This is my first post on LeoFinance; I'm just so excited about CubFi that I wanted to post what I learned! So please forgive me if any of the analysis is incorrect.

Wow, I thought, what an insane APR! Beats my 0.05 in Ally Bank. I see these Dens: Why would I want to settle for only 1000% when I could have 2500?!

I had heard about impermanent loss and thought "how bad can it be? It's like, impermanent". So I threw my money into the Farm and was super excited about the CUB I racked up.

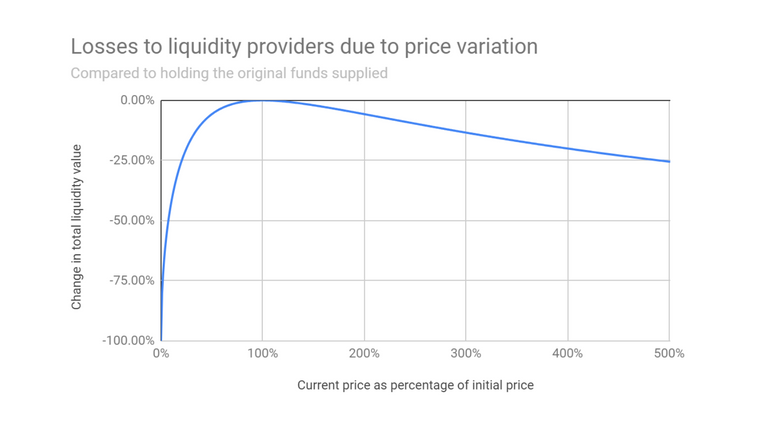

However, I started reading that people were only staking because it's safer. I read about impermanent loss and saw the chart below, which I thought meant that even a 500% gain would only cause a 25% loss, and the over 2x APR must be greater than that, right?!

But is it?

After some more Discord chats with people having more experience than I, I thought I should just see what my gains were doing. So I used the new CUB finance monitoring bot by @deathwing and @rishi556, recorded all the values for an hour, and put them in the spreadsheet. Not very long, but it caught the price of CUB rising and falling, and that's interesting.

My Pool is the CUB-BUSD pool valued at $1,121.

My Den is the CUB valued at $667 👈 nearly half the size!

Sorry about not having the same size; I didn't plan on doing the calculation until after I created the accounts. My calculations were based on percentages, so it shouldn't really matter.

You can see all the data here: https://docs.google.com/spreadsheets/d/1isCxonvExIturEedZwNN6RL1fWcWEu6Hr1pJhRamIeo/edit#gid=0

Please keep in mind this is over a small period with small amounts, but can be extrapolated to larger sets.

Analysis

I expected that when CUB went up in large amounts that it would negatively impact performance. But for small amounts, I expected that this would be offset by the >2x APR.

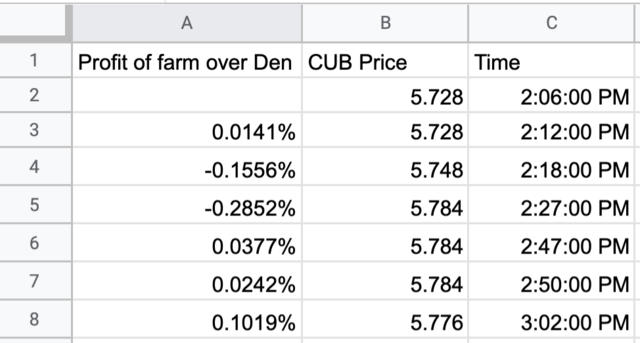

Here are the key columns:

The first column shows the difference between the the profit I made with the Farm vs the profit I made in the Den. The second two are obvious

You see on line 3 with the same CUB price that the Farm outperformed the Den. But then you see between 3 and 4, that only a 2 cent increase in CUB caused a significant difference in the gain. Then from 4 to 5 the near 4 cent increase. Only when the price stays the same or goes down, then I began to see a small improvement in the LP vs the Den.

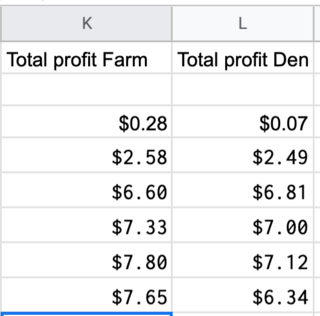

This only struck home when I looked at the totals without percentages:

So Farm slightly outpaced Den. Which is crazy because Farm was nearly 2x the size of Den!

Beware of simple comparisons

That's when I realized that with only small CUB increases (this was less than a 1% increase) would make a big difference in the return.

