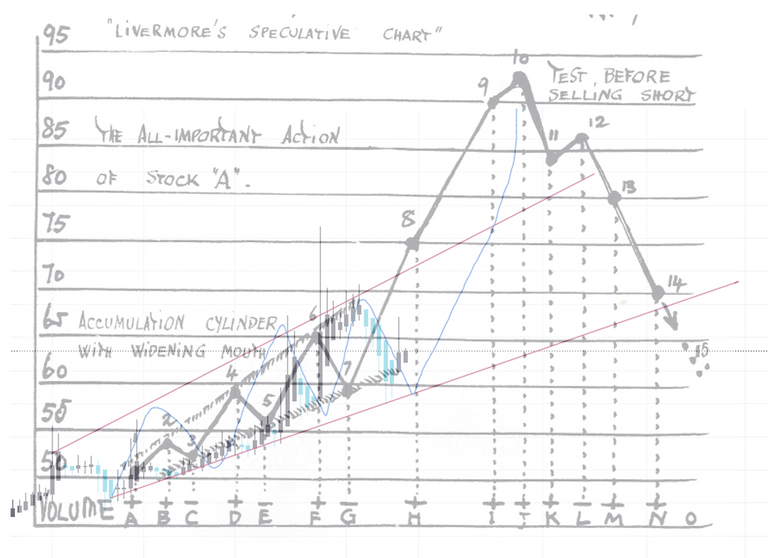

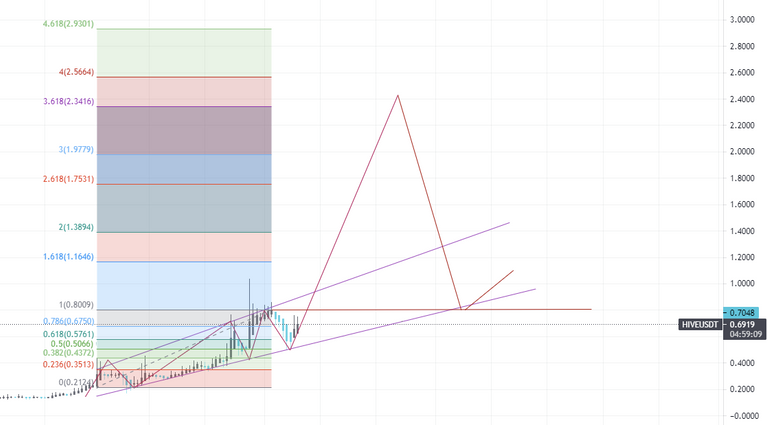

While you may not get much out of these two overlayed charts let me brief you by saying that if Hive finishes this famous pattern, things are about to become very crazy, very fast. Volatility so far is going to be nothing compared to what we might witness in the coming months. Not paying close attention to Hive's possible Livermore's accumulation cylinder will be the demise of many wannabe traders leaving them with minuscule profits after selling way too early while Hive keeps ripping to new All-Time-Highs.

Day in day out.

The volatility will be so brutal that the price action will manipulate your emotional state in order to get you to sell at a very undesirable time.

In turn, this will leave many traders holding value-eroding tethers instead of value-incurring Hive, and just like always, the uninitiated will be left out of massive gains while seasoned vets will flourish trading this well-known pattern, making sick profits on the back of uninformed plebs.

Playing this right will demand balls of steel and laser-focused attention

I'll show you what I mean through a couple of possible scenarios of how this might play out.

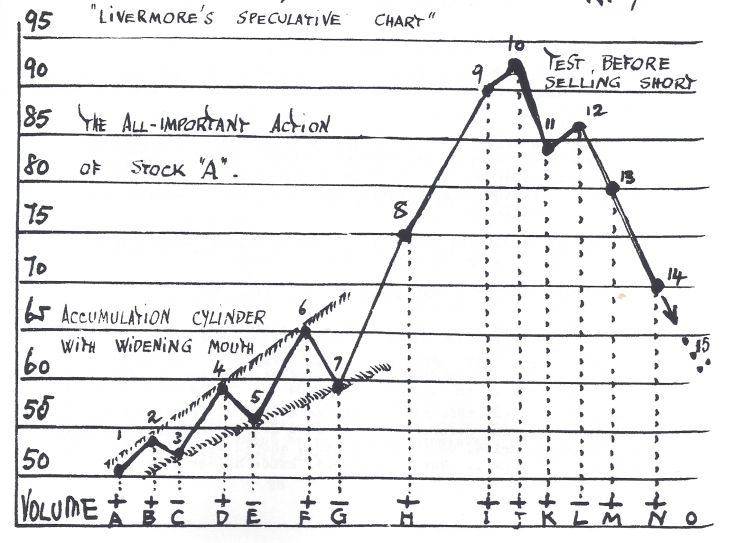

For starters let's establish a direct correlation between Livermore's accumulation cylinder and Hive's recent price action.

