Markets across Asset Classes experienced a drop earlier this week. Though some were able to bounce back immediately. Trump's inauguration date as US President is on Monday, January 20. I don't think there will be significant market movement on that day mainly due to the inauguration. It's just a formality.

The significant information that the market awaits is on the policies that will be pushed through under the Trump Administration.

1.) Rising Treasury Yields

Some experts expect that the US 10 year note would reach up to 6% by the 3rd quarter this year. The equity market is being pressured as the yield is now approaching 5%. High market interest rates tend to attract fund flows from the equity market to Fixed Income.

2.) Federal Reserve's Stance on Interest Rates

There is also uncertainty regarding whether or not there would be Fed Rate cuts given strong job growth and persistent inflation. It is possible that they may maintain high interest rates longer.

3.) Cross-Border TradePolicies

Trump has been threatening to impose increased tariffs on Canada, China and Mexico to curb illegal immigration and drug smuggling. However, some studies show that this will only result to lower GDP

4.) Crypto friendly

Former SEC chair Gary Gensler under the Biden administration pushed a lot of regulations on the crypto space. His term ends as Trump gets inaugurated. Trump's nominee for SEC chair is Paul Atkins who is seen as a supporter of financial innovations which includes cryptocurrencies. This lessens the regulatory risk of crypto which by design wants to be decentralized.

US Market (S&P500)

Same as what I've shared last week , US market is bound for a correction. It has been trading well beyond the 200 Moving Average mark. Trade the Range.

Philippine Market (PSE)

We finally got confirmation on Monday where PSE is headed. It still remains Bearish. Avoid.

I was hoping it would get another bounce from trendline support; however, this time it breached. Possible dead cat bounce soon, that's why I'll stay away for now until we get to see some strength.

I had to immediately cut loss one of my recent buys (SM) because of the big drop. I bought it when it was consolidating and the Bollinger bands were tightening. However, it was 50/50 whether it will go up or down. So the first time it went pushing the bands downwards, I had to sell. Cutting losses is not easy and requires practice and discipline. Need to remind oneself that having cut loss points is part of risk management.

SM seems fundamentally sound though so I might buy back later. Although only once prices stabilize and at signs of strength will I buy.

Crypto (Bitcoin)

Seems like Bitcoin is trying one more push to breakout resistance. It has been trading within a range since Q4 of last year. Paul Atkins' confirmation by the Senate as SEC chair may be a stronger signal for Bitcoin to be bullish and escape the current box.

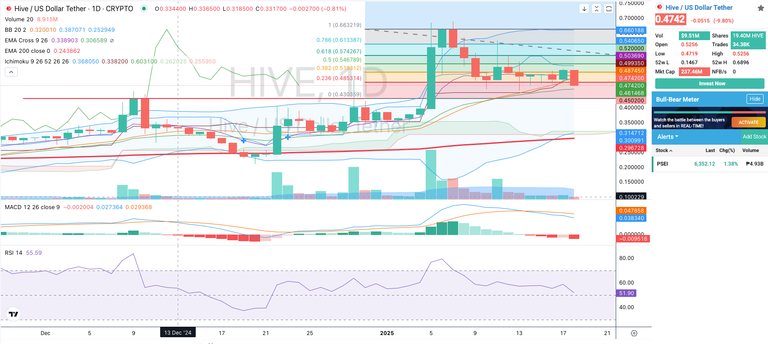

Hive

After the surge of Hive upon entry to new exchanges and the introduction of Futures trading, it has retraced a bit. I like current prices and will be accumulating at such levels especially since I still plan to continuously increase my HP.

In Binance, you can lend your Hive with their Flexible Earn product. It started at around 80% and now dropped to 20%. At current prices, I would send it here until yield dries up.

Long BTC, SOL, PAXG, HP, and HBD!

I have yet to learn about SOL but indeed it's a popular one. Thanks for the PAXG idea, to get exposure to Gold!

Yes Paxos is a very trusted custodial partner and the Gold is held at the London precious metals vault. I feel much better holding the liquid gold than fronting the carrying costs (or safety boxes) on my own.

SOL is the next wave of cheaper/quicker fees and is its own L1 rival ETH blockchain built with sharding vs Polygon's L2 on ETH built with sharding. There are huge memecoin and NFT communities on Solana that have been building all through the bear market due to its lower fees and have driven up SOL's price/demand.