The 2500% APR is confusing, as it seems to be based on how much CUB you've invested in the LP, not the total value you have invested. And since you must invest 50% CUB and 50% BUSD. So you have to invest twice as much into Farm as the Den.

So it really only makes sense if you desire the hedge of BUSD in your portfolio. And even then, it's likely better to put that in to a separate BUSD den.

Or of course if you think CUB is going to go down or stay the same. But if that's the case, you should question whether investing in a product which pays out in CUB is the best choice for you.

Thanks to the great people at the LeoFinance discord server and CubDeFi telegram channel who tried to explain this to me, but I needed to learn the hard way.

♥️ shawn.

Posted Using LeoFinance Beta

I was a little confused by the complexity of pools so opted for the den instead

Posted Using LeoFinance Beta

Yeah you're not the only one. That's why I wanted to see if it was just complexity and confusion, or if there was a financial reason to not choose the higher APR. I found it.

Nice math. I have also moved my CUBs out of the farm. Maybe a bit too early but I am happy about what I got so far and the den is still producing nicely.

Posted Using LeoFinance Beta

Congratulations @shawnlauzon! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 800 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPwho tried to explain this to me, but I needed to learn the hard way.

Just like I am now 😑

Yep, that's how it always works 😩

Posted Using LeoFinance Beta

I think of it as in the value in the den or pool does not matter. Then considering the incentive for being in either I get a 3x return on being in the pool. Kinda like being paid to take the loss. The pools fuel my den and if I don't put back in the den I change that over to a split on the pools again. However with BUSD-CUB I think I will lose regardless which is why I effectively move some over time into the ones that could go up together like bnb-cub , leo-bnb etc . Still loss but I think a bit less and still great incentive to keep about half of what I have in the pools.

Nice writeup.

Posted Using LeoFinance Beta

Interesting perspective. Are you considering your contribution to the LP as helping the community, rather than doing it to maximize profit? I can't think of another reason you would be invested somewhere you think you will lose regardless.

I am only losing if I look at my LP in isolation.. and fair enough I am quite lazy to track these things but from my first week alone I have been able to fund the Den to equal value of my entire LP. Overall I feel I am earning optimally but definitely at higher risk and I should probably remove my LP on the cub-busd specifically and re-add it at the new "norm" since I added cub at I think $3 ... If I can keep inline with the norm I am personally then reducing my impermanent loss while gaining from the amplified reward... I guess that is how I rationalize it since I don't know the ins and outs of the math or keep track really.

I love a good spreadsheet.

Another way to look at it:

The CUB-BUSD pool has a 40x weight.

The CUB den has a 10x weight.

Looks like a 4x difference.

But you don't need to sell half your CUB in the den. So the effective weight for CUB purposes is 20 to 10, 2x difference. And then you're exposed to the market swings.

Both are great, but which is better really depends on what your expectations for the future are and what you want out of cubdefi.

Posted Using LeoFinance Beta

Do LP providers only earn CUB or some of the Fees?

If so where do you see the Fee earnings?

If not, good to know.

Posted Using LeoFinance Beta

What fees are you referring to?

I know they don't get the deposit fees, as those are burned.

Yeah, the more in CUB, the more you're in market swings. And yikes I've been seeing that recently.

See I don't get it though. My cub creation has been greater then the den so I switched. But you're saying in the long run the Den is better than the farm? I make twice as much in the farm than the den.... so confusing

Posted Using LeoFinance Beta

Given what the price of CUB has been doing, you are doing it exactly right. My analysis was during a time when CUB was mostly rising, and during that time the Den would be better.

In the long run I think Den would be better, but during the bear market we're in, you've made a better decision than me. Now the question is when to get out.

I just moved them all across now. I ended up with an additional 15 CUB when I sold BUSD paired amount for CUB. Not sure if that's because of the drop in value?

Posted Using LeoFinance Beta

Yep, exactly. The value of your CUB must equal the value of the BUSD. Since CUB decreased in value w.r.t BUSD, it needed to sell BUSD to buy CUB to balance it out.

And I hope we're at the bottom now ... considering whether I should buy more CUB now, but I've been doing this the whole way down ... trying to catch a falling knife 🤦♂️

I took a risk and would anticipate that we are at the bottom based on launch price and this is the 3rd time we have hit this low and bounced back up.

I could be wrong and this is all a risk

Posted Using LeoFinance Beta

Interesting, The higher value on the BUSD for sure attracted me to it while the DEN CUB was more of a backup. However after reading this and better understanding DeFI it kind of makes sense to move a bit and better strategies this. From what I hear DeFi matters a lot on timing when you're in the farms.

Posted Using LeoFinance Beta

I'm glad it could be helpful. Yes, timing is super important, and what you think CUB will do.