The similarity is uncanny.

Pause here for a minute and take some time to study this pattern. Notice how the price first coils up and ranges, over time creating an upwards sloping channel, touching both sides for three times before finally blasting off.

More importantly, take notice of how severe the drop is after topping out.

Now take a look at what our beloved Hive has been doing for the past few months.

I see a perfect Livermore accumulation cylinder here.

It doesn't mean it will play out though, but at this point the chances are higher of it playing out than not.

With this in mind let's see what this means for Hive in the next few weeks to a month.

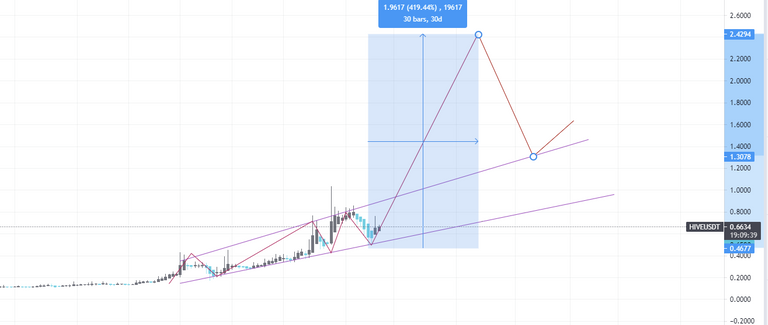

To start off I'll show you a less dramatic outcome first to ease you in

The meatgrinder

- Top targets is anywhere from 1,2$ to 1,8$

- Retrace targets from 80c to 1$

#1 Bounce off key resistance level

#2 Bounce off the top of the channel

A 140-260% pump followed by a 30-55% retracement is, believe it or not, the light version.

After the sudden increase, a heavy downturn is expected with key support levels to watch being either at the top of the channel or at the key currentr key resistance level of 80c.

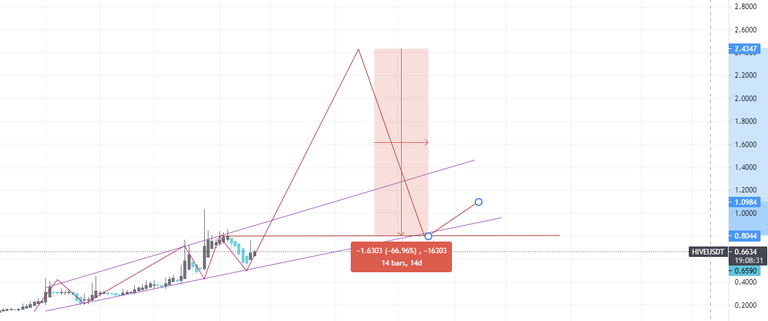

The widowmaker

- Top targets anything in-between 1,8$ and 3 $

- Retrace targets in the range of 80c to 1,8$

#1 Bounce off the top of the channel

#2 Bounce off key support

A 250 - 500% pump followed by a 30-75% crash is the dreaded scenario.

Pure savage. So chaotic. Much devastating. No bueno.

Not sure how Hivers would stomach holding through such an insane move without taking any profit during the uptick in order to pick up more cheap Hive when it inevitably retraces. Missing out on more than 400% gains only to have to watch the price return back to the starting point would be severely devastating.

I'm not willing to leave so much money on the table by simply hodling through such massive price swings.

I'll risk some Hive in a well-thought-out and rational manner to try and snatch 20-60% more tokens than I entered the trade with.

The end goal is still intact, to acquire and accumulate as much Hive as possible.

This market structure (if it plays out) will be one of the most profitable opportunities to substantially increase our holdings and I'm not going to let this go by without participating.

The way I'm going to play this is

- Put aside as much as 10k Hive for this trade

- Incrementally sell at crucial fib levels 5 to 10% at a time (increasing the amount sold as price increases)

- Hold profits in $USDT until a major correction occurs

- Incrementally buy back in 5 to 10% at a time, again at crucial fib levels (increasing the amount bought as price decreases)

By selling at pre-determined price points, I plan to achieve a high average sell price and eliminate the chances of selling too early.

Price targets

- 1,15$

- 1,39$

- 1,74$

- 1,97$

- 2,32$

- 2,56$

- 2,9$

Target average sell = 2,5$

Target average buyback = anywhere from 0,8 to 1,5$ would make me an extremely happy camper

= GG or it keeps pumping way above where I can buy back in at a cheaper price

The worst possible scenario that could I can see happening is that I end up selling at a 2,5$ average and Hive reaches 5$.

