As we are halfway through July, I don’t believe the rental market has played out in the fashion most assumed when the COVID crisis first hit.

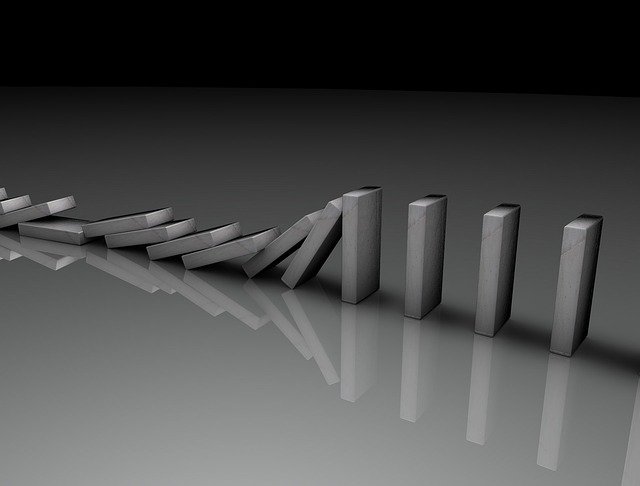

However, there are some key changes coming up that very well could turn the current tide.

The Impact of Unemployment Benefits on Rent Payments

If you ask me a big saving grace for the U.S. rental market was the quick and aggressive unemployment benefits offered to citizens who lost work.

The additional federal benefit of $600 a week coupled with state benefits led to many low income workers making more money while out of a job then when working. This allowed millions to continue paying rent with ease, even while out of a job.

Small Cracks In the Foundation?

Even with the sweeping unemployment benefits, the percentage of rent payments made has declined. It has been marginal thus far, considering 87.6% of tenants paid this month’s rent as of July 13th, according to a Co-Star report. That is only slightly below the 89.1% from a year ago.

Federal Benefits Running Out

As of now the federal benefit (the extra $600 a week) is set to expire at the end of July. If that does occur millions will likely have money to pay their August rent, but what then?

Those living off this inflated unemployment benefit will no longer be able to pay rent so easily. Also, with COVID spiking in states like FL, AZ and CA more shutdowns have happened and could still happen, leading to additional unemployment.

The State of Rental Payments

It isn’t outlandish to assume rental payments for August will be lower than July if federal benefits expire. Many people will be less inclined to pay rent in full now that they won’t get that income anymore.

Then come September many will not financially be able to pay rent even if they wanted too.

We don’t know what unemployment benefits will look like in September or the state of COVID in our society, but there is a real scenario where the percentage of rental payments made takes a large hit.

This is why allocating for vacancies and having reserves is so important. It may not cover everything, but it can be the difference between making through the rough times or not.

Conclusion

And with all that said, I’m still buying rental properties. Buy right, rent right and manage right.

If you don’t know how then check out my videos and do the strategy calls with me.

Posted Using LeoFinance

I didn't know you had education material. I'm in the middle of buying our first home. I will likely take advantage in future.

2008 left a ton of nonperforming notes on the market. I think there will be a similar effect after 2020.

Posted Using LeoFinance

Yes indeed! Education on the external website (I'm also a licensed real estate agent.) I'm going to publish a first time home buyer book (someday) but to be honest the first half of my rental property book is about buying your first home/property. ;-)

Aw. I guess I could cram. We go to the title company on Monday.

Haha, dude you are already at the finish line! Here's wishing a smooth closing on Monday! :-)

People need to live somewhere... more people will be looking to rent when affording to buy a house gets out of reach..Finding a renter with a good job is the key... 😊

Agreed, but if blue states keep extending eviction moratoriums there will be lots of tenants that decide not to pay rent cus they can just squat. And yes, job is key. The latest tenant I had move in is a nurse at a hospital.

👍😊