When someone mentions the word "pool", most people think about the real, swimming pool, but those in crypto think differently... 😃 Recently, people have thought about liquidity pools, but I remember that maybe 7-8 years ago nobody was talking about them, but rather about mining pools... So, what's the difference?

Created in Canva.com

Firstly, let's explain mining pools as this pool, what we are participating in, is a mining pool!

A mining pool is a group of miners who work together to solve the cryptographic problems required by certain blockchains which reward the miners with cryptocurrency. Pools were created when cryptocurrency mining reached a difficulty level that only miners with enormous capacity could accomplish.

Source: Investopedia.org

What that definition explained was exactly one of the reasons why I have launched this pool... As more and more WORKERBEE tokens were bought and staked, there was less probability for small investors to "mine 1 BEE token"... Here comes the pool that "unites" all those WORKERBEE owners (by delegations) and split the profit... Even if you didn't mine 1 BEE token, you get your part or even a fraction of a token!

The same principle was implemented for Bitcoin mining when there were thousands and thousands of miners competing to mine 1 BTC... At the moment, there are almost 20 million BTC miners, actively mining Bitcoins!!!

Now, let's talk about liquidity pools and why they are important... For this, I would like to focus on HIVE and why different liquidity (diesel) pools are very important!

A liquidity pool is a collection of crypto held in a smart contract. The purpose of the pool is to facilitate transactions. Decentralized exchanges (DEXs) use liquidity pools so that traders can swap between different assets within the pool.

Source: bitpay.com

So, to add liquidity to the pool you need to add 2 tokens from the "supported" pair... For example, if you provide liquidity for BEE:SWAP.HIVE pool, you need to add the same VALUE of both tokens... Not the same amount, but the amount of same values on both sides (for example, $5 of BEE tokens and $5 of SWAP.HIVE tokens)... Now, that we understand that, we should check out the benefits of doing that!

The benefits for both tokens (from the pair when you provide liquidity) are obvious from that definition, but there are some other benefits... One of the important benefits is that both tokens are in some way "locked" inside the pool, which means that they are not actively participating in "speculating" (buying/selling on the markets)... That means less "liquid supply", which usually means less selling pressure (especially in bear markets)...

On Hive-Engine, for some token pairs, there are rewards provided for LPs (liquidity providers), which is an additional incentive to keep those tokens "locked" in the liquidity pool as long as possible... to harvest those rewards...

Combining transaction fees (also income for LPs) and these additional rewards, liquidity pools are an additional use case for the tokens!! So, if we have more liquidity pools with more SWAP.HIVE (pegged HIVE token on Hive-Engine), there will be more HIVE locked inside them and fewer liquid tokens... That should help with price action on the markets and less sell pressure...

Another example is a BEE token that is paired with many other tokens in different pools... Because of all that, the price of the token is relatively stable, and sometimes even goes up, despite HIVE going down... That's happening because there is a lot of liquidity in the BTC, SPS, ETH (BEE) pools, which makes the BEE token more resilient on HIVE price fluctuations...

All in all, liquidity pools are good for the ecosystem and for the main chain token, in our case HIVE (and BEE as a main H-E token)!

