Introduction

Klima DAO is made up of a group of individuals that is aiming to make radical changes within the voluntary carbon market.

Klima DAO is a protocol on Polygon that originated as a fork of Olympus DAO.

Let's first dive into what exactly the voluntary carbon market is, and what Olympus DAO is. Finally we will go into the crossroads of these two, where we'll be at the core of what Klima DAO is, and what it is trying to accomplish.

Carbon Credits

A carbon credit is a a tradable permit, which represents the rights to emit one tonne of carbon dioxide (or an equivalent amount of a different greenhouse gas).

As global warming continues at an alarming rate, governments have decided to establish rules and regulations to ultimately curb the amount of greenhouse gasses that their companies emit. As such, a company may have a quota of greenhouse gas emissions that they are allowed to emit.

A carbon credit is the result of an company that has not used up their quota of allowed emissions. This operator can then sell their credits on an open market.

The idea behind this model is that the combination of pricing greenhouse emissions, and allowances becoming smaller over time, would cause company's to actively make choice that results in reducing emissions.

Similarily, if a company actively makes choices to reduce emissions, they'll be able to financially benefit by providing those allowances to company's that may not be able to reduce their emissions adequately.

The Voluntary Carbon Market

The paragraphs above focused more on the compliance market for carbon credits, which is mandated by governments throughout the world.

The voluntary carbon market differs, as there is no government mandating its need. The voluntary carbon market differs by taking a cue from the compliance markets described above. Essentially, the voluntary market exists because a company is interested in actively reducing their carbon footprint, without being mandated to do so.

While a carbon credit represents the allowance to emit one tonne of carbon dioxide, within the voluntary market, a carbon offset represents the reduction in emissions of carbon dioxide.

Voluntary carbon offsets are issued by a handful of different certification programs which provide standards, guidance, and requirements for projects in order to generate carbon offsets. The certification program defines the rules by which a carbon offset can be issued. For example, Verra only issues a carbon offset if the project is:

- Real (proven to take place)

- Measurable

- Permanent

- Additional (the reduction of emissions must be in addition to what would have happened under a business-as-usual scenario, this is meant to ensure that a carbon offset is only issued when active effort, outside of the normal course of business, is made to reduce emissions)

- Independently audited

- Unique

- Transparent

- Conservative (the greenhouse gas emission cannot be over-estimated)

The Carbon Bridge

Toucan (https://toucan.earth/) is a protocol that will take in VCU's, carbon offsets issued by Verra, and tokenizes them on the Polygon network.

This results in a BCT (Base Carbon Tonne) to be issued. The BCT is the reserve currency of the Klima DAO protocol.

Olympus DAO

Mentioning 'reserve currency' may have raised some eyebrows, so to explain what a reserve currency is in this case, let's look into Olympus DAO.

Olympus is a protocol that is based on the OHM token. Each token is backed by a basket of different assets which exist within the treasury. Essentially, one OHM cannot be worth less than whatever that OHM represents in the treasury. This is similar to the USD beind backed by gold. Except now we have OHM backed by a basket of different assets.

Olympus goes far beyond that short little blip, and I invite you to take the time to understand what Olympus has done, and what it is continually trying to do. I am still getting there.

Klima DAO

Klima is a fork of Olympus. What makes Klima different is that its goals lie in the environment, and for that reason, the treasury is initially going to be backed by Base Carbon Tonnes. Meaning, one KLIMA is backed by one BCT. The goal behind this is to disrupt the voluntary carbon market by actively reducing the availability of VCU's in the marketplace. The result being that an increase in cost in VCUs would mean that businesses are incentivized create projects to generate VCUs, and to reduce their carbon footprint in order to avoid needing to purchase VCUs.

Ultimately, Klima aims to add a variety of different environmental assets to their treasury, and leverage those assets in order to drive positive environmental change.

The Gain

I mainly focused on what Klima is aiming to do when it comes to the environment, but what drives market participants to Klima over purchasing VCU's directly, is this:

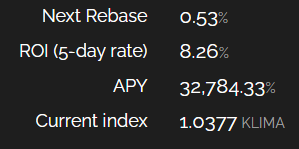

As the treasury grows, the protocol will issue more KLIMA and OHM to participants that stake their KLIMA and OHM. This is done through the process of 'rebasing.' Essentially, if you were to stake 1 KLIMA, you would receive 1 sKLIMA. If the rebase is .53%, then you would end up being issued .005 KLIMA.

Essentially, the idea behind Klima, and Olympus, is the expectation that their treasuries will continue to grow over time. This means that each KLIMA, and each OHM, will be worth more in the future than it is worth today.

Will that be the case? It has seemed to work out very nicely for Olympus DAO, which is currently trading at $924, and is currently at an index of 25.25.

This means that if you staked 1 OHM at the launch of the protocol (April), you'd have 25.25 OHM today. Not a bad deal.

Anyway, there is a lot more to take in here than what I've described above. Olympus is a complex application, and there are a lot of fascinating ideas involving game theory, liquidity ownership, community, and so on that are worth checking out. The carbon credit market, and carbon offset can't be described adequately in one blog post, and if the interaction between the environment and finance interests you, there is plenty to read out there. Klima is aiming to take these two different ecosystems, and merge it into one. Only time will tell whether they'll succeed in doing so, or if this will all end up disappearing next month.

Posted Using LeoFinance Beta

Congratulations @phul! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 1250 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP