The novel coronavirus has killed more than 3,100 people worldwide, the vast majority in mainland China. There have been more than 85,000 global cases, with infections on every continent except Antarctica.

Italian officials announced Sunday that the number of positive cases of coronavirus is now at 1,694, including 806 additional cases on Sunday. In addition, over 30 people have infected in Italy have died.

Over the weekend a man in the Washington state died from the virus and then within 24 hrs, a second death occurred in the Seattle area. I grew up in New York City and it was just a matter of time before the virus hit the Big Apple. New York State’s first case of the virus is a woman, who got the virus while traveling in Iran and is now in New York isolated in her home.

We also received our first reported case in Dominican Republic and Scotland. I see why COVID-19 has spread so fast, let me tell you about what’s going on in South Korea.

Last week, in the city of Daegu, South Korea had at least 30 people infected. South Korea’s government raised the COVID-19 alert to its highest level after the number of people infected exploded to 602 two days later. But lets talk about the 31st case in Daegu, a city about 150 miles south of the capital where the vast majority of known infections were located. An unidentified 61-year-old woman, who lived there and occasionally commuted to Seoul, tested positive. The previous 10 days, the woman attended two worship services with at least 1,000 other members. Several days later the number of people inflected was over 1,000 in which at least half of the new cases were linked to the two services the woman attended.

Late last week, Goldman Sachs said U.S. companies will see profits stagnate in 2020 thanks to the spread of the coronavirus. Goldman said they see a severe decline in Chinese economic activity in the first quarter, lower demand for U.S. exporters, supply chain disruptions and a slowdown in domestic economic activity.

A private survey showed China’s manufacturing activity slumped in February, as the coronavirus outbreak hit the world’s second largest economy.

On Monday, the Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) came in at 40.3 for February — the lowest reading since the survey was launched in early 2004.

“China’s manufacturing economy was impacted by the epidemic last month,” said Zhengsheng Zhong, chief economist at CEBM Group, a Caixin subsidiary. “The supply and demand sides both weakened, supply chains became stagnant, and there was a big backlog of previous orders,” he said in a press release.

On Monday, the Dow closed 1,293.96 points higher or 5.1%, it biggest percentage gain since 2009. The S&P 500 was up 4.6%, its best one-day performance since Dec of 2018. The Nasdaq also surged more than 4%. However, this means nothing to me, although I went long on the Nasdaq on Friday through options.

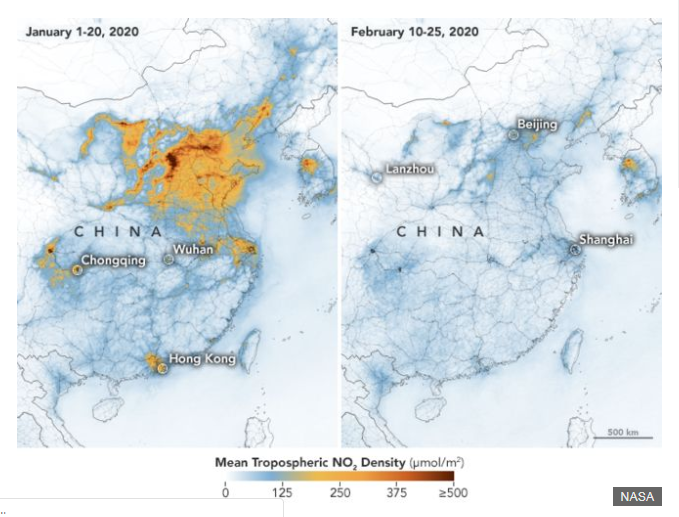

China consumes almost as much coal annually as all other countries combined, and is the biggest source of both air pollution and Chinese cities are among the most polluted in the world emitting tons of nitrogen oxide into the air.

However, since the virus outbreak in Wuhan, China’s air as a whole has been the cleanest since the Great Recession.

So have we reached a bottom, I don't know, but if China’s air gets dirty again, I would say the rally we saw today is real.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo

Calling a bottom is one of the toughest things in the world. This is going to be a massive buying opportunity when it eventually does end. However, it might be some time for the market since we will get a lot of earnings in Q2 telling us how bad Q1 was.

Count on the media to keep this one going.

Posted via Steemleo

@taskmaster4450le yeah you are correct,and i also feel sad with the way the media can sometimes promote a kind of market manipulation......and also no one knows the exact time when the bearish trend will end...

Posted via Steemleo

@taskmaster4450le yeah you are correct,and i also feel sad with the way the media can sometimes promote a kind of market manipulation......and also no one knows the exact time when the bearish trend will end...

Posted via Steemleo

There will be a lot of volatility over the next several weeks...so hold on for dear life.

Posted via Steemleo

for now no one can be certain if this is the right time to buy because the market might still dip further,so one should just keep his or her fingers crossed until the turmoil is over...@rollandthomas

Posted via Steemleo

Intermarket analysis is needed during these times, look for bonds prices to go down, then stocks will rise.

Posted via Steemleo

great idea

Posted via Steemleo