Two of the best performing macro hedge funds of recent weeks have a tip for investors: buying the dip in stocks may not work this time.

“This could become a textbook bull trap: the market rallies, you think it’s over, mommy and daddy are going to intervene,” said Parrilla, referring to central banks and governments. “If this doesn’t really play out, it’s game over.” His $250 million Quadriga Igneo fund surged about 10% last month.

This time around, the stimulus could prove impotent. Haidar Capital Management’s Said Haidar expects the spread of the virus, which has so far infected more than 90,000 people and killed over 3,100, to drag out. Efforts to contain it are having a serious negative effect on economies around the globe and central banks’ easing won’t turn them around, he says.

Switzerland reported its first death from the virus and the virus continues to infect people in Italy and South Korea to the point that Italy has closed schools until March 15.

U.S. airline stocks continue to decline big time shortly. The fears surrounding the virus is lowering demand for flights and disrupting airlines’ flight schedules around the world. According to the International Air Transport Association, airlines could lose as much as $113 billion in revenue worldwide in 2020, if the spread of the virus persists.

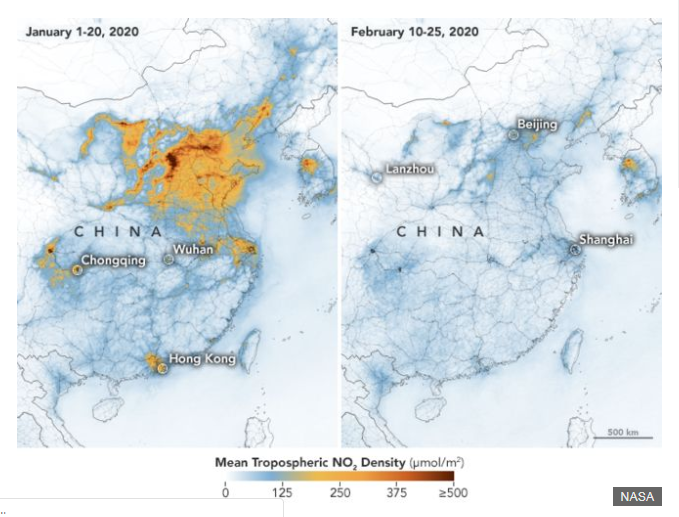

So is there any hope for the equity markets? The other day I talked about the pollution in China. China consumes almost as much coal annually as all other countries combined, and is the biggest source of both air pollution and Chinese cities are among the most polluted in the world emitting tons of nitrogen oxide into the air.

However, since the virus outbreak in Wuhan, China’s air as a whole has been the cleanest since the Great Recession.

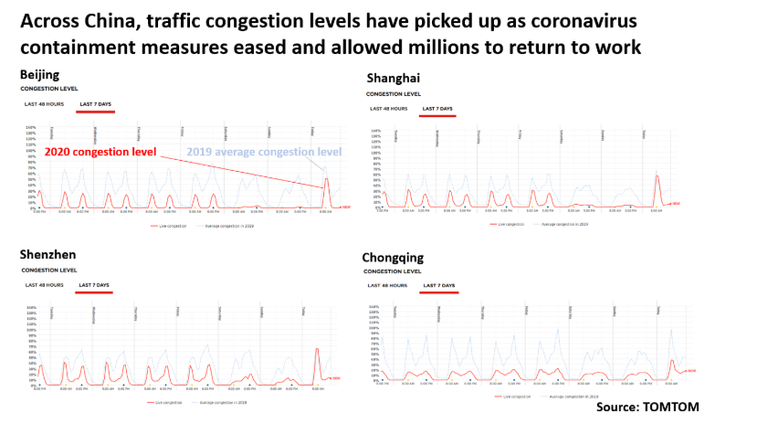

Well pollution, air travel and traffic are increasing again. Satellite data now shows that the amount of nitrogen dioxide polluting China's atmosphere has jumped by nearly 50 per cent since mid-February, according to the Centre for Research on Energy and Clean Air.

iShares MSCI China ETF (MCHI) is an ETF that seeks to track the investment results of the MSCI China Index. The index is a free float-adjusted market capitalization-weighted index designed to measure the performance of equity securities in the top 85% in market capitalization of the Chinese equity securities markets. And while the US equity markets are attempting to form a bottom, the MCHI appears to have already bottomed, indicating a low on the equity markets in China are in.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo

I have already bought some STEEM for the occasion of both the COV and the TRON Drama.

Posted via Steemleo

great inisghts,thanks for sharing this good info...@rollandthomas

Posted via Steemleo

my pleasure @iamgre

Posted via Steemleo