In the past posts we have talked out the basics of personal finances:

- Security is the priority (Step 1: Personal Finance Management)

https://leofinance.io/@raka/step-1-personal-finance-management

- How to save & become rich(The 50 - 30 - 20 Rule)

https://leofinance.io/@raka/how-to-save-money-and-become-rich

The third most priority should be given to Emergency Funds, which will come under the slab "20" of"50-30-20 rule.[Reminder: Go and read it first]

However, very less acknowledgement is given to this particular fund as people often underestimate the possibility of unforeseen circumstances. Sudden death of the only wage-earner of the family, accidents, loss of employment, natural disaster, heath complications, unplanned pregnancy are few examples of them which no one wishes for that's the reason they are unforeseen.

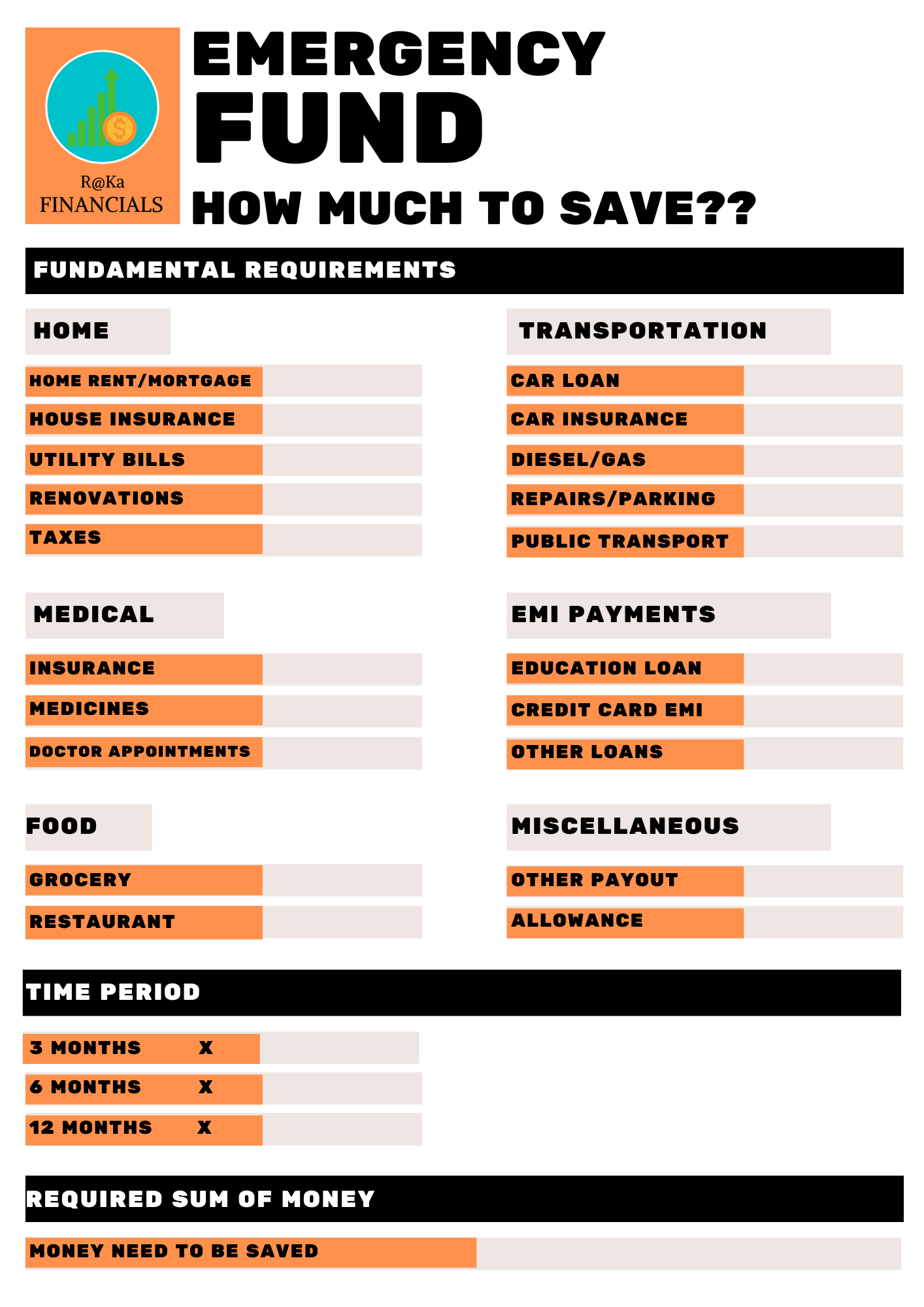

So, now after understanding the importance of emergency funds, the foremost question arises is How MUCH??

MONTHLY EXPENSES * DURATION

Monthly Expense covers all of your rent, bills, medicals, groceries, supplies. Basically the constants of your expenditure. You may add some opulence to it like dine-ins or not that's totally up to you. [Well I keep it. Some abundance will not hurt me!!]

Duration summarizes the level of emergency fund you want to create.

| LEVEL | DURATION |

|---|---|

| Beginner | 3 months |

| Intermediate | 6 months |

| Expert | 12 months |

Level you choose, absolutely depends on you.[My preference - Intermediate]

How wonderful would it be if you get an "EMERGENCY FUND CALCULATOR"!! Right??

We got it covered. Here, I am attaching a calculator, just print it, fill it and you got it all.!!

Once you have a clear cut idea of how much to save follow the 50-30-20 rule or any other strategy and save up the money. But where should you keep the money saved for the fund.?

Here we will be introducing you to the 80 - 20 Rule. So, many rules..!!! aarrghh. Oh, no no , once you start doing your financials, I promise you, you are going to love it because unknowingly you will feel a lot relaxed knowing you have sorted the most easy yet complicated task in your personal front.

So, lets continue with the 80 - 20 Rule. In simple words, 80% of the fund should be liquid money & 20% should be solid money.

The former refers to "the money you can have immediately, like- cash, savings account(just go to ATM and cash out), Fixed Deposits(nowadays FDs can also be broke immediately and the money gets transferred to your account within a matter of few hours. Thanks to online era) are few examples. The later i.e., solid will be covering bonds with lock-in period(but should be giving you good returns than FDs), stock market(because it's risky, that's why in 20% slab) and not to forget mutual funds.

So, that is it for today. If you have reached till here then definitely start saving for your emergency fund from today. Do comment and follow if you like the content.

Posted Using LeoFinance Beta

Congratulations @raka! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 600 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: