It was a pretty exciting April and early to mid May, enjoying the relatively stable crypto highs and the insane DEFI yields, but this recent 30% dip has made me appreciate my stables and my Hive and LEO.

This is because crypto can suffer from not only 30% dips, but also 50% and 90% (remember December 2018), and if that crypto is staked in DEFI the yields are likely to follow suit, given that yields are paid in crypto!

So crypto staked in DEFI can suffer from a double dip whammy - declining percentage yields on declining capital value.

However, with Stables staked in DEFI you can only suffer yield reduction not capital depreciation (assuming stables don't go tits up) and with Hive and Leo you can only suffer capital depreciation not yield reduction, because you always yield at 12% or there abouts.

Below I've tried to compare the three....

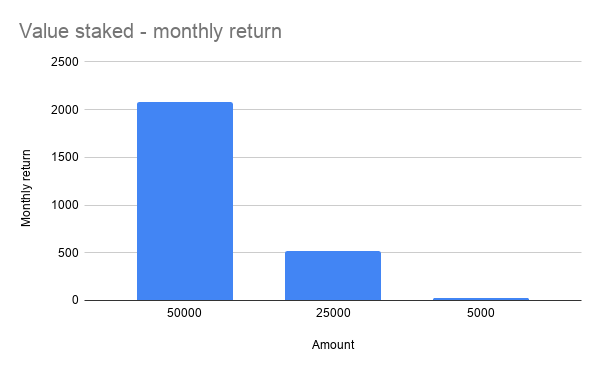

Dodgy DEFI Crypto....

Below I've imagined a scenario in which you have an initial $50Ks worth of crypto staked in DEFI with a 50% yield, which is (conservatively reflective) of what many of us have been enjoying recently.

Then I've imagined two further scenarios:

- A mild crash - in which there is a 50% reduction in the value of that staked crypto to $25K and a corresponding reduction in yield to 25%, and then...

- A severe crash- a 90% reduction to $5K and a corresponding reduction in yield to 5%.

The results are charted below:

- $50K @ 50% yield = $25K a year, or around $2K a month

- $25K @ 25% yield = $6250 a year, or $520 a month

- $5K @ 5% yield - $250 a year, or $21 a month

So today (or at least three days ago?) that $50K stake was earning you a living wage, a 50% dual crash (in value and yield) turns this into a second income, and a full on dual 90% crash turns that into one Dominos a month.

A severe crash here means you're 100 times worse off than when you started!

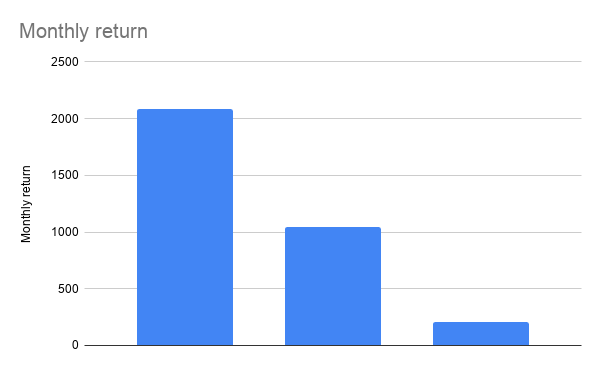

Stable Returns with declining Yields - Better Protection!

If you had $50K of Stables stacked then if yields dropped from 50% to 25% to 5%, you'd be A LOT more protected and end up with the following:

- $50K @ 50% yield = $25K a year, or around $2K a month

- $25K @ 25% yield = $12.5K a year, or $1000 a month

- $5K @ 5% yield - $2.5k a year, or $200 a month

Given that the values of stables can't fall, even a 5% return ends up being a reasonable second income, and even with a 25% crash you've got a 'survival' income.

A Severe crash here means you're only 10 times off worse than when your started!

NB these stats are the same if we assume the reduction in crypto value and stable DEFI yields, but that's unlikely given that yields are generally paid out in crypto!.

Hive/ Leo with declining values and stable 12% yield

Here we start off with relatively lower returns and the returns and once again the returns only decrease by 10 times if we assume a 10 times drop in value, or 90% reduction.

.png)

- $50K @ 12% yield = $6000K a year, or around $500 a month

- $50K @ 12% yield = $3000K a year, or $250 a month

- $50K @ 12% yield - $600 a year, or $50 a month

Final Thoughts

Of course if yer only sticking to stables and hive/ Leo you're less likely to enjoy the potential upsides of other cryptos and, if you're a DEFI degen, you could miss out on returns even better than 50%.

However, being Vested in stables and Hive/ Leo does offer better protection against a downside.

My own personal strategy is to have a mix of cryptos and stables in Defi project, naturally.