In that case, I'd just sell more to increase my average sell price.

Either way, I'll probably end up selling at a fairly decent price (higher than most traders who sell large chunks at a time while not getting lucky enough to sell the absolute top) and I still got more than 40k powered up so it's a GG for me anyway.

As soon as we see signs of a blow-off-top, I'll stop selling and start easing back in to finish this play with a lot more Hive than I started with.

Making gains during times of Giga volatility can only be made possible by selling a few percentages (of the entire amount you want to sell) at a time.

Figure out the best take-profit price targets straight and stand by them.

Don't keep increasing the ceiling as the price keeps going up because you will inevitably have to hodl through a 50% correction.

As with all of my technical analysis posts

This post is not meant to constitute trading advice and should only be considered as an entertainment piece portraying my crazy thoughts and ideas about the market. It goes to show how I'm going to play this move but should not be considered as trading advice on what you should do with your bags. So don't come crying back to me because you've made a lousy decision following a random anon on the internet and don't come back praising me if it makes you money.

I don't deserve the credit both ways, it's all on you.

I love a good TA strategy and DCA is a very safe one at that. It's all about to blow, so being prepared is the secret.

Posted Using LeoFinance Beta

DCA truly is a traders best friend. It takes so much guesswork out of the equation and makes it a lot easier to acquire a better entry.

Who is not ready?

I am ready.

Posted Using LeoFinance Beta

The weak-handed among us which is a category that I'm certain you don't fall into :D

What is the time frame here?

Posted Using LeoFinance Beta

It could take as long as it took us to get from point 1 to 7 so about two months max.

Although I wouldn't be surprised to see this happen much quicker as we've recently seen how incredibly fast Hive can run when it really wants to run.

I'd love to see big time priced Hive, but I'd also like more time to accumulate! Such a trade off

Posted Using LeoFinance Beta

We're way past the accumulation phase at this point.

We literally had close to a year to fill our bags.

Now is the time to start thinking about materializing some profits and/or flipping from Hive to USD in order to snatch a profit during these times of extreme volatility.

I just joined in December! I wish I had a year to accumulate. Good points raised though, I don't know that I want to sell much but I'd like to be responsible with my funds.

Posted Using LeoFinance Beta

can be also much higher.

We are early, we should not forget :)

Posted Using LeoFinance Beta

It will definitely go further til the end of the bull run but not much higher than 3$ in this move imho.

sure everything is possible.

Compare to steem, we are again behind. I don't know it because of the weakness of holders or shorts and bad marketing?

Because hive has a lower supply as steem with the DAO fund + the stabilizer.

And price is around 50%.

Rest assured that Hive's unsatisfactory performance compared to Steem has nothing to do with fundamentals. We know for a fact that the former is fundamentally light-years ahead of the latter but the price doesn't show it.

There is a direct correlation between their price movements though and it can be clearly observed by overlaying the two charts.

The only difference is that Hive moves more dramatically.

For a long while I've had a suspicion that there is a certain someone or a group of people who don't want to see Hive prosper more than Steem and it might turn out to be true.

Just look at the chart. Every single time Hive has a signifficant pump the price is instantly crashed by 30-60% while when Steem pumps, it doesn't dump as much.

In turn this makes Steem stay above Hive and makes it look like there is more interest in Steem than Hive which couldn't be further from the truth.

Imho it's just Sun's crooked marketing technique to entrap noobs into a valueless shitcoin.

This can't go on forever.

I agree with this 100%.

But I would also think, steem holders ( special korean old ones) not retards.

I think at some point they flip ( or do already) for hive. They like the technology.

If you compare the exchange rates steem/hive. It bounces most time from 1.7 to 1,0. It's very interesting. There are good trades were made, besides this, it shows as a huge buy opportunity every time steem overperform.

And with this in mind + all dapps are on hive +ü active development, I think it can be a mega year for hive.

And even more interesting IMO, pump for steem and hive always start on Korean exchanges.

Think about it, that shows the market is still very very little. Demand can become global at some point :)

We should IMO build a closer connection again to the Korean community.

Steem is the ultimate Hive miner :)

Milk milk milk

Posted Using LeoFinance Beta

2021 is definitely the year for Hive to shine!

Korea pump is indicative of last cycle repeat as that's exactly where the money flown into Steem when it went to 8$ last bull run. I expect a reapeat for both Steem and Hive plus an aditional few X's from last ATH.

I agree, this space is so little it has tremendous upside potential growth which we're going to materialize with our collective efforts throughout the years.