, Gitcoin, Balancer, Gitcoin and Golem.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions..

What does this mean?

It’s means many things, but the main one is that Ethereum isn’t dying. The So Called Ethereum Killers are going to kill Ethereum. They are perhaps more accurately described as Ethereum Alternatives.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

DeFi is very big.

Today on Bankless Podcast they announced DeFi has 44 Billion in total Value Locked, which means 44 billion dollars US are locked in DeFi Smart Contracts.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

The success of one doesn’t equal failure of another..

I feel the idea that one Blockchain’s success is the other Blockchain’s death is a fallacy.

The truth, I feel, is that the space is big enough for multiple Ethereum-like Networks with Ethereum like components, that can be duplicated and assembled into platforms like Uniswap, Pancake Swap and Cubfinance.

Just like there’s enough room in this space for both a successful Uniswap, a successful PanCakeSwap and now a successful CubFinance.

Certainly like we saw with PanCakeSwap there is some movement of investors from one Network like Ethereum to another like Binance Smart Chain.

But the other big component, I believe is as DeFi grows some of its growth is fueled by new or first time investors coming into both the old and new spaces. We certainly have seen that with CubFinance when many community members entered DeFi for the first time.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

Last Words

Ethereum is here to stay, so is Binance Smart Chain, and we can expect other Ethereum Alternatives to develop in the future. In fact some of Ethereum’s Second Layer solutions will ultimately become separate Blockchain developments beyond or separate from Ethereum. The future of DeFi is very bright, but more importantly very big.

Penned by my hand. @shortsegments

Shortsegments is a writer focused on cryptocurrency, the blockchain, non-fungible digital tokens or NFTs, and decentralized finance, where finance meets technology.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

.

Leofinance, where you can blog or share financial topic content to earn cryptocurrency, as part of a passionate social media community.

Learn more about Leofinance with my Seven Minute Quick overview and QuickStart Earning Guide. Then you can Join for FREE! Signup takes 20 Seconds!

Click Here

.

Posted Using LeoFinance Beta

Even with moving to staking and these second layers I don’t see how it solves the problem it only opens up additional capacity and not that many people are using ETH so the more people that come in they’ll eventually price themsleves out of the chain again

Regarding second layers they still too complicated to use so a lot of people will avoid it until they can be added in a way that’seemless to the user it won’t catch on

I agree that although the second layers provide discounted transaction fees, they are still higher then fees on Binance Smart Chain. So in that sense you are correct.

In fact, one of the second layer solutions may migrate to its own chain to lower those fees further.

The centralized nature of BSC allows them to better control fees charged by the 21 nodes providing blockchains ledger integrity. It’s hard for a decentralized network like Ethereum to compete.

POS on ETH 2.0 should, as you point out, solve transaction speed and capacity issues, but it’s still unclear what the fees are going to look like on that new network, so I agree that we don’t know how much lower the fees will be.

I am waiting to see if the large developer braintrust at Ethereum can solve this through further innovation.

I despise Ethereum right now, I can't do anything for under $80 these past few days. Have a coin I want to unstake, failed once and cost me $50, now I can't find fees under $80 and some hours of the day even as much as $150 or higher.

Posted Using LeoFinance Beta

Optimism is the only reason I haven't sold het my UNI.

Posted Using LeoFinance Beta

That seems wise,

Uniswap is still a popular exchange.

Posted Using LeoFinance Beta

Your optimism is supported by historical performance.

Posted Using LeoFinance Beta

Wow!

I never heard of these ...

I like how this makes sense, your not doing a deep dive, but just enough technical info for me to connect the dots.

Thanks!

Posted Using LeoFinance Beta

Thank you for the compliment.

Posted Using LeoFinance Beta

Yeah, I agree with you.

Posted Using LeoFinance Beta

I think a lot of users are greatly awaiting the new update

The high gas is not tolerated by most

We must wait

Posted Using LeoFinance Beta

True the high cost of transactions has led to plenty of investors migrating to networks like Binance smart chain with lower transaction costs.

Posted Using LeoFinance Beta

Your sentiment is understandable.

Posted Using LeoFinance Beta

This is a nice explanation of these concepts. Thanks

Posted Using LeoFinance Beta

Shared!

🦁💪

Posted Using LeoFinance Beta

!SEOcheck

Posted Using LeoFinance Beta

Title is of good length- Perfect

Permlink is of good length-Perfect

Both headers found - Perfect

Image available-Perfect

Title keywords are used in header-Perfect

Internal link found-Perfect

External link found-Perfect