I've currently got most of my stables staked on two Polygon Platforms - Adamant Finance and Polycat Finance, both yield aggregators.

I'm in the UST-DAI pool on Adamant for a current 30% return which is FANTASTIC on a pure stable-pool and a much lower return on Polycat as I've opted for the 'safe' single USDC pool on Aave which autocompounds - so it's EASY!

However I'm going to move my Adamant funds out because although the returns are good I've had enough of the 3 month addy lock. I'd rather just farm and sell every week or autocompound.

Rather than just put this money into the rather low return Aave vault I thought I'd dig around and see what my options are for staking on Polygon.

I'm interested in the following:

- Any pure stable vaults or pools involving USDC/ DAI (UST I've decided to put on the Terra network for a straight 20% return, but more of that later).

- Matic with a stable pool. I'm prepared to put 25% of my stables in these mixed-pools. I've also got some Matic kicking around doing nothing ATM!

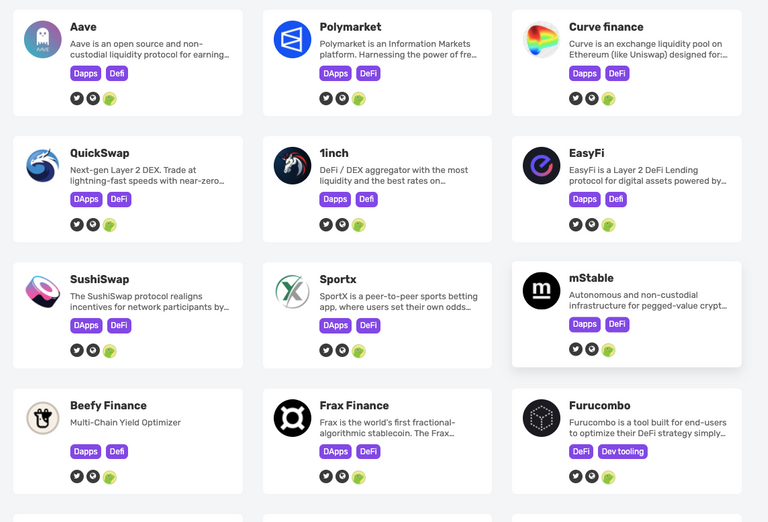

I used DefiLama to explore some of the DEFI apps on Polygon, as it ranks platforms by TVL, and I've focussed below mainly on the more established ones I'm familiar with.

I also used 'Awesome Polygon' to randomly pick a few other platforms I've never heard of!

What can you Earn on Polygon Stable and Stable-Matic pools...?

I had to check out just pure Aave as it's the largest my TVL, but this only gives me the option of a 6% return on USDC, although I currently get a better return via Polycat finance yield aggregator, which is OK for a very sensible safe sit.

AutoFarm which is very well established on both BSC and on Polygon gives me a range of single pools and stable pools at around the 10% return mark, but also a matic-usdc pool option at nearly 40%.

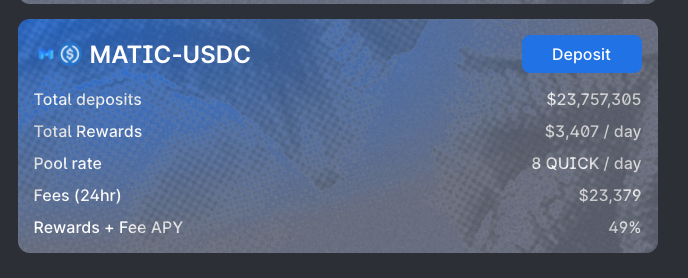

QuickSwap stable pools offer me a similar return to the above, and a 50% return on Matic-USDC:

And an impressive return on BNB-USDC, THAT is appealing but part of the reason I'm exploring Polygon is to diversify out of BNB, and besides I will probably be putting quite a lot of SPS-BNB into that pool over on BSC, otherwise I'd consider this:

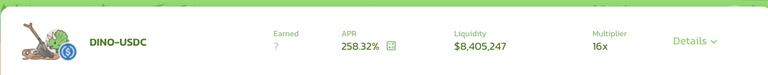

DinoSwap is something I've heard mentioned in the LEO Discord, not too much on offer in the way of stable pools except a 20% return on USDC-UST which is OK, and I find this > 200 % return on Dino-USDC appealing, but I'd need to research the token release schedule more before piling into it...