One final thought is this: why am I so heavily Vest in Hive and Leo, the returns are TERRIBLE!

Someone give me a rational pill!

Posted Using LeoFinance Beta

how does the math on the stabels yield work if the staked is same 50k with 12% yield, how does it drop in your rxperiment?

am i missing something?

Posted Using LeoFinance Beta

Ah well spotted, typos, I just correct to 50/25/5 !

Posted Using LeoFinance Beta

There is such massive potential in DeFi and the unique variations of each coming out. Still a long way to go and super high risk if you don't do at least a little research. But with that comes some seriously amazing rewards and earnings that can skyrocket you into financial freedom even faster.

I'm starting to mix up a little myself such as you I was 100% crypto with no stable but I'm starting to move partial into stable and playing around with moving them into various projects. ETH still has high fees though so primarily been in BNB lately for such projects.

Posted Using LeoFinance Beta

This is the safer play especially with all your dollars 💸! You rich man 😂

Posted Using LeoFinance Beta

I do regard DEFI as risky, less so with stables, and less so with ETH.

At some point I will move a portion of my stables stake to ETH network, I think it's more secure, albeit with a lower return!

Posted Using LeoFinance Beta

lol on the last statement. Investing in hive is pretty illogical as the hope for long term rewards is not something they advice in trading school; but there's just something downright compelling about this platform that attracts. We all feel it

Yes it's true, always a pleasure, never a chore here on HIve!

Posted Using LeoFinance Beta

Because you've already taken the Hopium pill! 😂

and . . . it's not all about the money.

Posted Using LeoFinance Beta

Yup, $5 Hive - right around the corner!

Posted Using LeoFinance Beta

I am just more bullish on HIVE and LEO long-term but your math really does show how much you lose when things crash in Defi. But those stable coin returns look quite neat since they should probably lose 10% at most. However they could always rug pull you since most of the stable coins tend to be centralized.

Posted Using LeoFinance Beta

DAI is not centralized.

Posted Using LeoFinance Beta

Indeed but to get these returns even on DAI you have to put them in some centralized / contract risk platform.

Thorchain would be one of the only one where I believe you keep control of your assets the entire way.

But there are other network risks.

Posted Using LeoFinance Beta

Thorchain is definitely a step forward in this.

You can pool either USDT or BUSD on Thorchain.

Posted Using LeoFinance Beta

But with RUNE on the other side right? So there is a volatility risk right?

or Can you do USDT-BUSD Pool

Posted Using LeoFinance Beta

No everything has to be pooled with Rune.

Posted Using LeoFinance Beta

Thanks for letting me know. I haven't researched stable coins as much since there are just way too many out there.

Posted Using LeoFinance Beta

Trust me I am VERY AWARE of the risks with stable coins - I'm diversified across BUSD/ USDT/ DAI AND USDC because of this!

Posted Using LeoFinance Beta

We must have been on the same wave-length, because just about two weeks ago I moved all of my stuff on Cub out of the other farms and put it all into the BUSD-CUB farm. I am going to chalk it up to luck more than anything. Now I just let it sit there collecting CUB and wait for things to turn around! I like the idea of holding more stable stuff as I start making some more gains.

Posted Using LeoFinance Beta

If you can get in at the bottom it's a good pool to be in! Risky though.

However the Cub Price does seem OK ATM

Posted Using LeoFinance Beta

Oh, I got in at $3 or so, so I am down right now...

Damn, $3 sounds expensive now!

Still if the APYs hold up you'll still be in profit eventually.

Posted Using LeoFinance Beta

Yeah same...

Someone give me a rational pill!

Lol

I’m here for the replies to this.

Posted Using LeoFinance Beta

Rational is SO overrated 😂

Degen is more fun but it will make you poor 😱

Posted Using LeoFinance Beta

Could, not will!

Posted Using LeoFinance Beta

Well I say terrible, but that's only based on curation and comparing that to DEFI yields and every other coin pumping while HIVE doesn't.

If you're 'in' the writing rewards can be great too!

Posted Using LeoFinance Beta

A bit of stake in a few tokens like Hive, a little activity in posting and voting etc and, the return can be pretty good for many people even in the bear markets, though it does take work. Ironically, if more people did this, the price would improve and even more could be supported :D

I don't have any in stable pools at the moment, but I do have BNB and BTC in single sides. If they collapse to the 5% mark, I will still get a few drips coming in until the next bull. If they build businesses on the pools in that bear market to generate value, more will be generated, even in a bear cycle.

Posted Using LeoFinance Beta

You know I just feel like Hive and all the tribes is a 'real return' - it just kind of goes on working and people keep on earning, it's not dramatic, just steady.