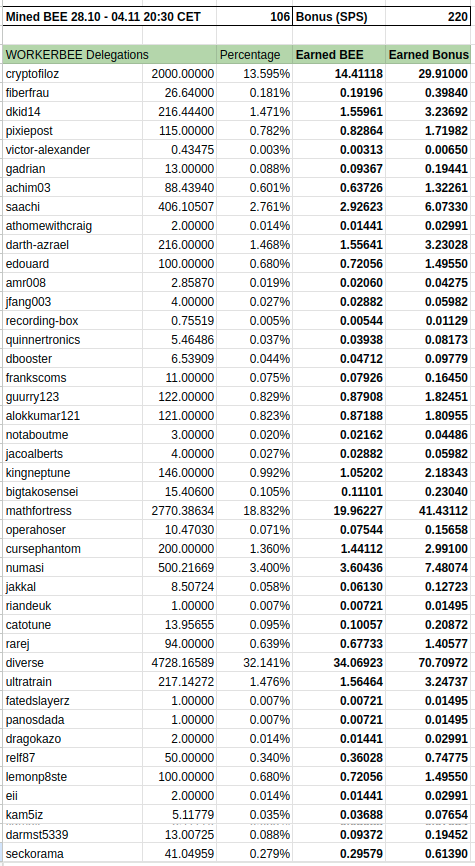

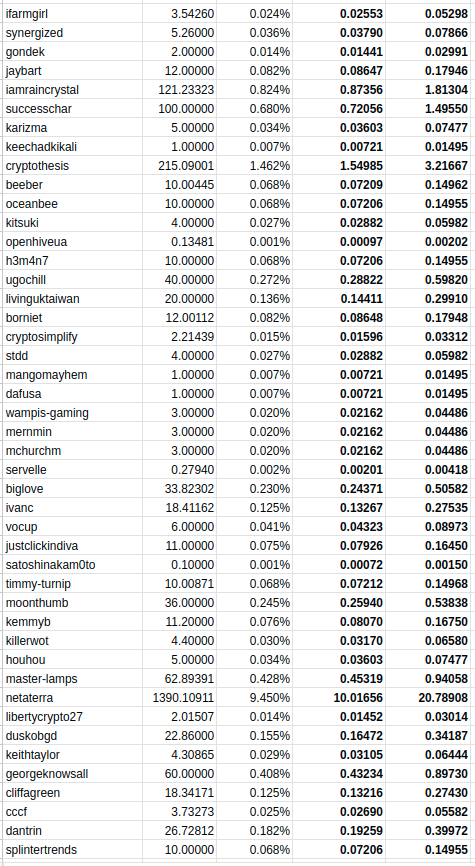

Back to the WorkerBee Pool numbers for this week... Keep in mind that I'm doing this report 1 hour earlier than usual...

This week we have mined 106 BEE tokens in total... Good job!

We had more action than usual this week... One person undelegated his WB tokens, and 4 old members added additional delegations to the pool! Thanks guys! Appreciate your support!

This week we mined 106 BEE tokens in total!!!

This POOL doesn't have fees and you get up to 20% MORE by delegating to it!

What about the bonus tokens?

As I have explained liquidity pools in the example of the BEE token, we can do the same for the SPS token too! If we would like to test how resilient is the SPS token to HIVE movements, we can check out the liquidity in the main pools that have SPS token pairs... The main pool (on the Hive Engine) with the most liquidity, is DEC:SPS (over 400K USD), and on the second place is the pool with HIVE... Also, we can't forget the SPS liquidity pool on the BNB network as that pool has over 200K USD locked... All these pools are incentivized by additional rewards (+ transaction fees) and they help the stability of the token...

There will be distributed 220 SPS tokens to the delegators of the pool as a bonus reward today!

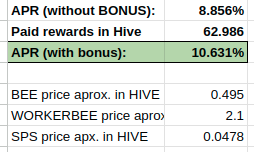

As always, in the end, let's give the exact numbers for this week... 106 BEE tokens and 220SPS tokens will be distributed as a bonus... The APR (without the bonus) was 8.856%, and when we added the bonus it went up to 10.631%!

I have calculated the ROI approximately with medium prices for all tokens at the moment of creating this post... So, those numbers are valid if you bought WB and sold BEE tokens at the middle HiveEngine price...

Do you want to sponsor the PH-Pool with your tokens, receive a short SPONSORED segment in this post, and raise awareness about your front-end or dApp? Please let me know in the comment section, or contact me through Discord or Twitter and we will find the best solution for both parties...

If you want to join the WorkerBee PH-Pool, the only thing that you have to do is to STAKE tokens to YOUR account and DELEGATE your staked WORKERBEE tokens to THIS account (@ph1102)! Every week you will get your portion of mined BEE tokens and BONUS rewards!

.:. DO NOT STAKE TOKENS TO MY ACCOUNT!!! Just DELEGATE! .:.

All payments will be made after publishing this post...

If you have any questions, please leave them in the comment section!

You can find more about this pool in the initial post here https://inleo.io/hive-119826/@ph1102/workerbee-p-h-ool-let-s-help-each-other

Thank you for your time,

--ph--

None of this is financial advice!!!

👉 Vote for Liotes HIVE Witness HERE 👈

Don't forget to follow, reblog, and browse my Hivepage to stay connected with all the great stuff!

You can also find me on inLeo .:. Twitter .:. LBRY

Posted Using InLeo Alpha

i don't get a point, you contribute in the pool locking your tokens, but they get 'eat' when someone does the conversion using your tokens right? then whats the advantage? a better quote in the conversion rather do it manually on hive engine?

You add liquidity to a token pair, for example, BEE and SWAP.HIVE... you add both tokens to the pool... people use the pool to swap one to another and vice-versa... Your liquidity isn't "eaten" by others if they exchange from them in both ways... someone buys, other sells... If the price of both tokens is stable, you earn money on transaction fees and on rewards from the pool (if there are any)...

Unfortunately, many times it happens that one token in the pair is constantly going down, which means that you "lose value" and suffer from impermanent loss... But, as I said, it doesn't have to be like that... ;)

Also, in some pools, you have more liquidity than on the "regular market", and you can exchange bigger chunks of tokens...

Thanks for the report! 👍😎

You are welcome! Thanks for your delegation and support!

To me, it sounds trading volume as in a stock , which prevents excessive price volatility.

@tipu curate

Upvoted 👌 (Mana: 16/56) Liquid rewards.

Both pools are useful towards crypto. I think both are useful but I think the liquidity pools are more important because it lets people get in and out of the ecosystem.

Thanks for running the pool and for the BEE/SPS tokens.