I did check out a few other options, such as Moon Finance (how could I resist with that name?!?) but there was nothing too appealing there, or any of the other lower TVL options I explored.

Besides, I'm done with fishing around for the next 'declining value defi coin' I'd rather be in pools on well established platforms with more stable defi coins to farm.

Final thoughts....

So far, Quick Swap is going to get my money, it's well-established and offers a decent range of safe returns, although I'll probably see if I can get a boost from a Yield Aggregator too.

Posted Using LeoFinance Beta

Thanks for sharing this information.

I will have a look into this.

It is going to be interesting to watch the stablecoin market as the regulators start to hone in.

Will it radically change things?

Posted Using LeoFinance Beta

I'm not sure TBH. I do avoid USDT - I'm actually reducing my stake in 4Belt on Cub because that's one of the elements.

Also I'm lowering the amount of stables I was thinking of holding, I may as well just cash out instead.

I can't imagine the regulators will be able to touch the pure crypto stables - like UST for example - the one's that are supposed to be backed with fiat assets are going to be their targets I guess.

Have you checked the Iron stables?

I did't - i just remember that HACK a while back and avoided it.

Are they any good?

Anything over a 30% return is kicking it in stables land, but I'm happy with some in at 10% and most around 15-20.

Yea there was the hack, I'm into it now and autocompounding on adamant. Not sure what the apr is now ... need to check :)

There's better offers our there aren't there?!?

Yes :)

Although ICE price is going up and down a lot, changing the APR all the time.

I might rebalance soon.

I entered the anchor app on terra with small 500$ amount to test it, still cant see rewards after few days :)

Now I screenshot it to see how exactly it works. If I see its 20%, then I might move bigger position there.

Although terra has around 0.5$ fee on each tx

OK That's all worth knowing - I don't so much mind that fee but it's worth knowing that it's larger amounts only to be moved around.

Have you used DinoSwap I'm thinking that looks interesting on Polygon!

Btw I moved the stables from matic to anchor on terra :)

Nice, I have some polygon sitting in a wallet not working, thanks for some ideas on where to stake it.

Posted Using LeoFinance Beta

I think the better established ones are likely to be the more secure!

Agreed! Thanks

Every time I read one of your posts talking about Polygon, I feel the urge to get in. But then I decide to wait till Polycub so I can get on through a service I am familar with and am already highly invested in. But then Polycub doesn't come yet, and you post about Polygon again, and I get tempted again.

Ahhh... the dangers of being indecisive.

It's very easy to use honestly, similar to BSC. You just need to add it to metamask to get started.

I started with Polycat.

So comfortable doing almost nothing on Adamant. Maybe I should start looking for alternatives too, as we approach the bear market and locking is not what we need through that.

Yes I DON'T want to be locked in for three months!

PIZZA Holders sent $PIZZA tips in this post's comments:

@revisesociology(2/20) tipped @dalz (x1)

Learn more at https://hive.pizza.

Hello revisesociology,

Would love to talk to you about the articles you have been writing. We are looking for a DeFi content writer for our website. If you are interested, send me a DM on twitter @MosDefi.

Posted Using LeoFinance Beta

Hey cheers, I will do !

Interesting, are you preppinig for the bear market by moving profits into stables or are you a stable coin investor primarily ? They seem to be very safe investments on yield farms, as long as the projects are safe.

I never heard of Admant so I will check it out.

Thanks

If something goes into stables I kind of see that as 'taking profit' - they are just waiting to be cashed out whenever.

For tax purposes I cash out less than £12K a year because that's the capital gains threshold! So most of my stables are sitting there, waiting for the next cash year, or the next and so on....

Really,, up to £12,000 pounds!

I think that’s $24,000 to $25,000 USD.

That’s am amazing tax break!

If only we had that in the US! 🙏

i think it's a bit less unless the dollar really is deflating that much? I thought it was nearer $19!

I'm not primarily a stable coin investor btw, I just have around 5-10% in stables, of the crypto portfolio, the returns are OK on some yield farms. Although that ratio does vary as crypto proper goes up and down!

Adamant is what i'm coming out of btw - 3 month lock on your rewards.

Oh okay. 5-10% is a small part of your portfolio.

I remember it seemed you didn’t like the 3 month lockup.

With so much competition - I've just been watching Adamant fall down the TVL rankings.

Honestly, I think Polycat and Autofarm are the best on Polygon, and Quickswap - the former too often point me to something like Ape too - all well established.

If I can get 10-25% across stables, I'll take that!