I think DEFI is the place to be whether you're in stables or cryptos (I kind of see Stables as 'fiat in waiting' - the returns on some of the farms/ pools is pretty good too.

I'm tempted by more BNB, less so BTC, I mean what's the point of the later, after all!?

Posted Using LeoFinance Beta

Isn't this what you want in a long-term investment? It is a sleeping giant - if it ever wakes up is the question.

I have a bit of both, but I think I should starting expanding into a bit of eth too and, some stables.

I'm more tempted by ETH rather than BTC.

RUNE is cheap atm too.

Posted Using LeoFinance Beta

Nice work!

It will be interesting to look at the data on Defi farms at some point to see the interaction between the APR (income) and the capital gains / losses.

There are farms out there paying high APR but the income rewards are in the underlying assets and the prices seem to be drifting down over time, probably as those rewards are sold.

So users may end up gaining income but building up capital losses.

Will these farms outperform farms with lower APR once gains / losses are taken into account? Who knows!

Ideal situation may be high yielding farms just after a price crash. I've put some in over the last couple of days on this basis. Although they could easily just drop again. No guarantees with this stuff!

Posted Using LeoFinance Beta

It's all so dame risky.

Most of my stake is paid out purely in Cub/ Panther/ Cake, they're the platforms I'm in and I just sell all the yield every three days (I've earmarked Weds and Sat for managing DEFI yields) and mostly for stables ATM.

Occasionally I might compound the Cub or Cake.

I make a point of not holding too many DEFI tokens - I've got some Cub and Cake but that's it - in pools not farms - they offer great returns, but that is a risk!

There is a lot to consider when calculating returns - I generally go for single pools, I figure I'm holding that money anyway so it may as well yield.

Rune on BEP is different, that pays out in the paired assets, one of which is always Rune, they've got a nice tracking tool though so it's easy. I'm not looking at it again until the prices recover though!

Posted Using LeoFinance Beta

I know this is just a simple exercise and doing what I'm thinking is probably a lot more work, but it would be interesting over a 10 year period which way you'd come out better if you sold all your cub and reinvested in said pools.

For instance, sold all your cub once a month and reinvested ins table pools, or sold half your cub and reinvested in the cub stable pool, assuming every 4 years cub set a new high and then crashed back down during the bear market. I would assume stables may perform better, but that just depends (I would think) how high cub value went each bull market.

Posted Using LeoFinance Beta

I guess that's what I'm interested in, what's the performance after 5 or even 10 years!

I'm sure it can't be that difficult to make a little model based on historical prices.

Could be a depressing look back!

Posted Using LeoFinance Beta

Investing in these tokens does seem like a fantastic way to hedge against market dips

Posted Using LeoFinance Beta

I'm currently agonising over where my next DEFI yields go to - more stables or take advantage of these low crypto prices now?

I'm tempted to wait, there's still a lot a volatility in the air, stables, and a reasonable yield, works for me!

Posted Using LeoFinance Beta

I hope whatever you decide on goes well for you, if prices bounce back it’ll be hard to be wrong here

Posted Using LeoFinance Beta

Because...

Ah who am I kidding, I've got nothing.

Posted Using LeoFinance Beta

It makes sense for me to have a balance of everything. I only play high-risk games if I can afford to. Also with Hive & Leo, you can earn more during the bear and later on enjoy the token price appreciation during the bull.

Posted Using LeoFinance Beta

Yes fair point, although TBH I haven't seen that much more activity here during the bull, so my earnings are similar in Hive terms to back this time last year!

Posted Using LeoFinance Beta

What Defi projects are you suggesting to look into?

Posted Using LeoFinance Beta

I'm mainly in Cub, but also Pantherswap, some in Bunny, some in Pancake, and, of course, BEPSWAP (Rune)

Posted Using LeoFinance Beta

And what price would you like the leo and hive to be stable?

Posted Using LeoFinance Beta

Thé most important is that you are sleeping well at night.

So choose your risk level accordingly 😉.

I guess you are a bit risk averse and therefore you like our blogging coins and stables 🙌

Posted Using LeoFinance Beta

Your post was promoted by @finguru

Congratulations @revisesociology! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next payout target is 41000 HP.

The unit is Hive Power equivalent because your rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

There are farms out there paying high APR but the income rewards are in the underlying assets and the prices seem to be drifting down over time, probably as those rewards are sold. Will these farms outperform farms with lower APR once gains

Posted Using LeoFinance Beta

Only time will tell I guess - it doesn't really apply to me as I don't hold the tokens I earn, except Cub, I sell every few days for stables, so whether DEFI token A yielding at 10% appreciates 1000% over the next months and thus would be better than DEFI token B yielding at 200% but with a declining value makes no difference to me!

Because I just sell for stables as I go it's the yield now that i'm interested in!