Hey welcome back!

Since my last post on my journey to build a passive income stream - the $hive price decreased quite a bit.

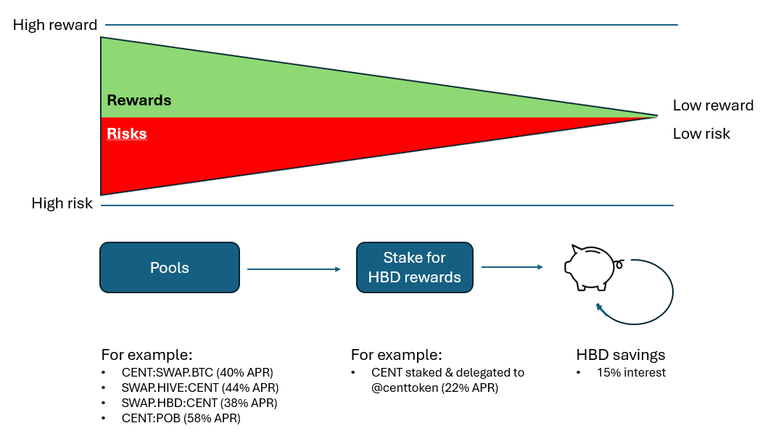

The price decrease hits my entire hive portfolio but especially the pools. In my strategy I accept this risk as it provides me also with higher potential rewards. But over time I will keep using pool returns to reduce my portfolio risks. Figure below illustrates this strategy:

Strategy:

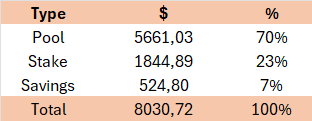

Most of my funds are in pools - for now 70%.

But over time following the sided pyramid I will reinvest the reventue from my risky positions into staking positions. The revenue from my staking positions will grow my HBD savings account. This way I will keep exposure to high potential rewards, but also gradually reducing my risks and dependance on taking risks.

This also provides me with a benchmark to evaluate passive income projects against. The 15% benchmark is obtained from HBD savings. If a project offers less than 15% (purely from a passive income perspective) it is likely to be less profitable and more risky compared to just holding HBD. For me to invest in such a project there has to be something interesting aside from the passive income to justify the investment.

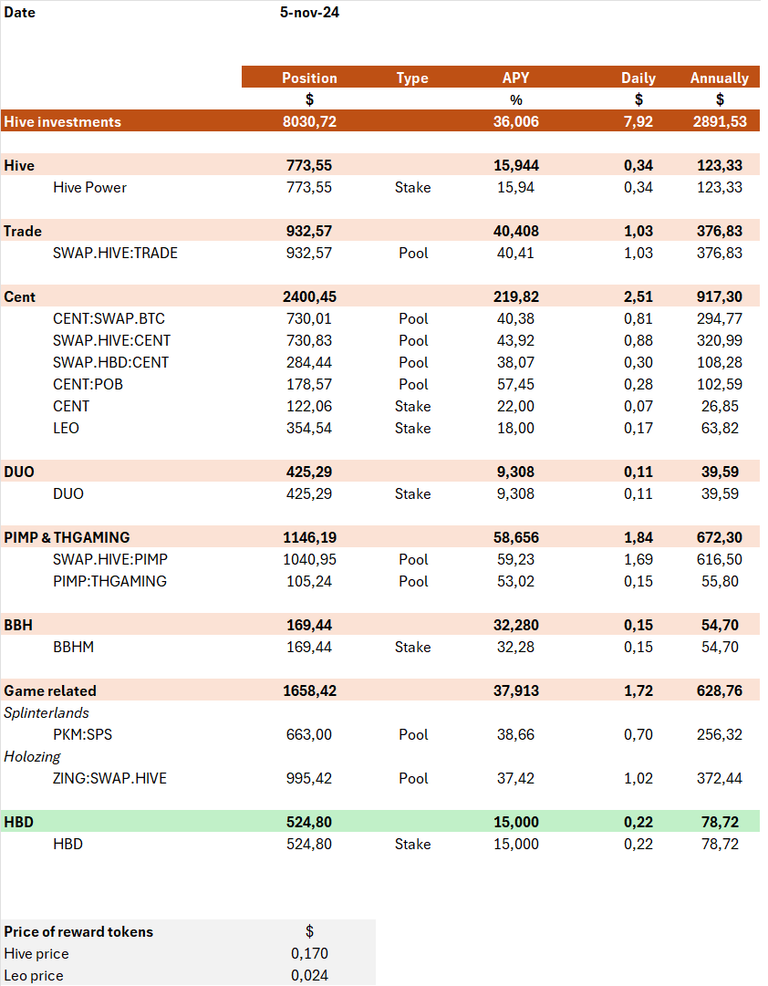

For me #DUO seems to have that additional value and I am happy to include it in my portfolio. I like the growth potential (both in $duo price as projected revenue). Furthermore there are additional benefits such as community trails, daily tipping (worth 0.2 hive/ day) and an active and passionate community. At this moment I am considering getting another 2500 tokens.

I really feel people are sleeping on the #Cent project - as it fits perfectly into my strategy: I use the pools to obtain quite a bit of $cent passively and stake and delegate those to @centtoken to get weekly HBD rewards (which I place in my savingsaccount).

So what did I do last week?

- Filled the #pimp and #zing pools to positions above $1000,-

- purchased another batch of #pkm and #sps

Lastly I finally purchased some #HP and #LEO as these also suit my strategy perfectly:

- Delegated 4520 HP to @leo.voter , which will get me daily staked LEO.

- I delegate the staked LEO to centtoken and receive weekly HBD rewards for them (last week 18% APR)

- End of the week I add the HBD rewards to my HBD savingsaccount and earn another 15% on that position.

Status November 5th

Despite investing another $2k my daily passive income dropped a bit to $7.92/day compared to last week - due to the drop in $hive price. Having a longer time frame - I am not worried and will just keep building consistantly until the passive income is really substancial.

looking forward

I feel my portfolio is now selfsustaining - meaning it can follow my strategy and grow without any additional investments.

That being said - I am eying the following opportunities to invest in additionally:

- Hive holding 4550 - eying 10k

- Leo holding 14944 - eying 50K

- Duo holding 2509 - eying 5k

would love to hear your feedback on my strategy and/or suggestions what to include in my portfolio!

Posted Using InLeo Alpha

Looks like you have a solid plan and now its just about consistency and time.

Good luck!

Congratulations @rainbowdash4l! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: